米国主要株価指数と米国債利回りで確認する米国市場のセンチメント, etc.

Updated time:2020-04-21 06:30:48

米国主要株価指数と米国債利回りで確認する米国市場のセンチメント

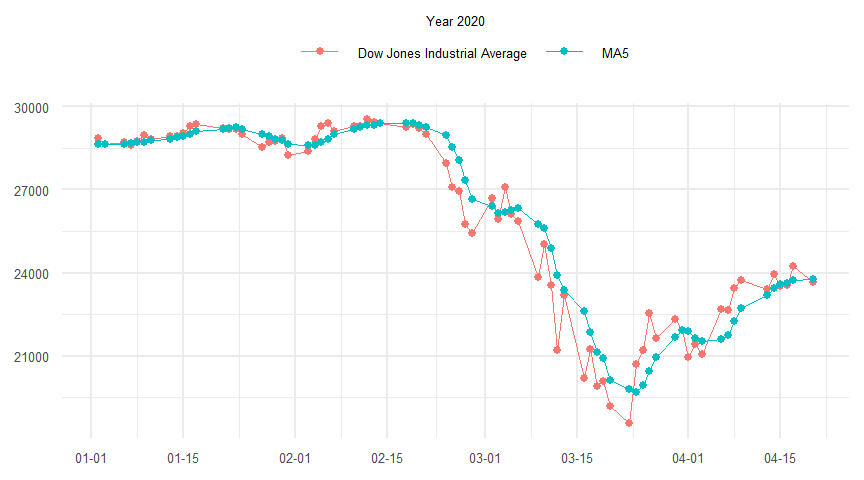

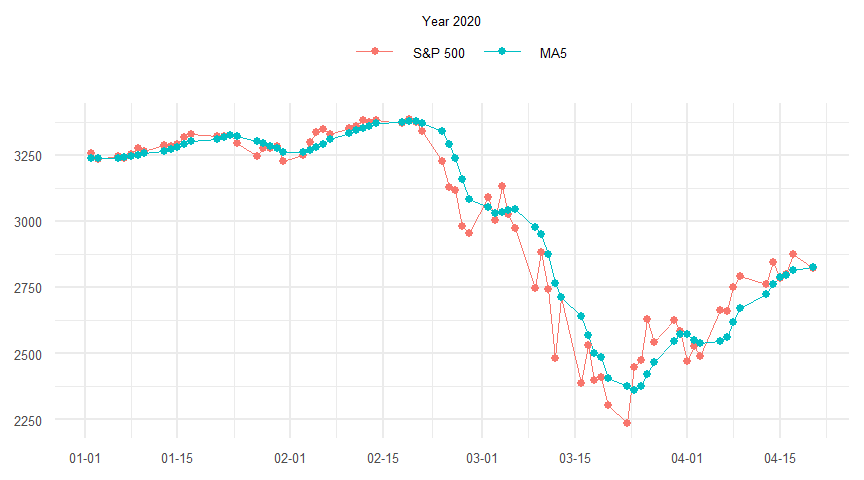

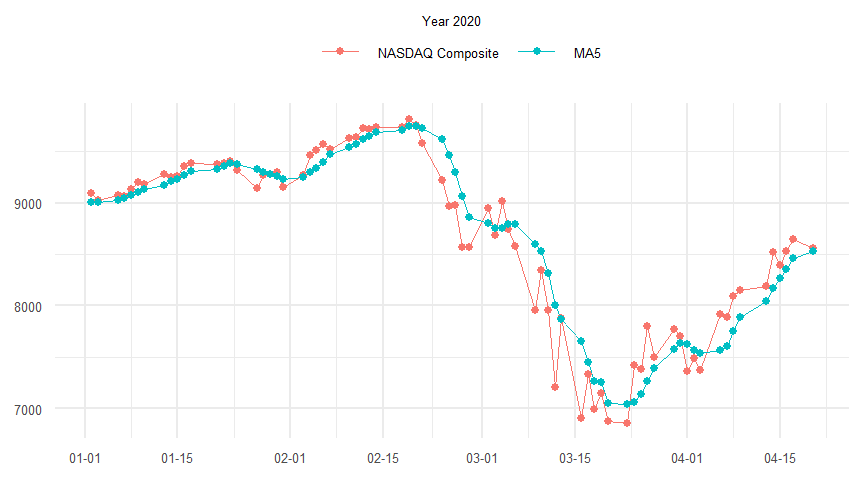

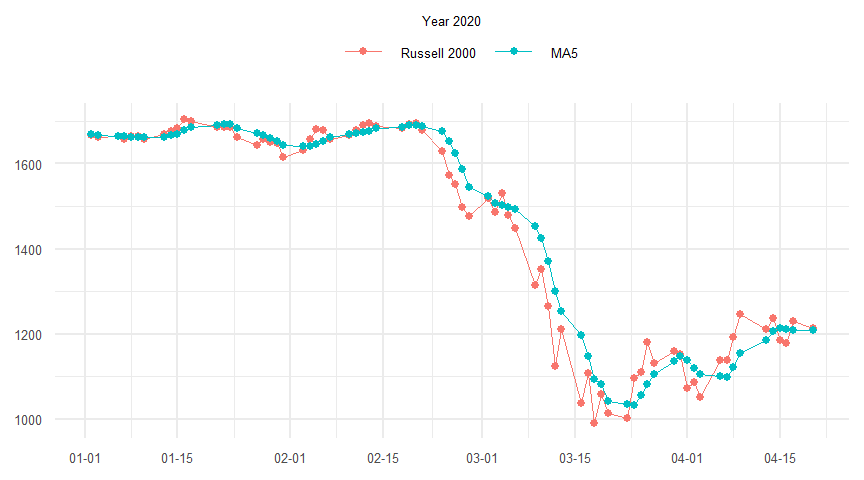

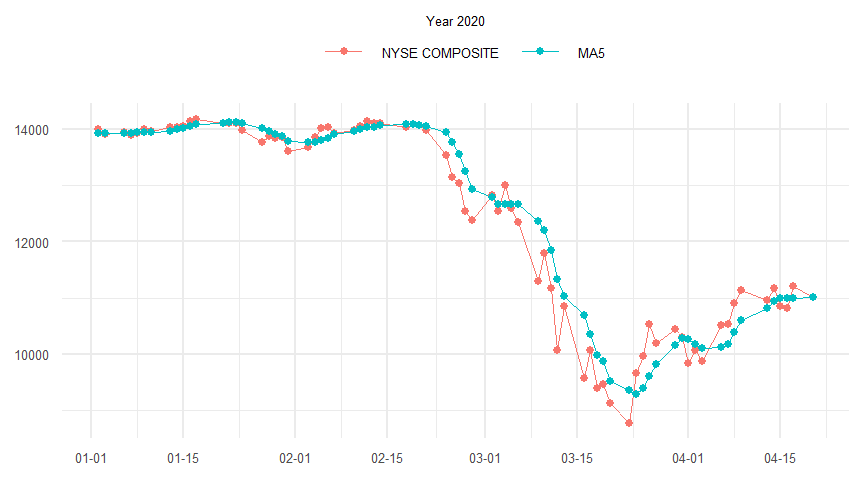

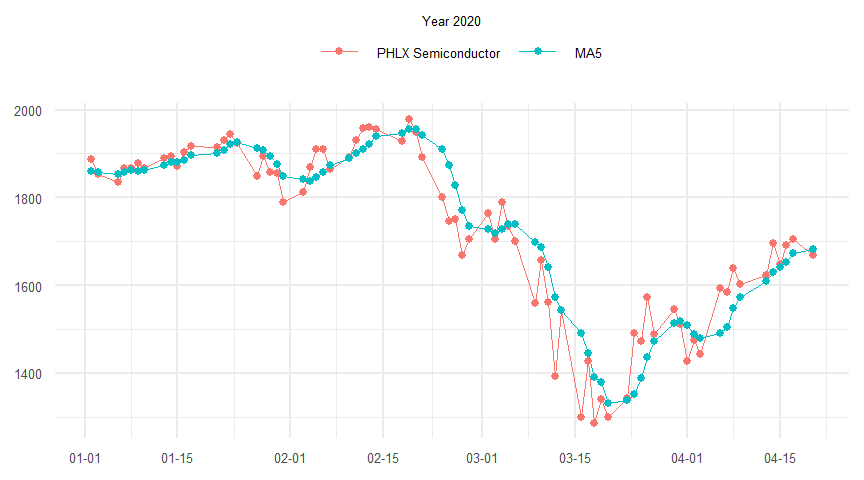

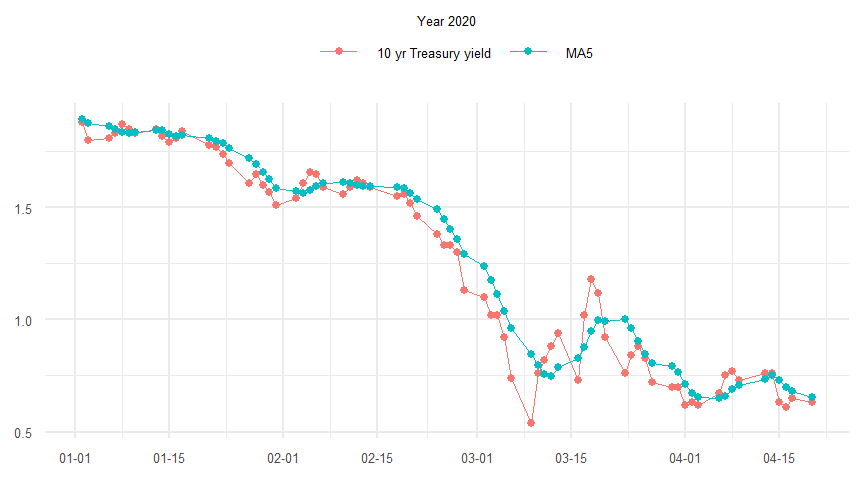

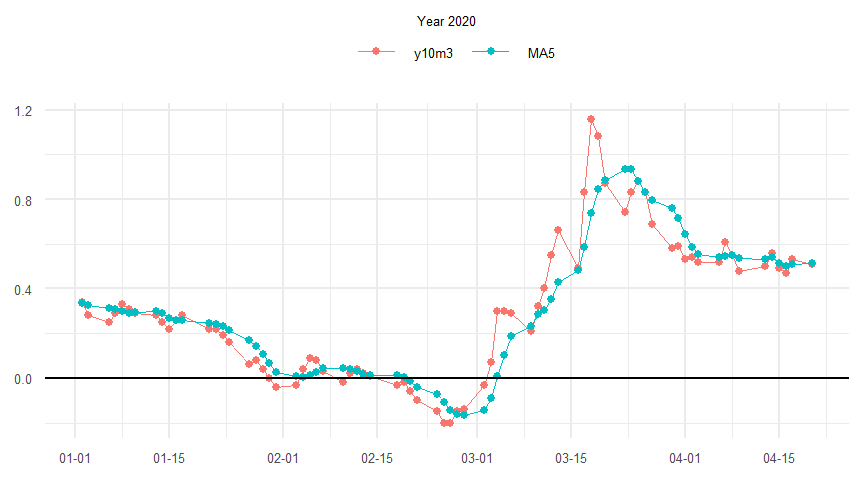

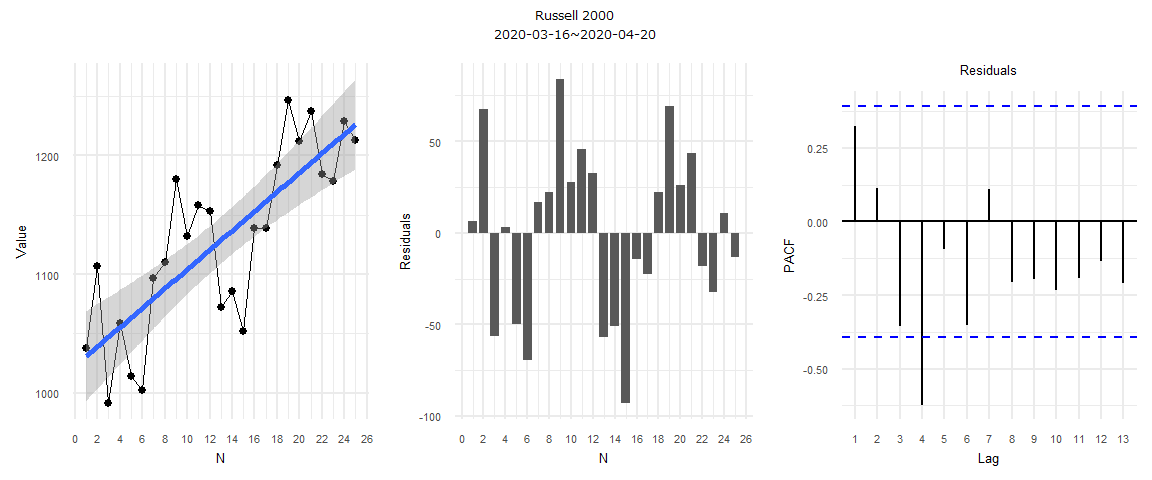

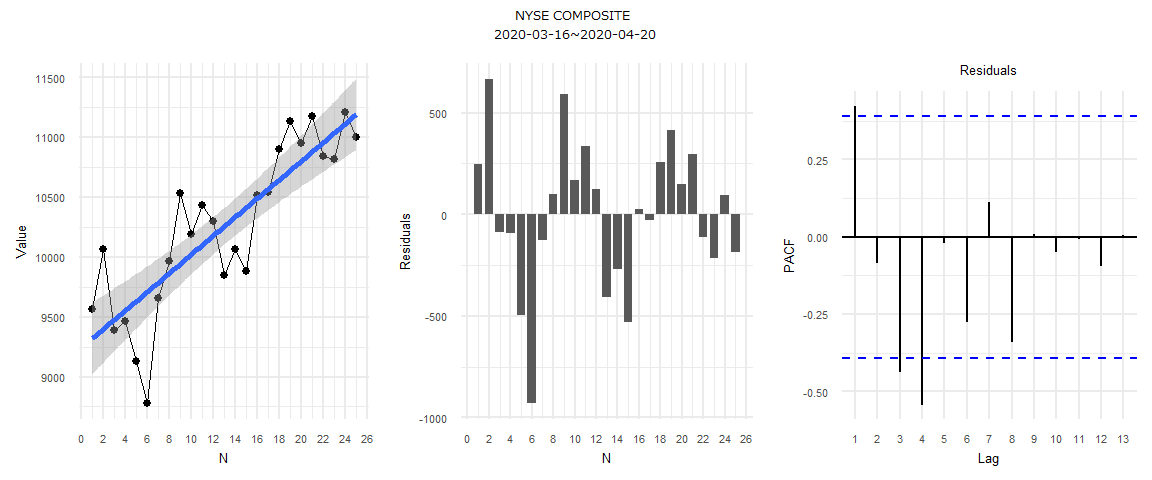

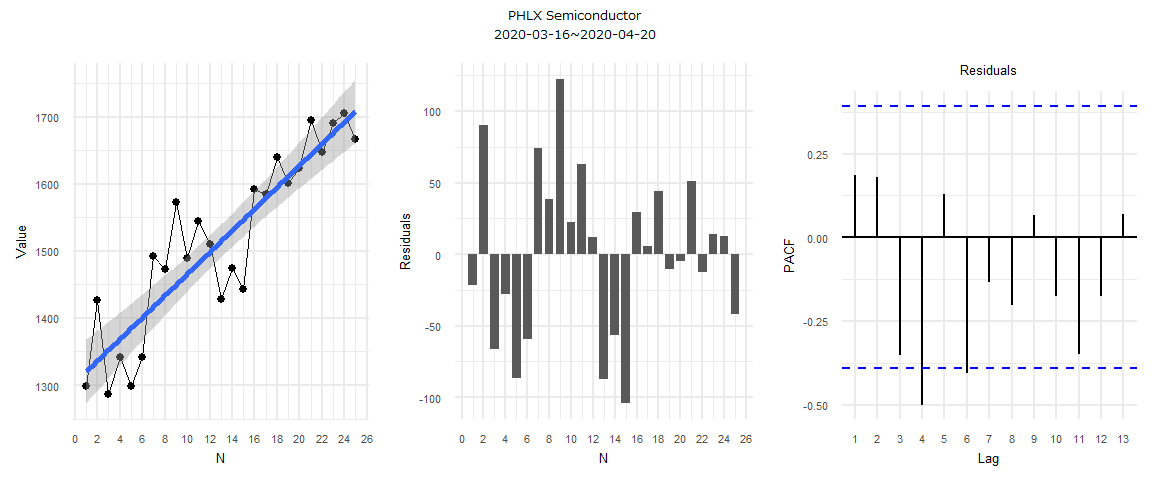

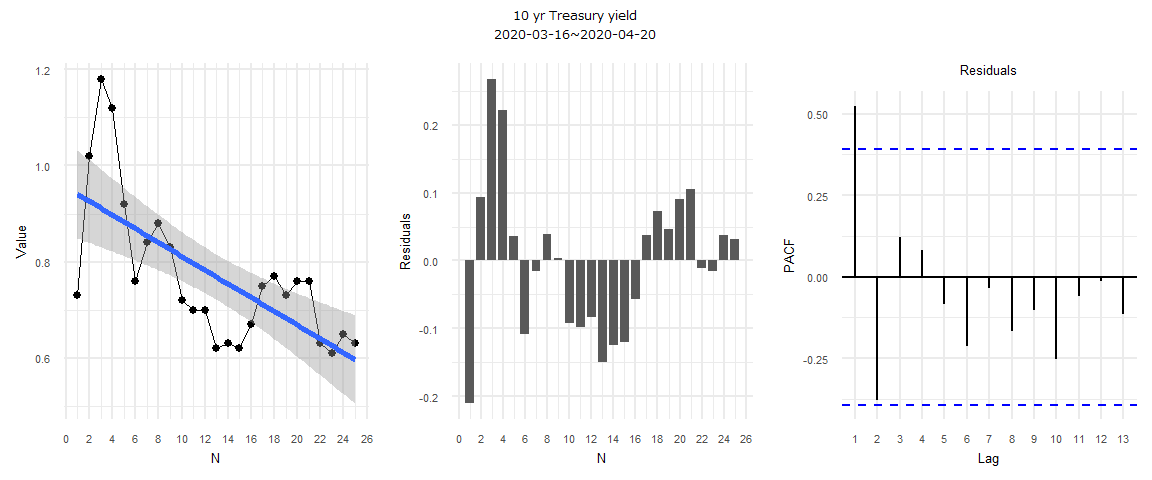

2020年04月20日(月曜日)の米国主要株式6指数(DJI、GSPC、IXIC、RUT、NYA、SOX)は前日比上昇が0、同下落は6、同変わらずが0。日足陽線は1、同陰線が5、寄引同時は0。米国債10年物名目利回りは低下(0.65→0.63)。

- 2020年04月20日の前営業日比(%):Dow Jones Industrial Average:-2.44、S&P 500:-1.79、NASDAQ Composite:-1.03、Russell 2000:-1.28、NYSE COMPOSITE :-1.82、PHLX Semiconductor:-2.23

指数値、利回りテーブル

- 直近6営業日分

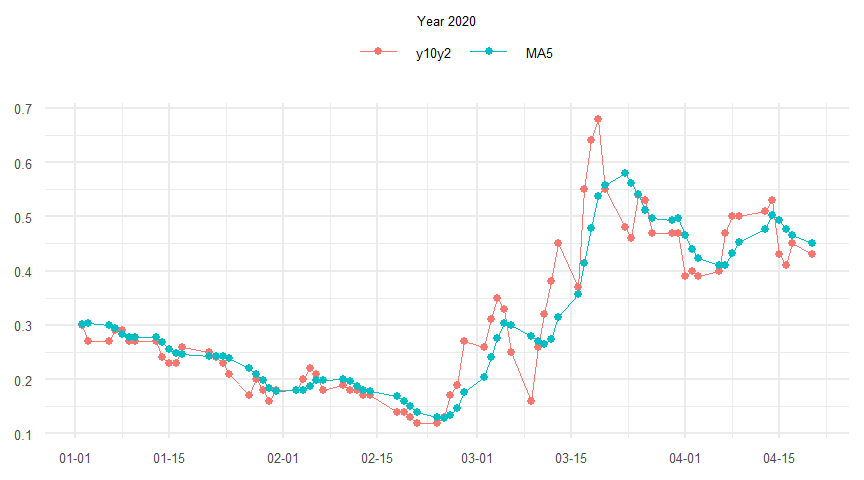

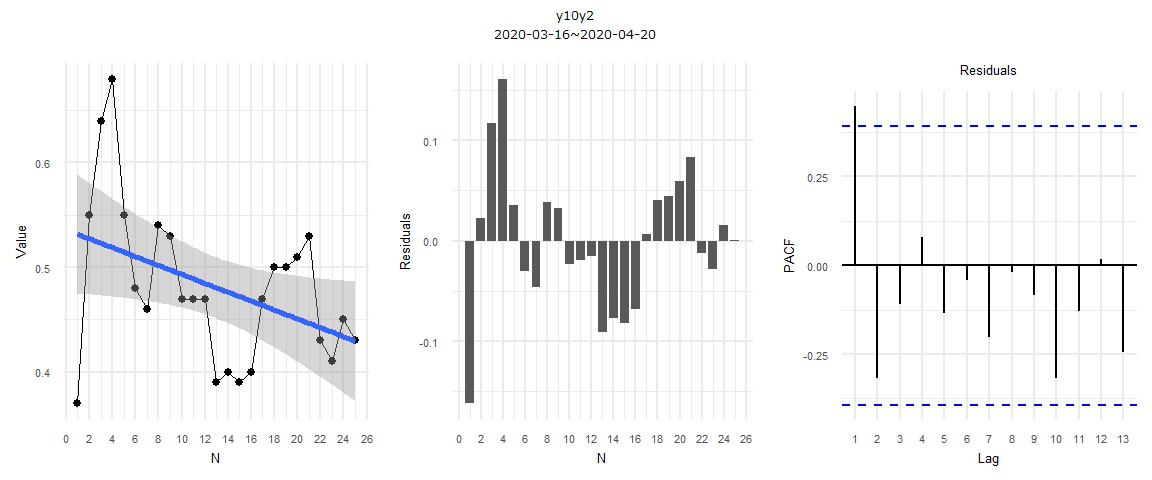

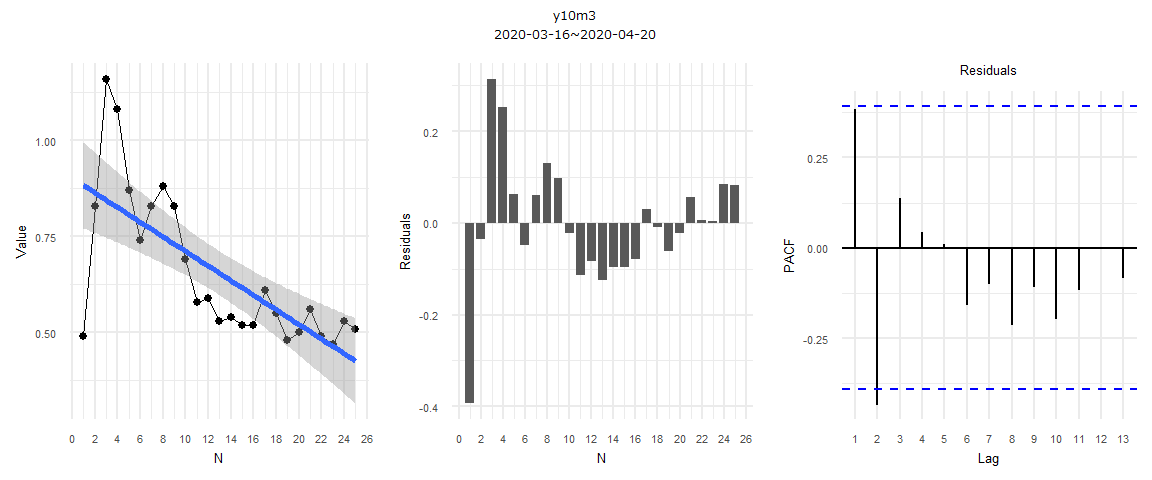

- y10y2:10年物と2年物の利回り差(pp)

- y10m3:10年物と3ヶ月物の利回り差(pp)

- 米国主要株価指数

- 米国債利回り

- 年初来最高値

- 年初来最安値

- 年初比(%)

- 年初比

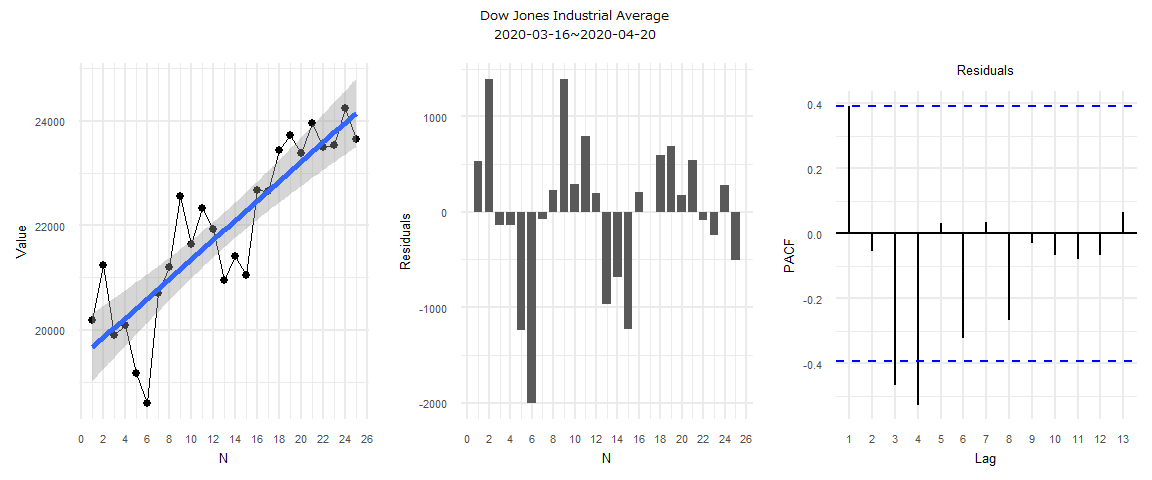

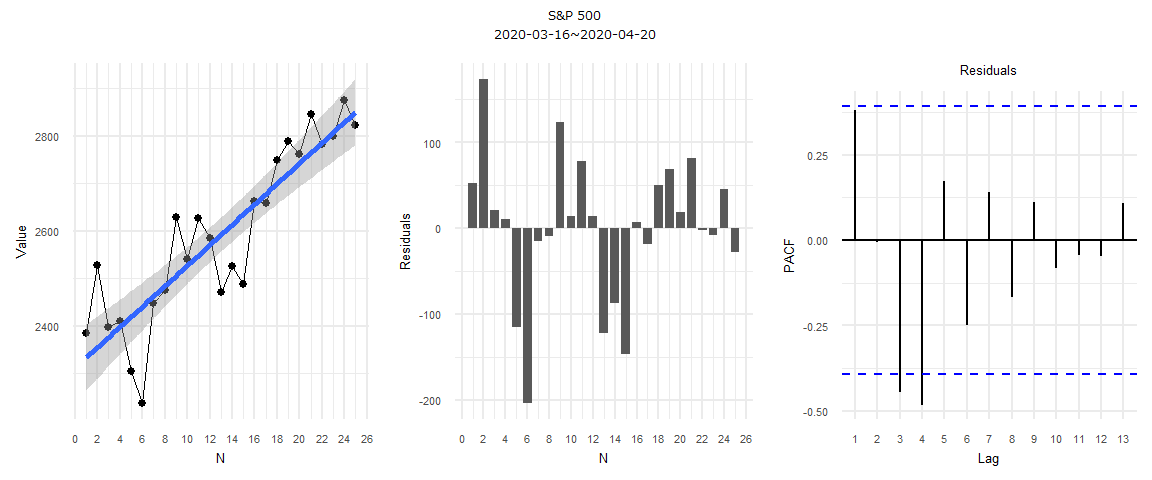

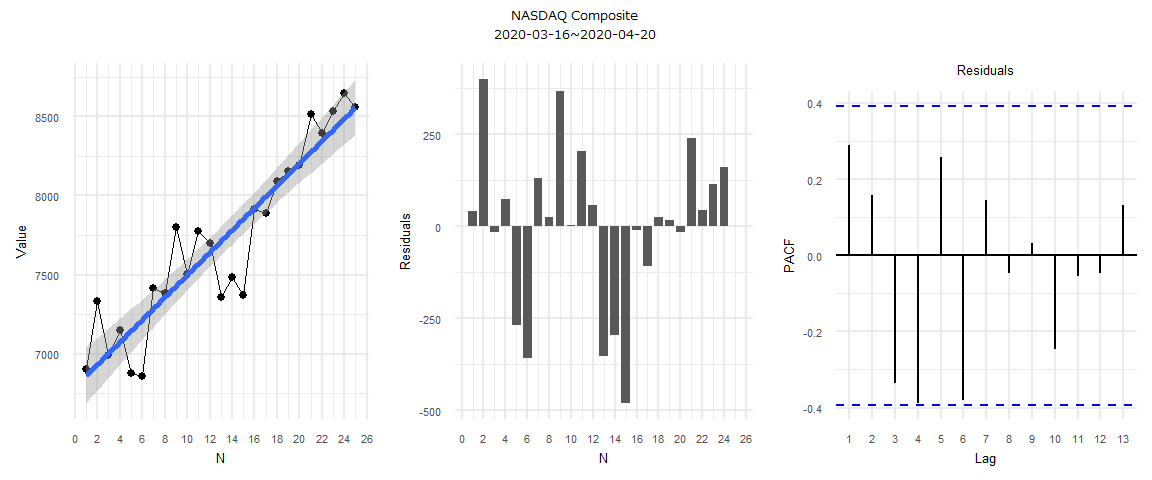

参考計量分析

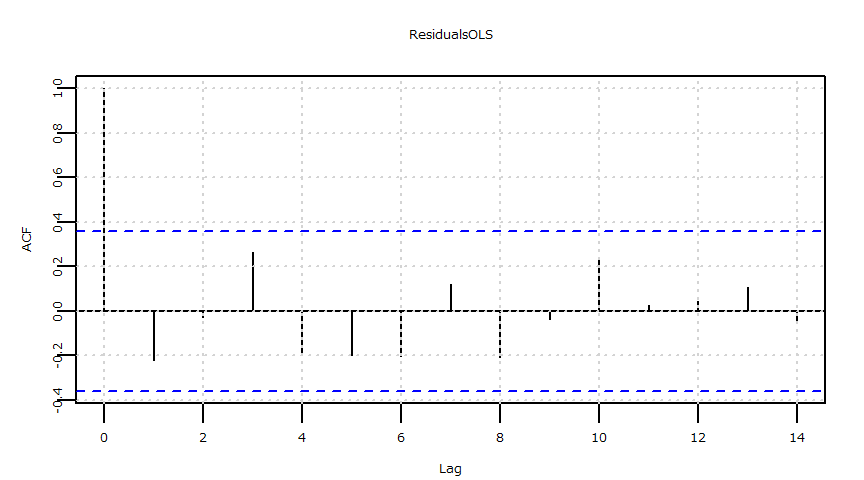

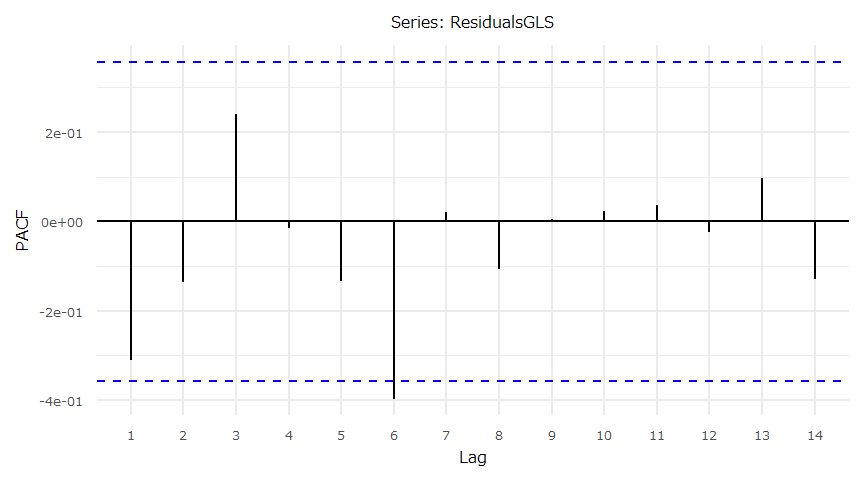

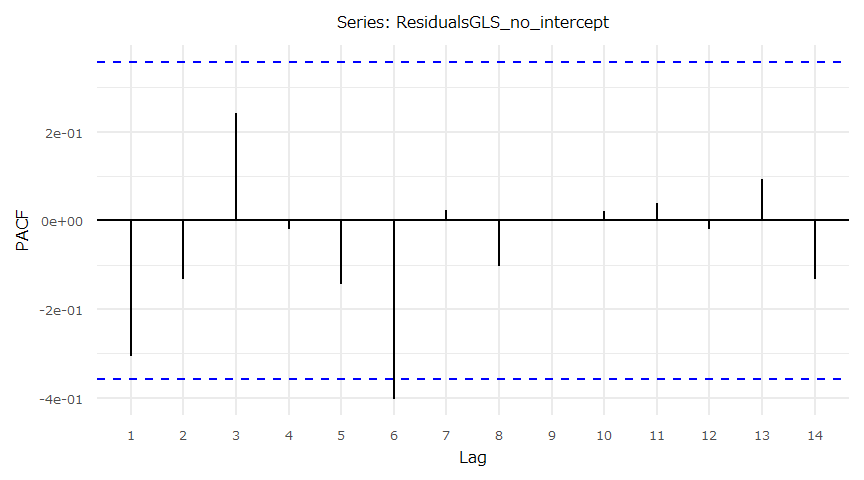

- 線形回帰、偏自己相関関数

- 説明変数をx={1,2,…,25}、応答変数をy={終値}とした線形回帰の結果一覧。“r squared”以外は全てp値。

- Durbin-Watson、Kolmogorov-Smirnov、Breusch-Pagan、Ljung-Boxは全て残差に対する検定。

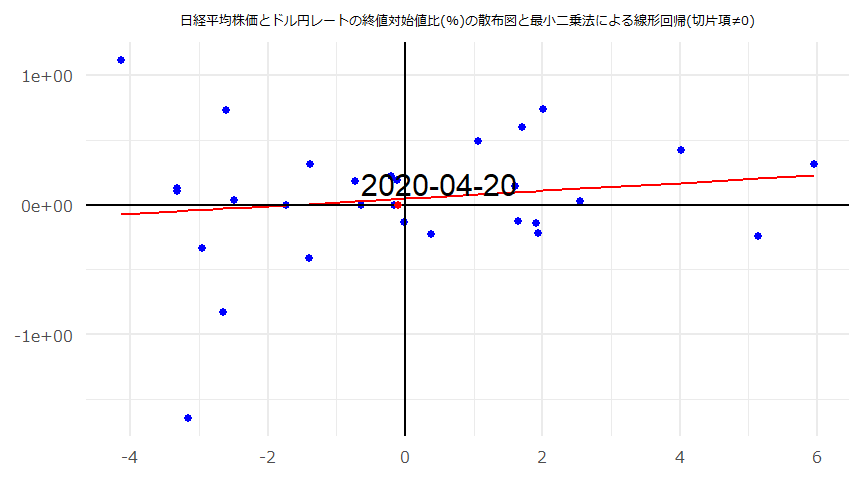

日経平均株価と東京市場ドル円レート

- Source:日本銀行,日本経済新聞社

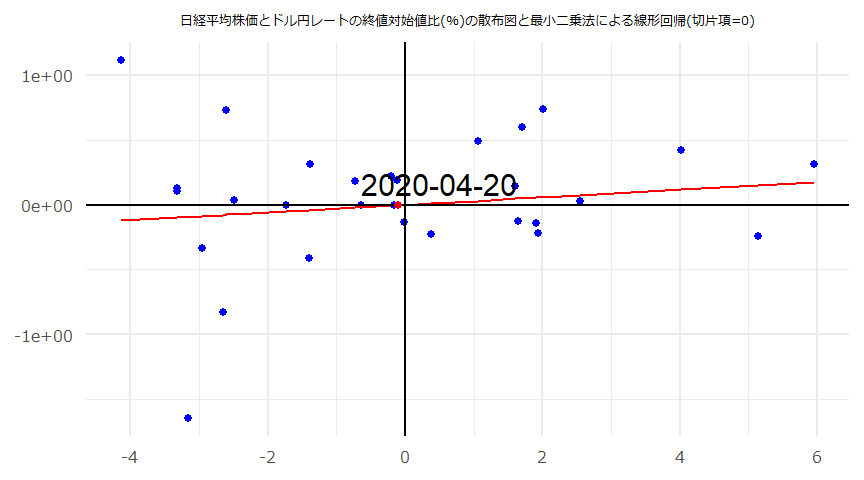

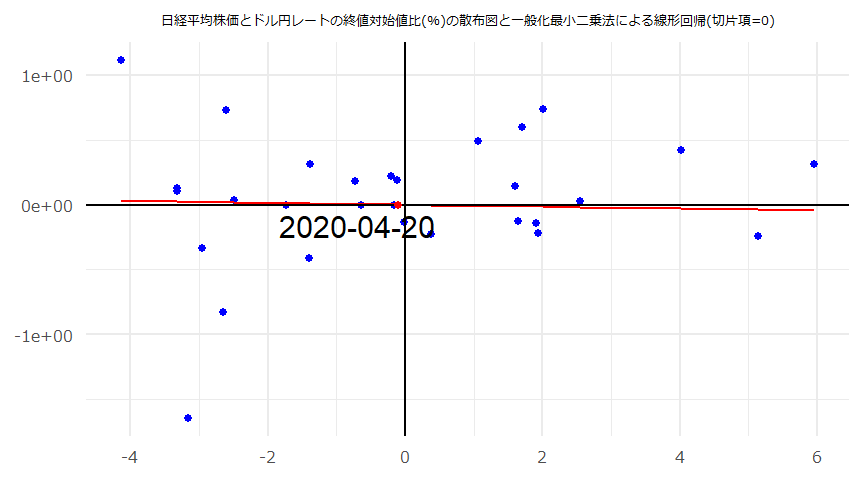

分析設計

- 日経平均株価の終値対始値比(\(x\))と東京市場ドル円レートの終値対始値比(\(y\))との正規線形モデル。

- 対象期間: 2020-03-09 ~ 2020-04-20,30営業日

- 終値対始値比(\(\%\)):分母は始値、分子は終値。

- \(y=ax+b+\epsilon,\;\epsilon \sim N(0,\sigma^2)\)

- 有意水準は\(5\%\)。

- \(a=0\)および\(b=0\)が棄却されなかった場合、15時時点(大引け時点)の日経平均株価が始値比で仮に1%上昇(下落)したとすると、その2時間後(17時点)のドル円レートは9時時点のドル円レートより\((a+b)\%\)上昇(下落)することを意味する。

- Ljung-Box 検定のラグは10としている。

- 過去の解説動画:twitter

- 過去の解説動画:twilog

- https://www.boj.or.jp/statistics/market/forex/fxdaily/fxlist/index.htm/

- http://www.stat-search.boj.or.jp/ssi/cgi-bin/famecgi2?cgi=$nme_a000&lstSelection=FM08

[1] "USDJPY"

Date Open High Low Close Center Index CloseToOpen HighToLow Close:Diff(lag=1) Close:Ratio(lag=1)

1 2020-03-09 103.95 104.60 101.60 102.24 102.10 111.22 -1.645 2.953 -3.56 -3.365

2 2020-03-10 103.09 105.02 102.04 103.85 103.25 107.94 0.737 2.920 1.61 1.575

3 2020-03-11 105.03 105.39 104.12 105.03 105.00 109.36 0.000 1.220 1.18 1.136

4 2020-03-12 104.54 104.80 103.10 103.67 104.00 110.25 -0.832 1.649 -1.36 -1.295

5 2020-03-13 104.67 106.00 104.50 105.84 105.08 106.89 1.118 1.435 2.17 2.093

6 2020-03-16 106.49 107.56 105.73 106.60 106.90 109.31 0.103 1.731 0.76 0.718

7 2020-03-17 106.23 107.19 105.90 106.87 106.58 107.99 0.602 1.218 0.27 0.253

8 2020-03-18 107.38 107.57 106.76 107.42 107.35 108.60 0.037 0.759 0.55 0.515

9 2020-03-19 108.37 109.56 108.00 109.16 108.85 106.80 0.729 1.444 1.74 1.620

10 2020-03-23 110.40 111.24 109.67 110.24 110.18 106.48 -0.145 1.432 1.08 0.989

11 2020-03-24 110.81 111.25 110.07 110.54 110.45 105.77 -0.244 1.072 0.30 0.272

12 2020-03-25 111.12 111.49 110.76 111.47 111.13 105.69 0.315 0.659 0.93 0.841

13 2020-03-26 110.85 111.24 110.37 110.48 110.74 106.43 -0.334 0.788 -0.99 -0.888

14 2020-03-27 109.15 109.51 108.24 108.91 108.40 108.01 -0.220 1.173 -1.57 -1.421

15 2020-03-30 107.46 108.24 107.15 107.99 107.55 108.57 0.493 1.017 -0.92 -0.845

16 2020-03-31 108.08 108.80 107.82 108.42 108.70 108.67 0.315 0.909 0.43 0.398

17 2020-04-01 107.52 107.94 107.25 107.66 107.58 109.64 0.130 0.643 -0.76 -0.701

18 2020-04-02 107.29 107.57 107.12 107.29 107.48 108.84 0.000 0.420 -0.37 -0.344

19 2020-04-03 108.03 108.30 107.81 108.23 108.10 108.55 0.185 0.455 0.94 0.876

20 2020-04-06 108.72 109.38 108.43 109.18 108.95 107.65 0.423 0.876 0.95 0.878

21 2020-04-07 109.13 109.26 108.68 108.88 108.86 107.46 -0.229 0.534 -0.30 -0.275

22 2020-04-08 108.68 109.00 108.51 108.84 108.86 107.50 0.147 0.452 -0.04 -0.037

23 2020-04-09 108.94 109.06 108.84 108.94 108.96 107.40 0.000 0.202 0.10 0.092

24 2020-04-10 108.55 108.62 108.32 108.40 108.60 107.31 -0.138 0.277 -0.54 -0.496

25 2020-04-13 108.34 108.52 107.79 107.89 108.26 108.20 -0.415 0.677 -0.51 -0.470

26 2020-04-14 107.64 107.76 107.54 107.67 107.65 108.51 0.028 0.205 -0.22 -0.204

27 2020-04-15 107.12 107.38 106.93 107.36 107.17 108.77 0.224 0.421 -0.31 -0.288

28 2020-04-16 107.63 108.08 107.41 107.83 107.69 108.55 0.186 0.624 0.47 0.438

29 2020-04-17 107.94 108.08 107.64 107.80 107.93 108.65 -0.130 0.409 -0.03 -0.028

30 2020-04-20 107.70 107.95 107.50 107.70 107.86 NA 0.000 0.419 -0.10 -0.093[1] "NIKKEI"

Date Open High Low Close CloseToOpen HighToLow Close:Diff(lag=1) Close:Ratio(lag=1)

1 2020-03-09 20343.31 20347.19 19472.26 19698.76 -3.168 4.493 -1050.99 -5.065

2 2020-03-10 19474.89 19970.35 18891.77 19867.12 2.014 5.709 168.36 0.855

3 2020-03-11 19758.26 19974.83 19392.25 19416.06 -1.732 3.004 -451.06 -2.270

4 2020-03-12 19064.51 19142.18 18339.27 18559.63 -2.648 4.378 -856.43 -4.411

5 2020-03-13 18183.47 18184.46 16690.60 17431.05 -4.138 8.950 -1128.58 -6.081

6 2020-03-16 17586.08 17785.76 16914.45 17002.04 -3.321 5.151 -429.01 -2.461

7 2020-03-17 16726.95 17557.04 16378.94 17011.53 1.701 7.193 9.49 0.056

8 2020-03-18 17154.08 17396.84 16698.46 16726.55 -2.492 4.182 -284.98 -1.675

9 2020-03-19 16995.77 17160.97 16358.19 16552.83 -2.606 4.908 -173.72 -1.039

10 2020-03-23 16570.57 17049.03 16480.95 16887.78 1.914 3.447 334.95 2.024

11 2020-03-24 17206.88 18100.39 17197.14 18092.35 5.146 5.252 1204.57 7.133

12 2020-03-25 18446.80 19564.38 18446.80 19546.63 5.962 6.058 1454.28 8.038

13 2020-03-26 19234.77 19240.29 18512.81 18664.60 -2.964 3.930 -882.03 -4.512

14 2020-03-27 19021.97 19389.43 18832.21 19389.43 1.932 2.959 724.83 3.883

15 2020-03-30 18884.07 19084.97 18578.20 19084.97 1.064 2.728 -304.46 -1.570

16 2020-03-31 19181.90 19336.19 18834.16 18917.01 -1.381 2.666 -167.96 -0.880

17 2020-04-01 18686.12 18784.25 17871.62 18065.41 -3.322 5.107 -851.60 -4.502

18 2020-04-02 17934.42 18132.04 17707.66 17818.72 -0.645 2.397 -246.69 -1.366

19 2020-04-03 17951.44 18059.15 17646.50 17820.19 -0.731 2.338 1.47 0.008

20 2020-04-06 17857.99 18672.26 17802.62 18576.30 4.022 4.885 756.11 4.243

21 2020-04-07 18878.86 19162.52 18553.14 18950.18 0.378 3.285 373.88 2.013

22 2020-04-08 19047.76 19454.34 18730.80 19353.24 1.604 3.863 403.06 2.127

23 2020-04-09 19376.00 19406.96 19158.55 19345.77 -0.156 1.297 -7.47 -0.039

24 2020-04-10 19500.07 19500.07 19235.96 19498.50 -0.008 1.373 152.73 0.789

25 2020-04-13 19312.04 19355.04 19014.32 19043.40 -1.391 1.792 -455.10 -2.334

26 2020-04-14 19150.30 19705.99 19093.12 19638.81 2.551 3.210 595.41 3.127

27 2020-04-15 19589.25 19660.68 19465.95 19550.09 -0.200 1.000 -88.72 -0.452

28 2020-04-16 19311.30 19362.17 19154.41 19290.20 -0.109 1.085 -259.89 -1.329

29 2020-04-17 19575.85 19922.07 19554.70 19897.26 1.642 1.879 607.06 3.147

30 2020-04-20 19689.85 19784.38 19611.79 19669.12 -0.105 0.880 -228.14 -1.147単位根検定・共和分検定

- CADFtest {CADFtest}

- ca.po {urca}

$USDJPY_CloseToOpen

ADF test

data: x

ADF(2) = -2.7782, p-value = 0.2165

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-1.137738

$NIKKEI_CloseToOpen

ADF test

data: x

ADF(0) = -4.0781, p-value = 0.01784

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-0.8222206

########################################

# Phillips and Ouliaris Unit Root Test #

########################################

Test of type Pu

detrending of series none

Call:

lm(formula = z[, 1] ~ z[, -1] - 1)

Residuals:

Min 1Q Median 3Q Max

-1.55209 -0.19539 0.07538 0.22926 1.23936

Coefficients:

Estimate Std. Error t value Pr(>|t|)

z[, -1] 0.02933 0.03604 0.814 0.422

Residual standard error: 0.4987 on 29 degrees of freedom

Multiple R-squared: 0.02233, Adjusted R-squared: -0.01138

F-statistic: 0.6624 on 1 and 29 DF, p-value: 0.4224

Value of test-statistic is: 15.0844

Critical values of Pu are:

10pct 5pct 1pct

critical values 20.3933 25.9711 38.3413最小二乗法

- lm {stats}

- dwtest {lmtest}

- ks.test {stats}

- confint {stats}

- Box.test {stats}

- 切片項\(\neq0\)

MODEL INFO:

Observations: 30

Dependent Variable: USDJPY_CloseToOpen

Type: OLS linear regression

MODEL FIT:

F(1,28) = 0.66, p = 0.42

R2 = 0.02

Adj. R2 = -0.01

Standard errors: OLS

---------------------------------------------------------------

Est. 2.5% 97.5% t val. p

------------------------ ------ ------- ------- -------- ------

(Intercept) 0.05 -0.14 0.24 0.53 0.60

NIKKEI_CloseToOpen 0.03 -0.05 0.10 0.81 0.42

---------------------------------------------------------------

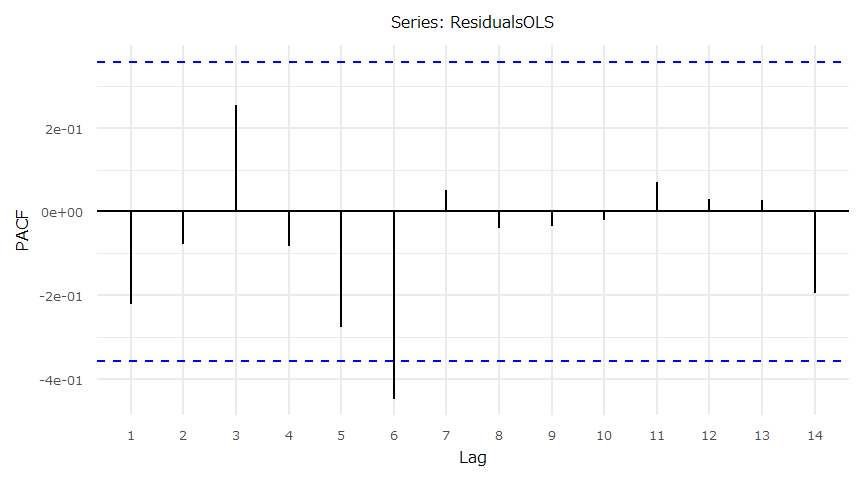

Durbin-Watson test

data: OLS_Model

DW = 2.0817, p-value = 0.5747

alternative hypothesis: true autocorrelation is greater than 0

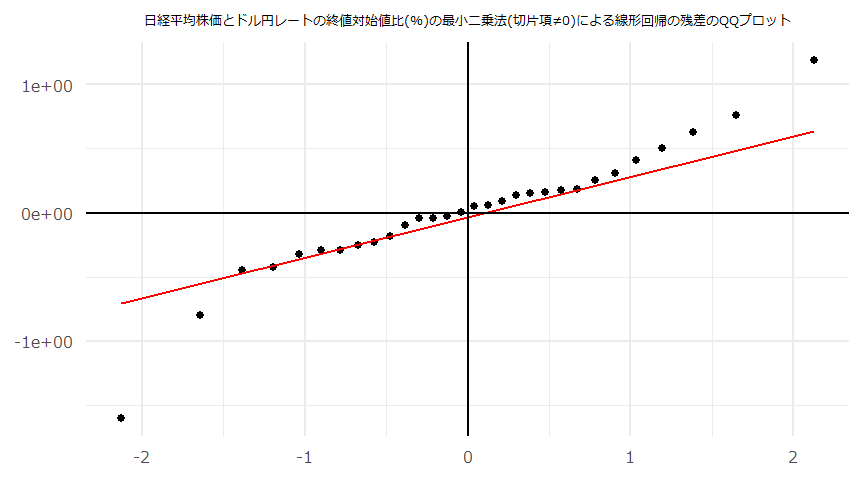

One-sample Kolmogorov-Smirnov test

data: ResidualsOLS

D = 0.12449, p-value = 0.6951

alternative hypothesis: two-sided 2.5 % 97.5 %

(Intercept) -0.13970134 0.2380463

NIKKEI_CloseToOpen -0.04512226 0.1043895

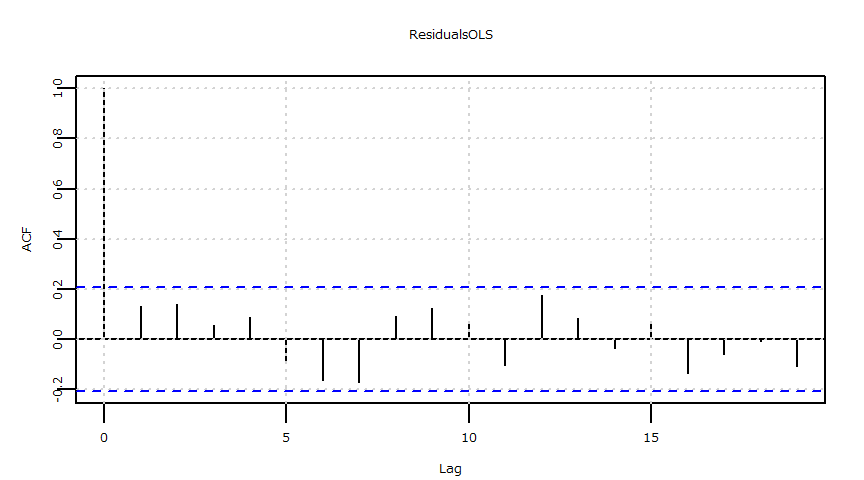

Box-Ljung test

data: ResidualsOLS

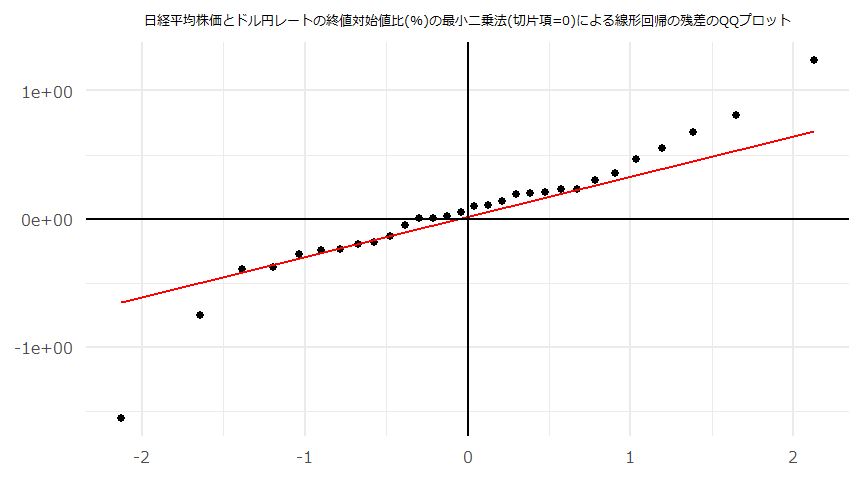

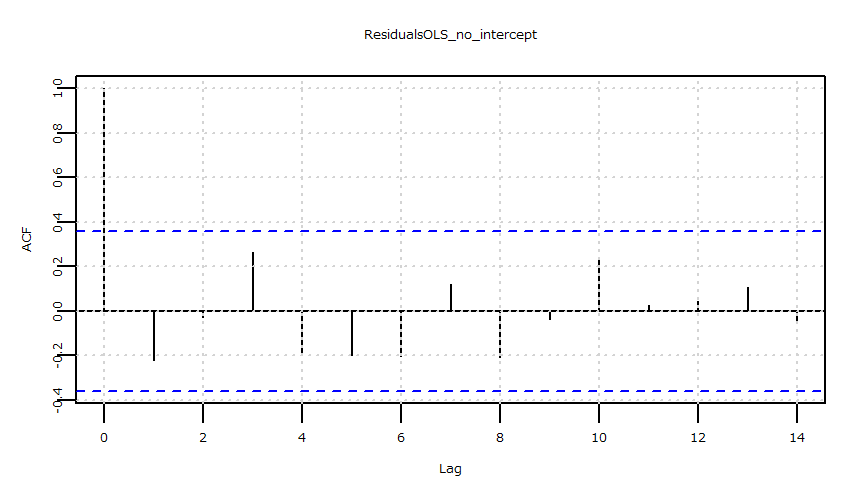

X-squared = 13.767, df = 10, p-value = 0.1839- 切片項\(=0\)

MODEL INFO:

Observations: 30

Dependent Variable: USDJPY_CloseToOpen

Type: OLS linear regression

MODEL FIT:

F(1,29) = 0.66, p = 0.42

R2 = 0.02

Adj. R2 = -0.01

Standard errors: OLS

---------------------------------------------------------------

Est. 2.5% 97.5% t val. p

------------------------ ------ ------- ------- -------- ------

NIKKEI_CloseToOpen 0.03 -0.04 0.10 0.81 0.42

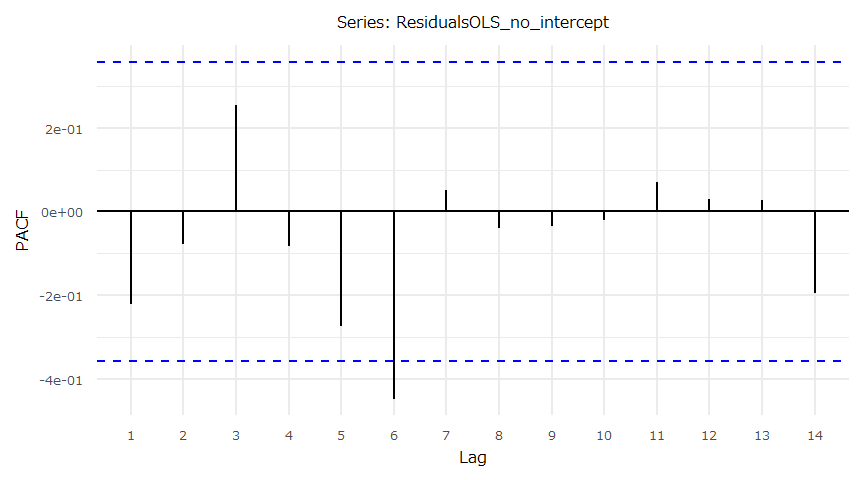

---------------------------------------------------------------

Durbin-Watson test

data: OLS_Model_no_intercept

DW = 2.062, p-value = 0.6289

alternative hypothesis: true autocorrelation is greater than 0

One-sample Kolmogorov-Smirnov test

data: ResidualsOLS_no_intercept

D = 0.15523, p-value = 0.4222

alternative hypothesis: two-sided 2.5 % 97.5 %

NIKKEI_CloseToOpen -0.0443754 0.103033

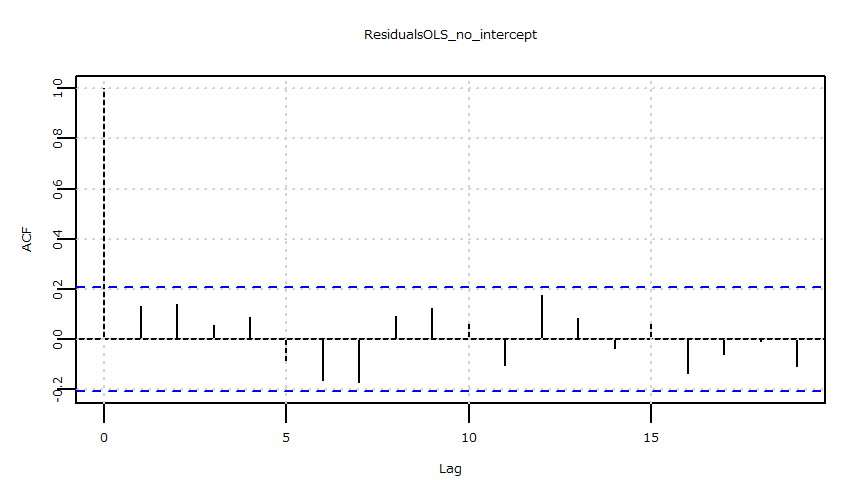

Box-Ljung test

data: ResidualsOLS_no_intercept

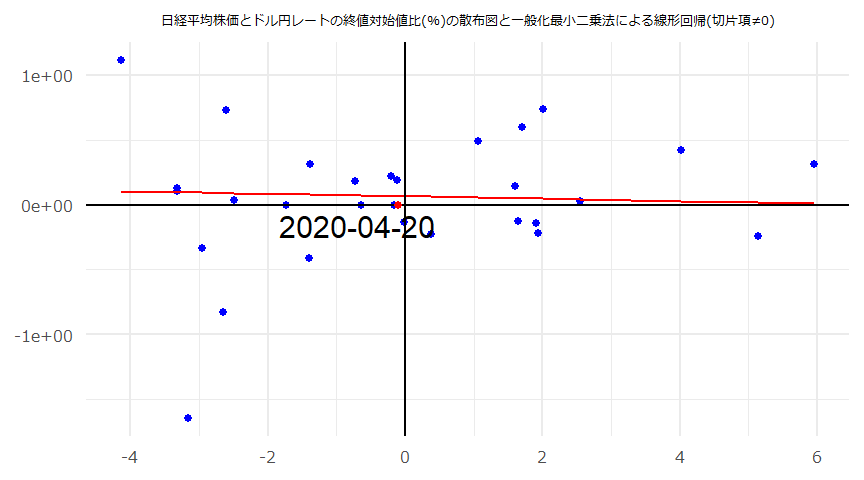

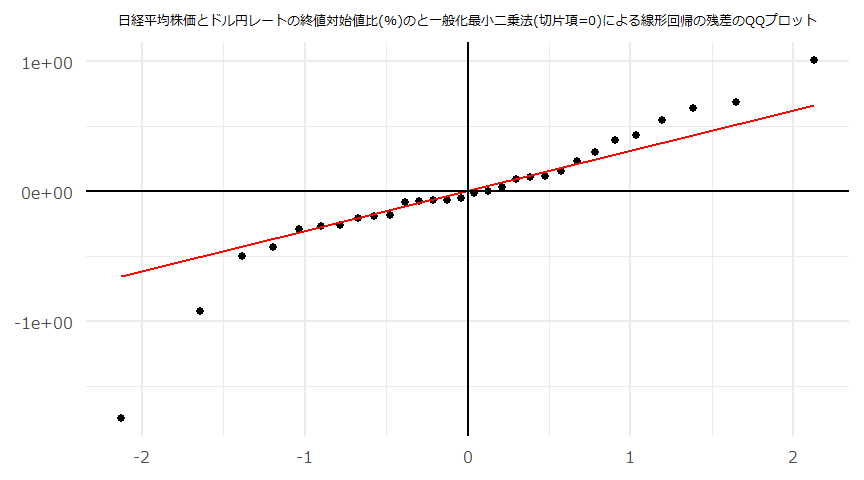

X-squared = 13.759, df = 10, p-value = 0.1843一般化最小二乗法

- gls {nlme}

- corARMA {nlme}

- ks.test {stats}

- confint {stats}

- Box.test {stats}

- 残差の系列相関の有無に拘わらず一般化最小二乗法による回帰係数を求めています。

- 最小二乗法の残差に系列相関が見られない場合、ここではAR(\(p=0,q=0\))の結果(AIC最小)が表示されます。

- http://user.keio.ac.jp/~nagakura/zemi/GLS.pdf

- http://tokyox.matrix.jp/wiki/index.php?%E4%B8%80%E8%88%AC%E5%8C%96%E6%9C%80%E5%B0%8F%E4%BA%8C%E4%B9%97%E6%B3%95

- 切片項\(\neq0\)

Generalized least squares fit by REML

Model: USDJPY_CloseToOpen ~ NIKKEI_CloseToOpen

Data: USDJPY_NIKKEI

AIC BIC logLik

55.29764 60.62645 -23.64882

Correlation Structure: AR(1)

Formula: ~1

Parameter estimate(s):

Phi

-0.4451758

Coefficients:

Value Std.Error t-value p-value

(Intercept) 0.06619396 0.06025475 1.0985683 0.2813

NIKKEI_CloseToOpen -0.00946658 0.02958071 -0.3200255 0.7513

Correlation:

(Intr)

NIKKEI_CloseToOpen 0.003

Standardized residuals:

Min Q1 Med Q3 Max

-3.30307059 -0.38219562 -0.06338854 0.40933578 1.92099120

Residual standard error: 0.5271411

Degrees of freedom: 30 total; 28 residual

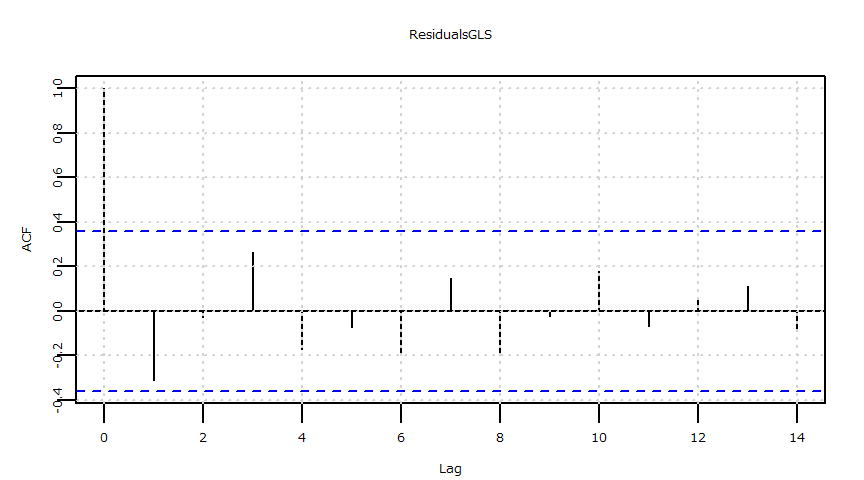

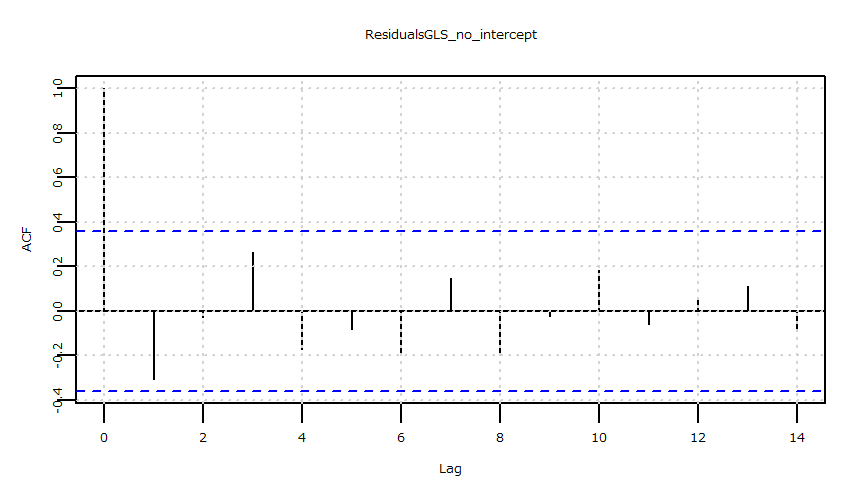

One-sample Kolmogorov-Smirnov test

data: ResidualsGLS

D = 0.14896, p-value = 0.4736

alternative hypothesis: two-sided 2.5 % 97.5 %

(Intercept) -0.05190318 0.18429111

NIKKEI_CloseToOpen -0.06744372 0.04851055

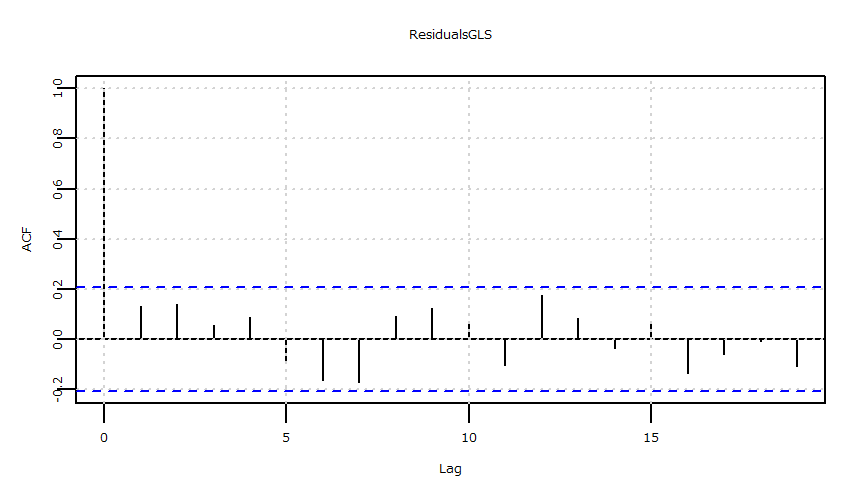

Box-Ljung test

data: ResidualsGLS

X-squared = 12.688, df = 10, p-value = 0.2417- 切片項\(=0\)

Generalized least squares fit by REML

Model: USDJPY_CloseToOpen ~ NIKKEI_CloseToOpen - 1

Data: USDJPY_NIKKEI

AIC BIC logLik

50.69885 54.80074 -22.34943

Correlation Structure: AR(1)

Formula: ~1

Parameter estimate(s):

Phi

-0.4085827

Coefficients:

Value Std.Error t-value p-value

NIKKEI_CloseToOpen -0.007212041 0.03018111 -0.2389588 0.8128

Standardized residuals:

Min Q1 Med Q3 Max

-3.21104944 -0.26249512 0.06298073 0.54758305 2.09499013

Residual standard error: 0.5194089

Degrees of freedom: 30 total; 29 residual

One-sample Kolmogorov-Smirnov test

data: ResidualsGLS_no_intercept

D = 0.19376, p-value = 0.1841

alternative hypothesis: two-sided 2.5 % 97.5 %

NIKKEI_CloseToOpen -0.06636593 0.05194185

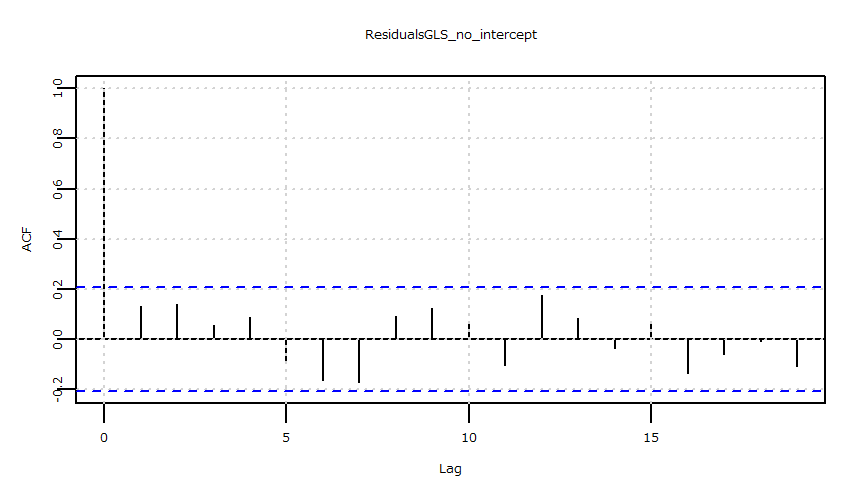

Box-Ljung test

data: ResidualsGLS_no_intercept

X-squared = 12.755, df = 10, p-value = 0.2377散布図・QQプロット・残差の時系列推移

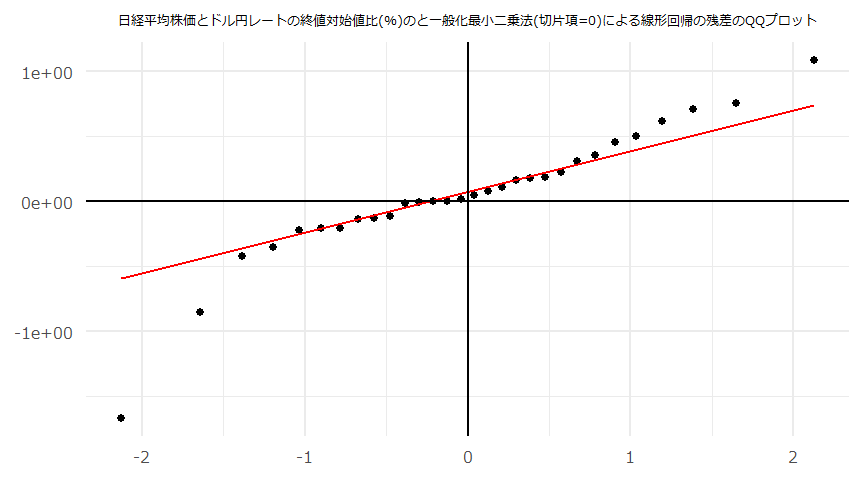

- (注意)線形回帰の傾き(\(a\))、切片(\(b\))それぞれの検定統計量、p値に関わらず\(y=ax+b\)とした回帰直線やその残差を散布図、QQプロット等にプロットしています。

- 散布図とQQプロット

- 残差の自己相関(ACF)

- 残差の自己相関(PACF)

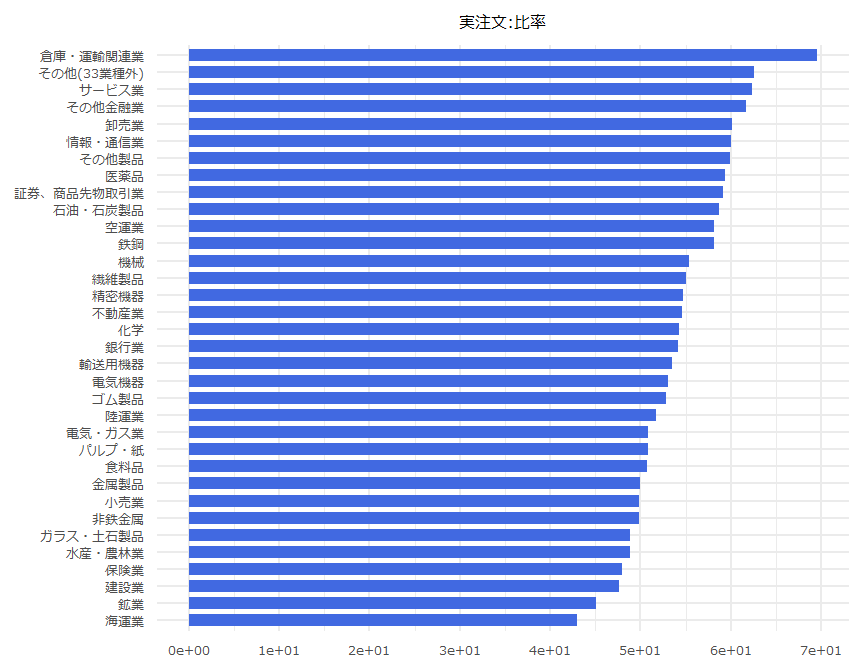

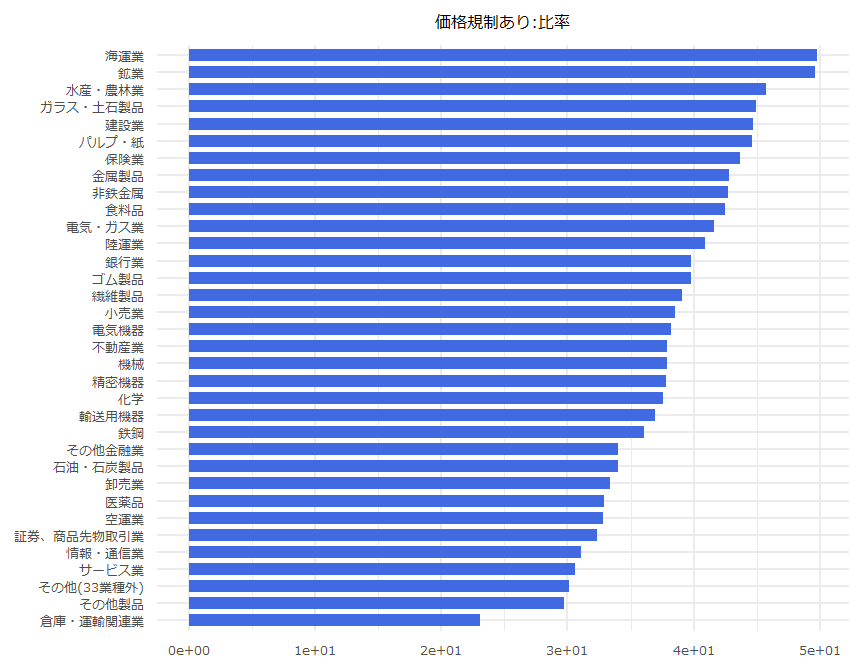

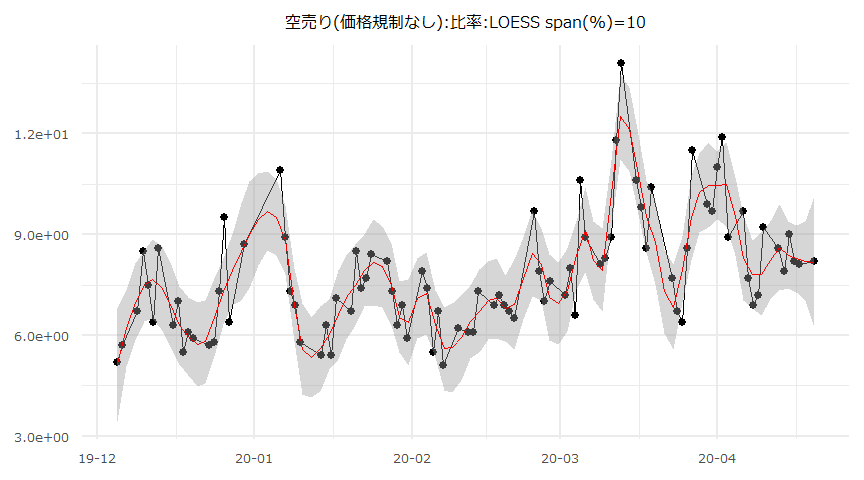

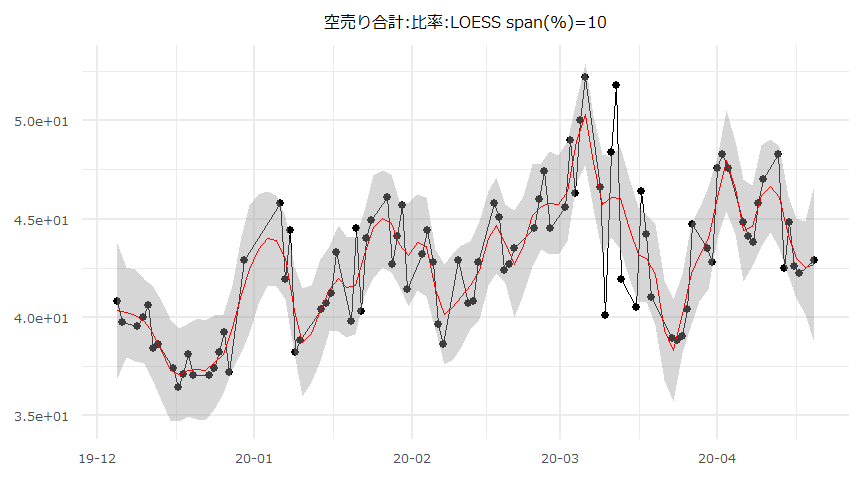

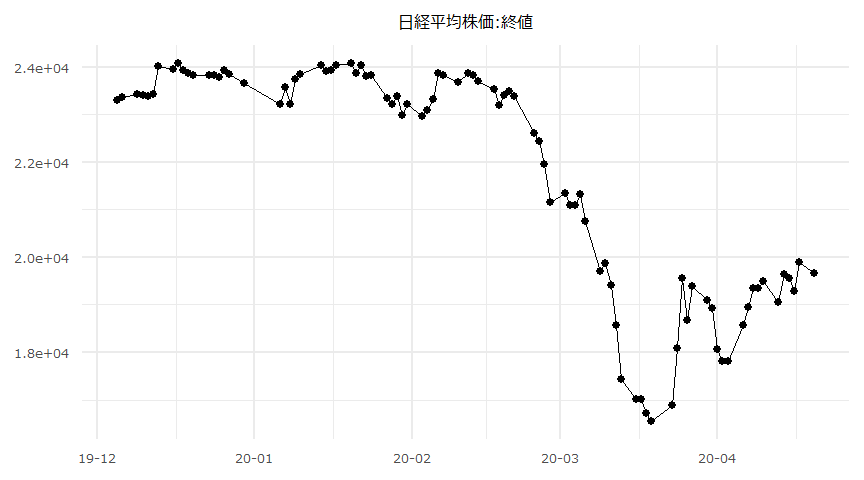

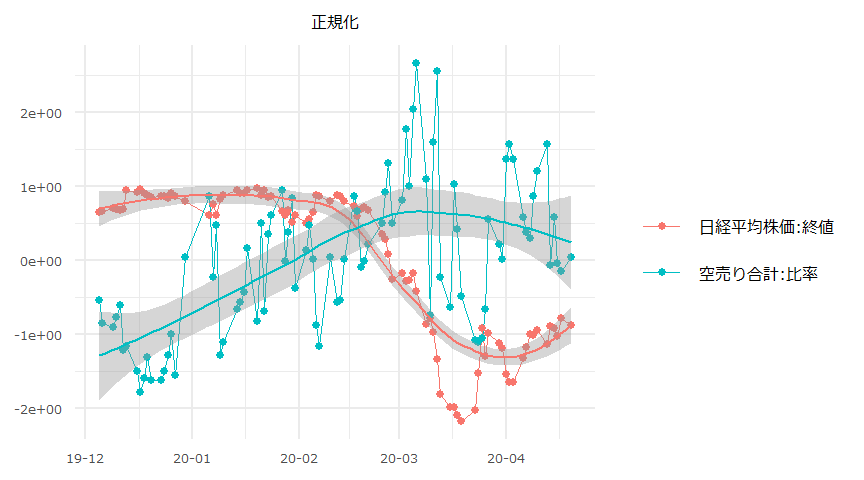

空売り比率と日経平均株価

- Source:日本取引所グループ、日本経済新聞社

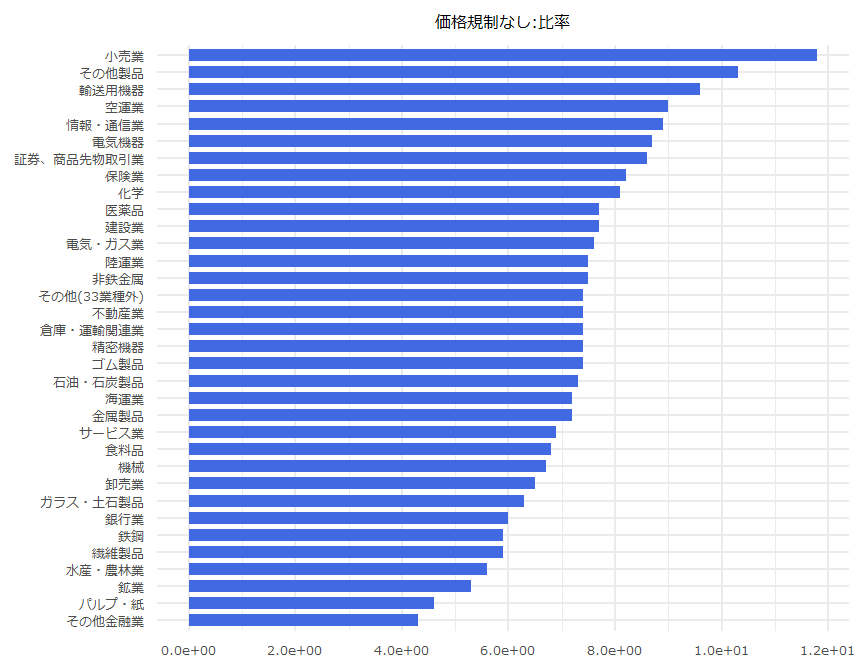

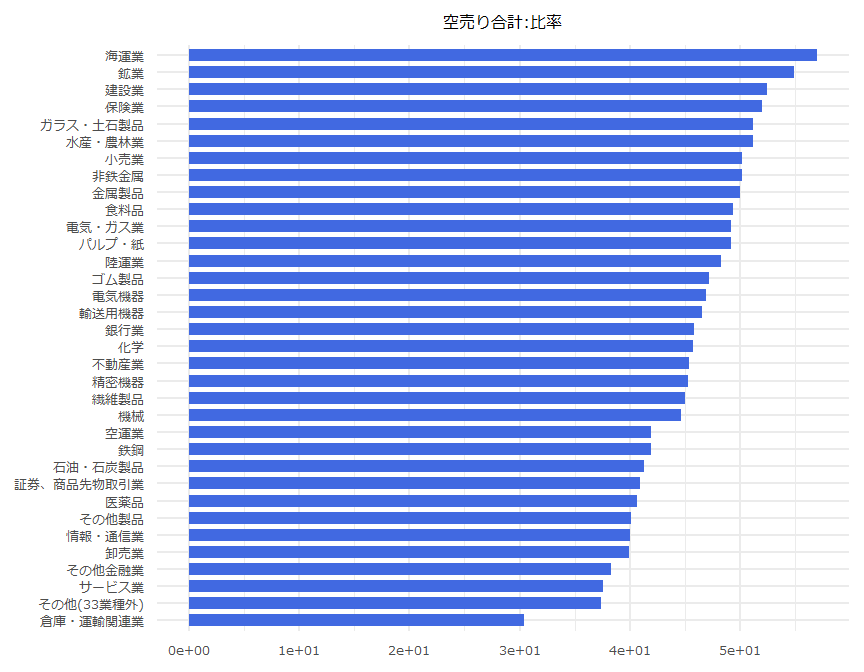

業種別空売り集計

- 2020年04月20日

- 「空売り合計:比率」は100から「実注文:比率」を減じた数値としています。

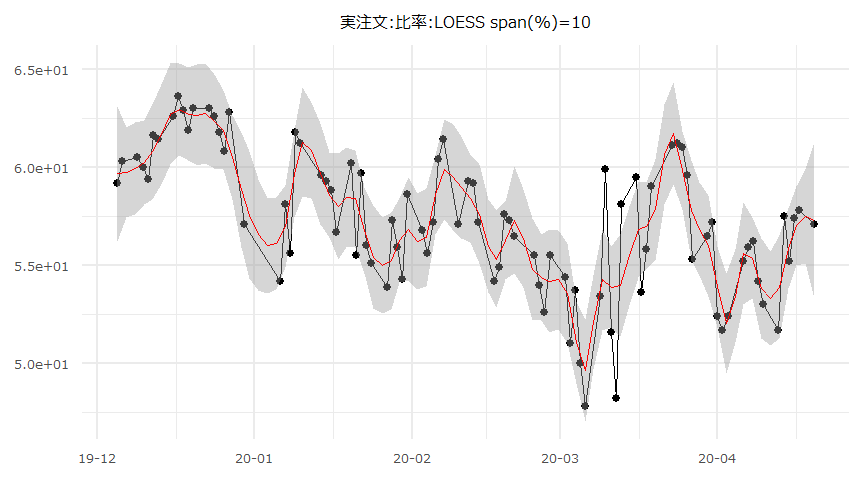

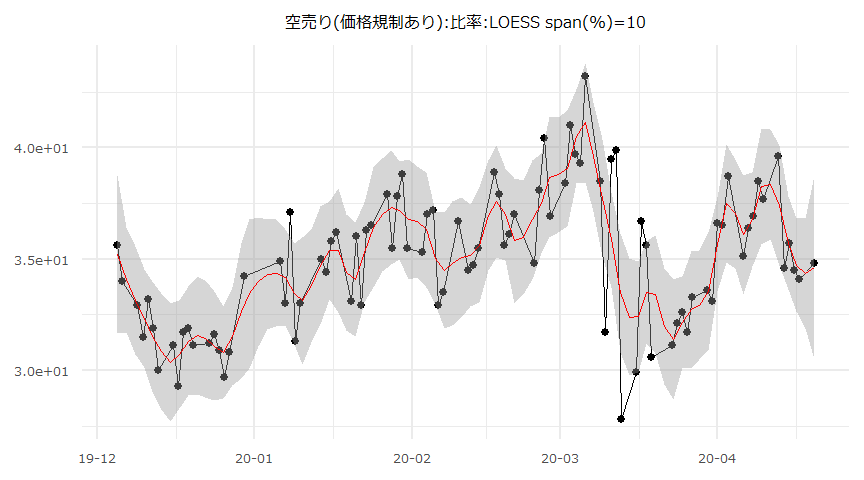

空売り比率の時系列推移

- 2019-12-05 ~ 2020-04-20

日経平均株価と空売り比率

時系列推移

- 対象期間:2019-12-05 ~ 2020-04-20

単位根検定/共和分検定

- CADFtest {CADFtest}

- ca.po {urca}

- 各系列の“_change“は前営業日との差。

- 対象期間: 2019-12-05 ~ 2020-04-20,90days

### 単位根検定 ###

$NIKKEI225.close

ADF test

data: x

ADF(2) = -2.128, p-value = 0.5229

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-0.07556282

$ShortSalerRatio

ADF test

data: x

ADF(2) = -2.881, p-value = 0.1738

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-0.345017

$NIKKEI225.close_change

ADF test

data: x

ADF(1) = -5.1364, p-value = 0.0003089

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-0.7399899

$ShortSalerRatio_change

ADF test

data: x

ADF(1) = -11.428, p-value = 0.0000000000001019

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-1.757469 ### 共和分検定 ###

########################################

# Phillips and Ouliaris Unit Root Test #

########################################

Test of type Pu

detrending of series none

Call:

lm(formula = z[, 1] ~ z[, -1] - 1)

Residuals:

Min 1Q Median 3Q Max

-7542.9 -2717.1 771.1 3328.9 5723.8

Coefficients:

Estimate Std. Error t value Pr(>|t|)

z[, -1] 503.910 8.665 58.15 <0.0000000000000002 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 3525 on 89 degrees of freedom

Multiple R-squared: 0.9744, Adjusted R-squared: 0.9741

F-statistic: 3382 on 1 and 89 DF, p-value: < 0.00000000000000022

Value of test-statistic is: 1.6365

Critical values of Pu are:

10pct 5pct 1pct

critical values 20.3933 25.9711 38.3413最小二乗法

- lm {stats}

- dwtest {lmtest}

- ks.test {stats}

- confint {stats}

- Box.test {stats}

- Ljung-Box 検定のラグは15としている。

- 対象期間: 2019-12-05 ~ 2020-04-20,90days

- 切片項\(\neq0\)

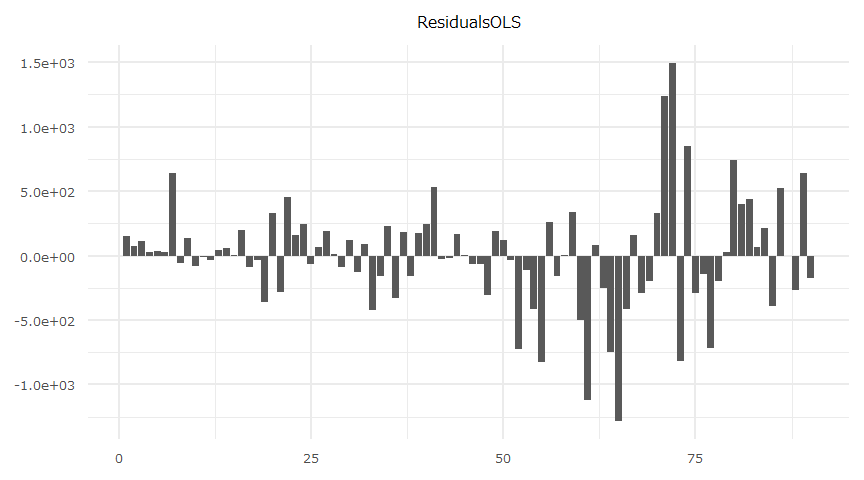

Call:

lm(formula = NIKKEI225.close_change ~ ShortSalerRatio_change,

data = datadf)

Residuals:

Min 1Q Median 3Q Max

-1282.12 -171.85 6.78 180.59 1496.80

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -38.64 44.57 -0.867 0.388

ShortSalerRatio_change -19.41 15.27 -1.271 0.207

Residual standard error: 422.8 on 88 degrees of freedom

Multiple R-squared: 0.01803, Adjusted R-squared: 0.006866

F-statistic: 1.615 on 1 and 88 DF, p-value: 0.2071

Durbin-Watson test

data: OLS_Model

DW = 1.7306, p-value = 0.1041

alternative hypothesis: true autocorrelation is greater than 0

One-sample Kolmogorov-Smirnov test

data: ResidualsOLS

D = 0.11392, p-value = 0.179

alternative hypothesis: two-sided 2.5 % 97.5 %

(Intercept) -127.20853 49.92503

ShortSalerRatio_change -49.76667 10.94125

Box-Ljung test

data: ResidualsOLS

X-squared = 19.513, df = 15, p-value = 0.1914- 切片項\(=0\)

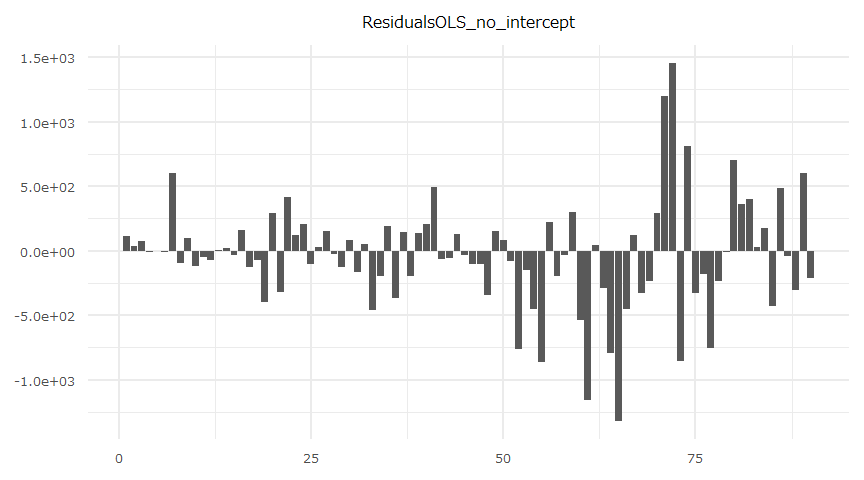

Call:

lm(formula = NIKKEI225.close_change ~ ShortSalerRatio_change -

1, data = datadf)

Residuals:

Min 1Q Median 3Q Max

-1320.47 -210.52 -31.87 142.04 1458.16

Coefficients:

Estimate Std. Error t value Pr(>|t|)

ShortSalerRatio_change -19.38 15.25 -1.271 0.207

Residual standard error: 422.2 on 89 degrees of freedom

Multiple R-squared: 0.01782, Adjusted R-squared: 0.006785

F-statistic: 1.615 on 1 and 89 DF, p-value: 0.2071

Durbin-Watson test

data: OLS_Model_no_intercept

DW = 1.716, p-value = 0.1108

alternative hypothesis: true autocorrelation is greater than 0

One-sample Kolmogorov-Smirnov test

data: ResidualsOLS_no_intercept

D = 0.14573, p-value = 0.03933

alternative hypothesis: two-sided 2.5 % 97.5 %

ShortSalerRatio_change -49.68923 10.92432

Box-Ljung test

data: ResidualsOLS_no_intercept

X-squared = 19.515, df = 15, p-value = 0.1914一般化最小二乗法

- gls {nlme}

- corARMA {nlme}

- ks.test {stats}

- confint {stats}

- Box.test {stats}

- 残差の系列相関の有無に拘わらず一般化最小二乗法による回帰係数を求めています。

- 最小二乗法の残差に系列相関が見られない場合、ここではAR(p=0,q=0)の結果(AIC最小)が表示されます。

- http://user.keio.ac.jp/~nagakura/zemi/GLS.pdf

- http://tokyox.matrix.jp/wiki/index.php?%E4%B8%80%E8%88%AC%E5%8C%96%E6%9C%80%E5%B0%8F%E4%BA%8C%E4%B9%97%E6%B3%95

- Ljung-Box 検定のラグは15としている。

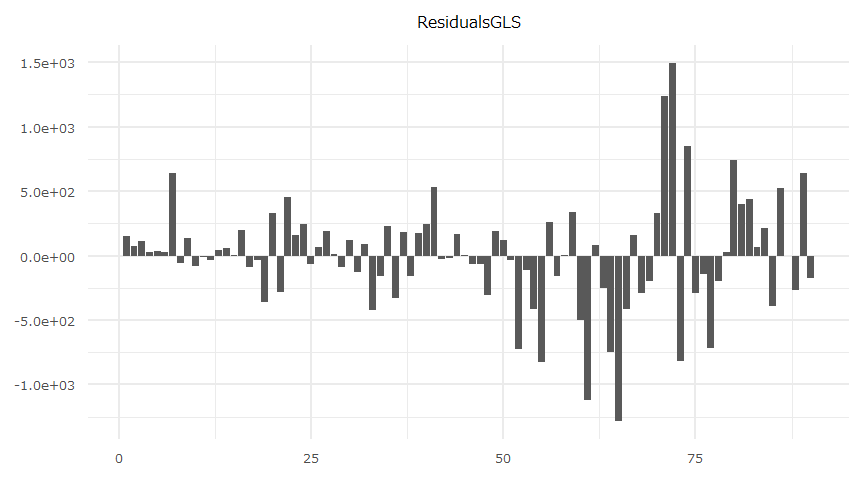

- 切片項\(\neq0\)

Generalized least squares fit by REML

Model: NIKKEI225.close_change ~ ShortSalerRatio_change

Data: datadf

AIC BIC logLik

1331.127 1338.559 -662.5633

Coefficients:

Value Std.Error t-value p-value

(Intercept) -38.64175 44.56661 -0.867056 0.3883

ShortSalerRatio_change -19.41271 15.27405 -1.270961 0.2071

Correlation:

(Intr)

ShortSalerRatio_change 0.002

Standardized residuals:

Min Q1 Med Q3 Max

-3.03249656 -0.40645203 0.01604199 0.42714459 3.54026088

Residual standard error: 422.7949

Degrees of freedom: 90 total; 88 residual

One-sample Kolmogorov-Smirnov test

data: ResidualsGLS

D = 0.11392, p-value = 0.179

alternative hypothesis: two-sided 2.5 % 97.5 %

(Intercept) -125.9907 48.70721

ShortSalerRatio_change -49.3493 10.52387

Box-Ljung test

data: ResidualsGLS

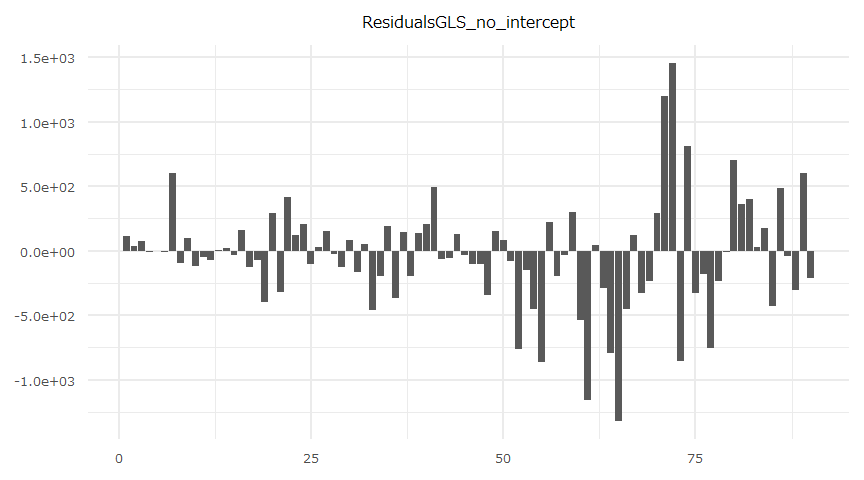

X-squared = 19.513, df = 15, p-value = 0.1914- 切片項\(=0\)

Generalized least squares fit by REML

Model: NIKKEI225.close_change ~ ShortSalerRatio_change - 1

Data: datadf

AIC BIC logLik

1339.31 1344.287 -667.6549

Coefficients:

Value Std.Error t-value p-value

ShortSalerRatio_change -19.38246 15.25269 -1.270756 0.2071

Standardized residuals:

Min Q1 Med Q3 Max

-3.12754828 -0.49861356 -0.07549153 0.33642742 3.45366996

Residual standard error: 422.2049

Degrees of freedom: 90 total; 89 residual

One-sample Kolmogorov-Smirnov test

data: ResidualsGLS_no_intercept

D = 0.14573, p-value = 0.03933

alternative hypothesis: two-sided 2.5 % 97.5 %

ShortSalerRatio_change -49.27719 10.51228

Box-Ljung test

data: ResidualsGLS_no_intercept

X-squared = 19.515, df = 15, p-value = 0.1914残差

- 時系列推移

- 自己相関

- 時系列推移

- 自己相関

Summary