空売り比率と日経平均株価

Updated time:2020-01-15 09:22:20

- Source:日本取引所グループ、日本経済新聞社

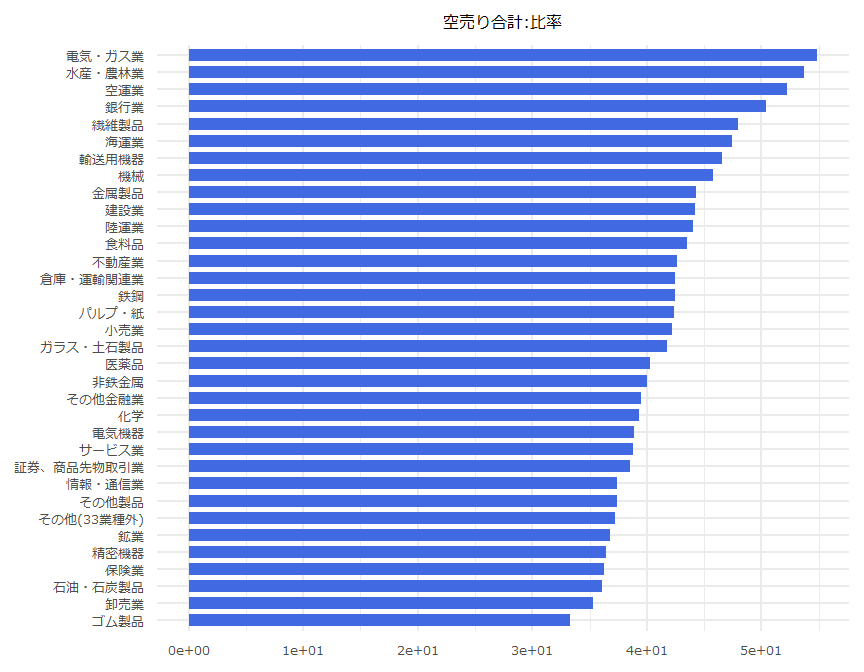

| N | 業種名 | 空売り合計:比率 |

|---|---|---|

| 1 | 水産・農林業 | 53.7 |

| 2 | 鉱業 | 36.8 |

| 3 | 建設業 | 44.2 |

| 4 | 食料品 | 43.5 |

| 5 | 繊維製品 | 48 |

| 6 | パルプ・紙 | 42.4 |

| 7 | 化学 | 39.3 |

| 8 | 医薬品 | 40.3 |

| 9 | 石油・石炭製品 | 36.1 |

| 10 | ゴム製品 | 33.3 |

| 11 | ガラス・土石製品 | 41.8 |

| 12 | 鉄鋼 | 42.5 |

| 13 | 非鉄金属 | 40 |

| 14 | 金属製品 | 44.3 |

| 15 | 機械 | 45.8 |

| 16 | 電気機器 | 38.9 |

| 17 | 輸送用機器 | 46.6 |

| 18 | 精密機器 | 36.4 |

| 19 | その他製品 | 37.4 |

| 20 | 電気・ガス業 | 54.9 |

| 21 | 陸運業 | 44 |

| 22 | 海運業 | 47.4 |

| 23 | 空運業 | 52.2 |

| 24 | 倉庫・運輸関連業 | 42.5 |

| 25 | 情報・通信業 | 37.4 |

| 26 | 卸売業 | 35.3 |

| 27 | 小売業 | 42.2 |

| 28 | 銀行業 | 50.4 |

| 29 | 証券、商品先物取引業 | 38.5 |

| 30 | 保険業 | 36.3 |

| 31 | その他金融業 | 39.5 |

| 32 | 不動産業 | 42.6 |

| 33 | サービス業 | 38.8 |

| 34 | その他(33業種外) | 37.2 |

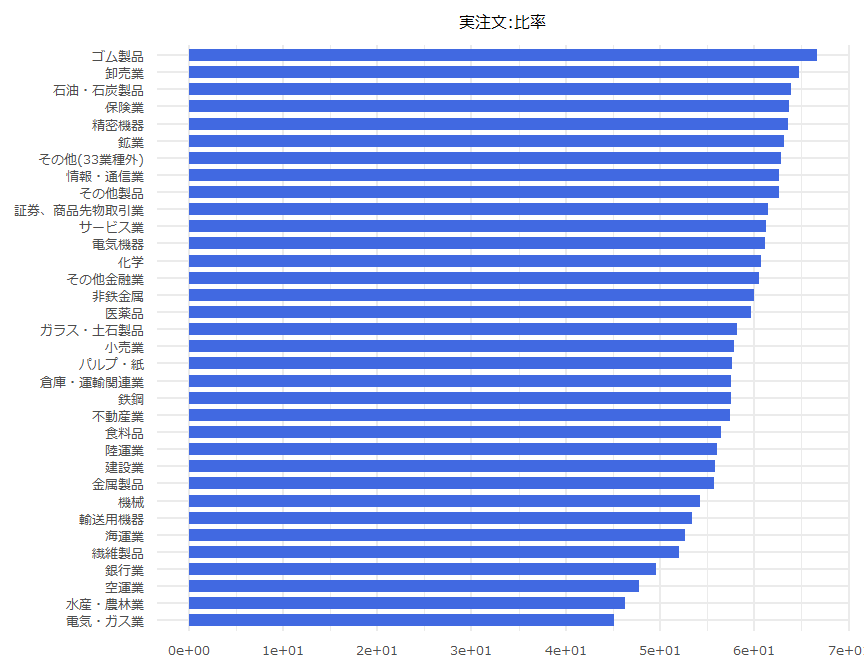

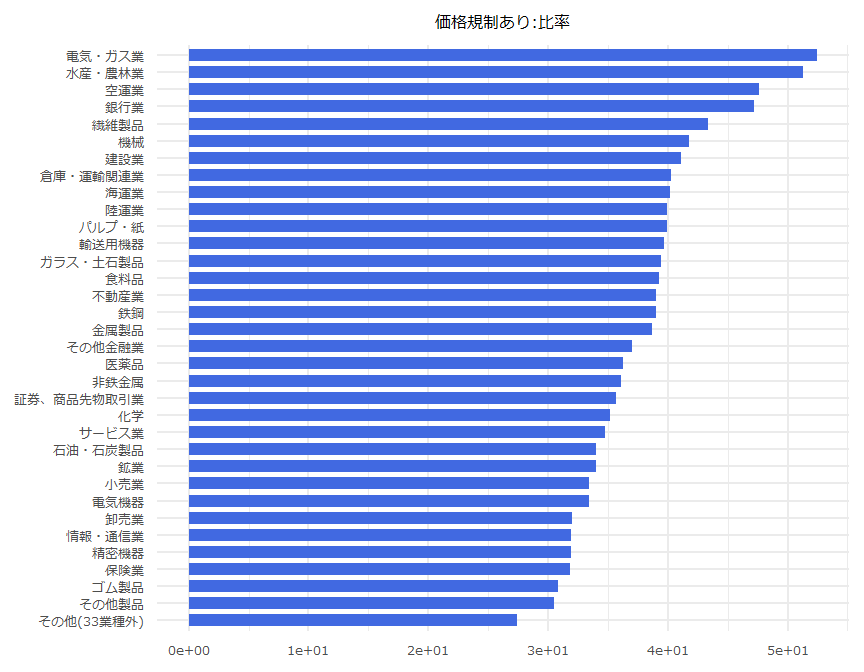

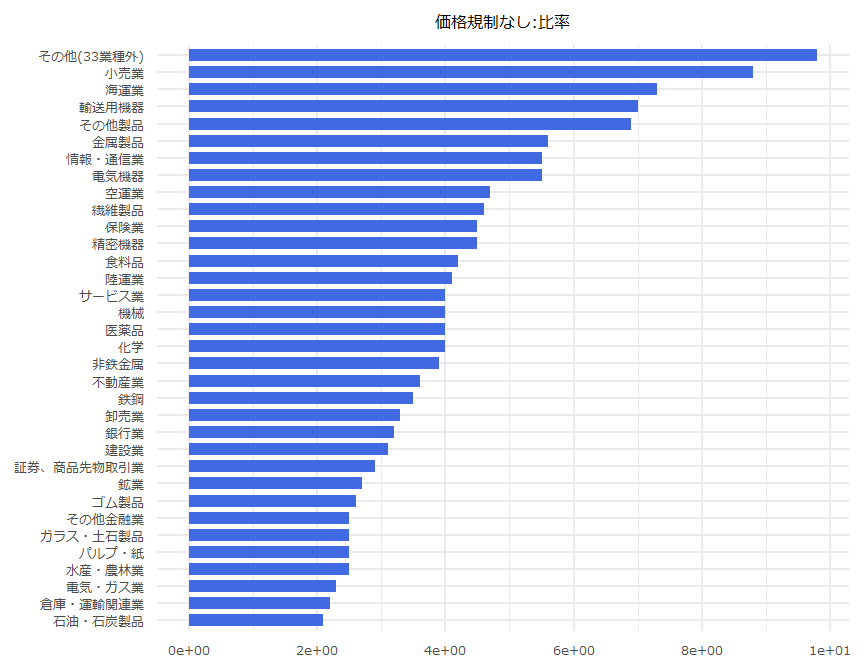

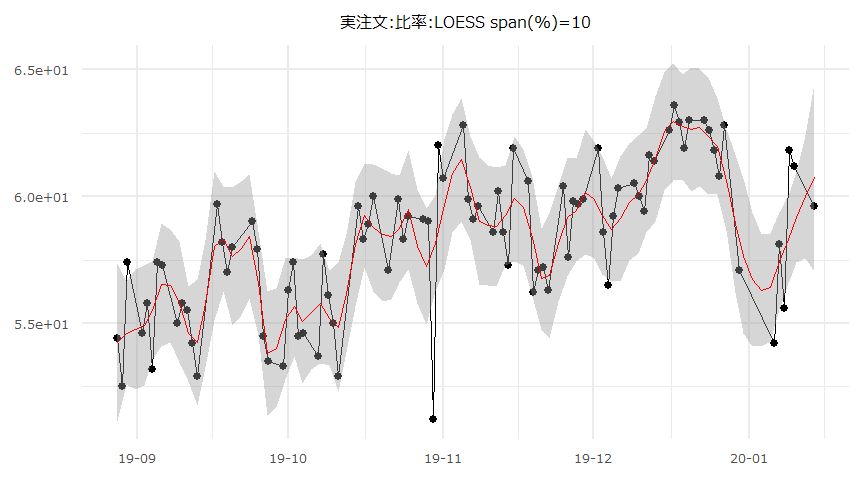

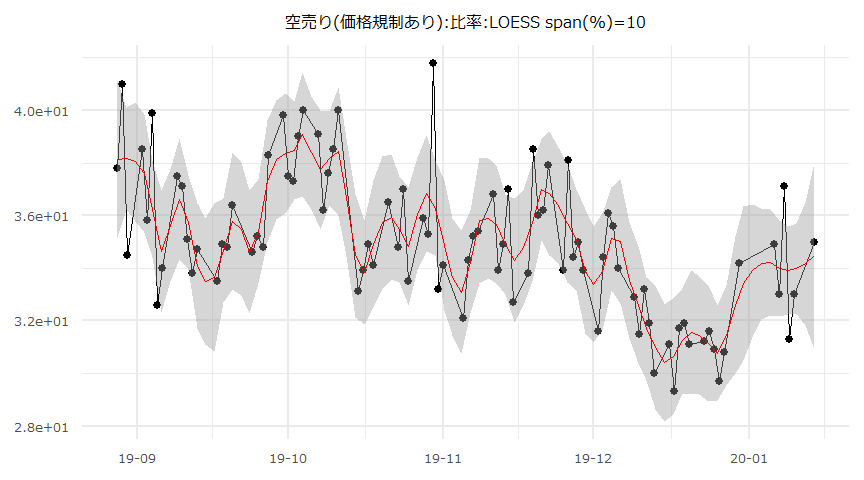

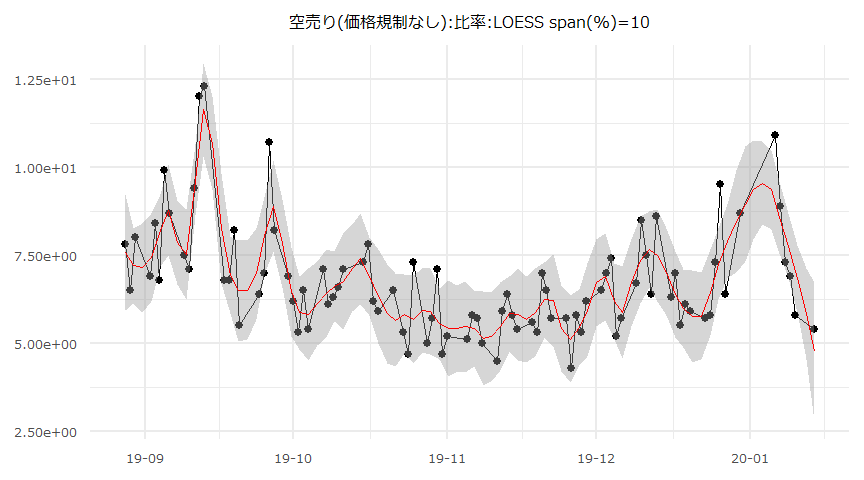

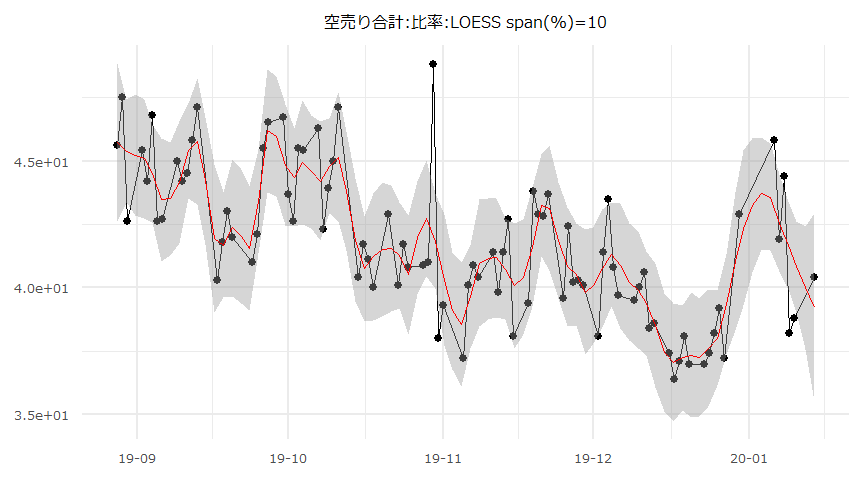

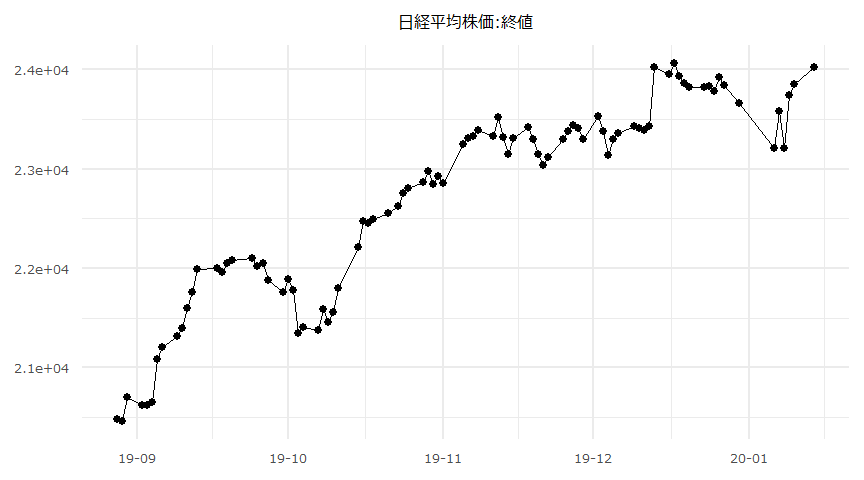

空売り比率の時系列推移

- 2019-08-28 ~ 2020-01-14

| Date | 01-14 | 01-10 | 01-09 | 01-08 | 01-07 | 01-06 | 12-30 | 12-27 |

|---|---|---|---|---|---|---|---|---|

| 実注文:比率 | 59.6 | 61.2 | 61.8 | 55.6 | 58.1 | 54.2 | 57.1 | 62.8 |

| 空売り(価格規制あり):比率 | 35 | 33 | 31.3 | 37.1 | 33 | 34.9 | 34.2 | 30.8 |

| 空売り(価格規制なし):比率 | 5.4 | 5.8 | 6.9 | 7.3 | 8.9 | 10.9 | 8.7 | 6.4 |

| 空売り合計:比率 | 40.4 | 38.8 | 38.2 | 44.4 | 41.9 | 45.8 | 42.9 | 37.2 |

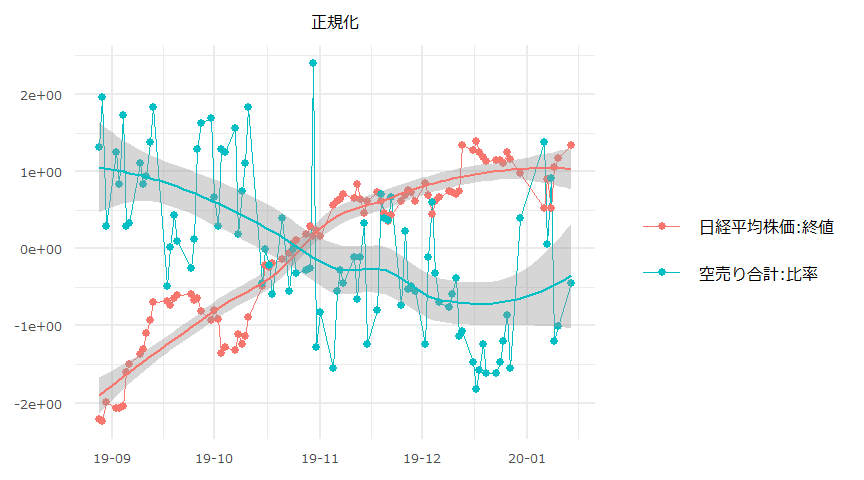

日経平均株価と空売り比率

時系列推移

- 対象期間:2019-08-28 ~ 2020-01-14

単位根検定/共和分検定

- CADFtest {CADFtest}

- ca.po {urca}

- 各系列の“_change“は前営業日との差。

- 対象期間: 2019-08-28 ~ 2020-01-14,90days

### 単位根検定 ###

$NIKKEI225.close

ADF test

data: x

ADF(0) = -2.5292, p-value = 0.3137

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-0.1289646

$ShortSalerRatio

ADF test

data: x

ADF(0) = -6.7065, p-value = 0.0000007748

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-0.6963772

$NIKKEI225.close_change

ADF test

data: x

ADF(0) = -10.04, p-value = 0.00000000000369

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-1.090583

$ShortSalerRatio_change

ADF test

data: x

ADF(2) = -8.2208, p-value = 0.000000002009

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-2.103106 ### 共和分検定 ###

########################################

# Phillips and Ouliaris Unit Root Test #

########################################

Test of type Pu

detrending of series none

Call:

lm(formula = z[, 1] ~ z[, -1] - 1)

Residuals:

Min 1Q Median 3Q Max

-5175.8 -1810.0 445.8 1925.6 4420.3

Coefficients:

Estimate Std. Error t value Pr(>|t|)

z[, -1] 539.720 6.075 88.84 <0.0000000000000002 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 2411 on 89 degrees of freedom

Multiple R-squared: 0.9889, Adjusted R-squared: 0.9887

F-statistic: 7893 on 1 and 89 DF, p-value: < 0.00000000000000022

Value of test-statistic is: 0.3606

Critical values of Pu are:

10pct 5pct 1pct

critical values 20.3933 25.9711 38.3413最小二乗法

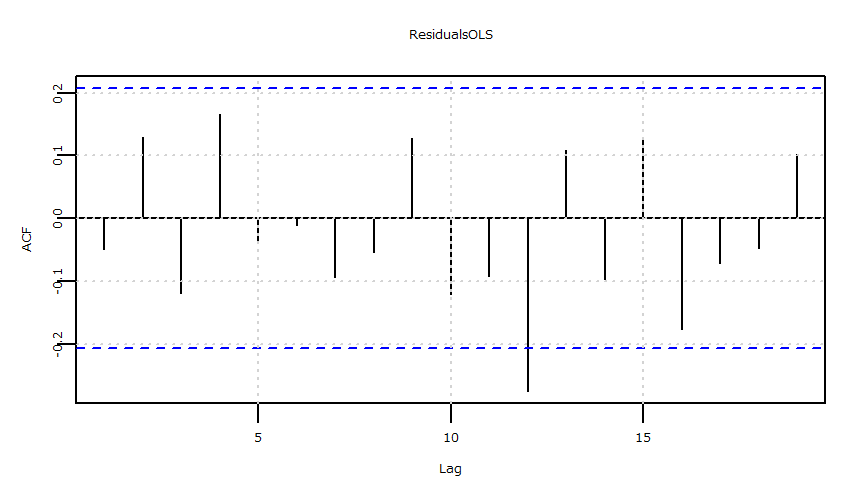

- lm {stats}

- dwtest {lmtest}

- ks.test {stats}

- confint {stats}

- Box.test {stats}

- Ljung-Box 検定のラグは15としている。

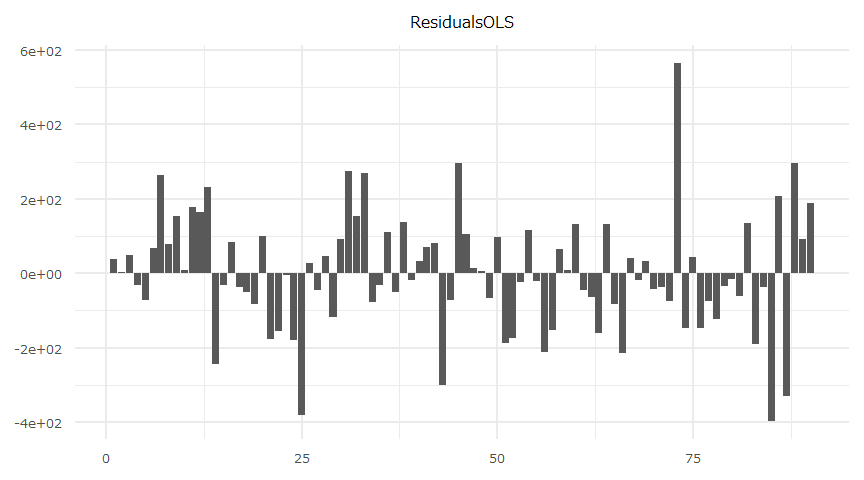

- 対象期間: 2019-08-28 ~ 2020-01-14,90days

- 切片項\(\neq0\)

Call:

lm(formula = NIKKEI225.close_change ~ ShortSalerRatio_change,

data = datadf)

Residuals:

Min 1Q Median 3Q Max

-397.06 -76.04 -17.09 92.27 566.30

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 38.408 16.609 2.313 0.0231 *

ShortSalerRatio_change -32.107 6.074 -5.286 0.000000901 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 157.5 on 88 degrees of freedom

Multiple R-squared: 0.241, Adjusted R-squared: 0.2323

F-statistic: 27.94 on 1 and 88 DF, p-value: 0.0000009009

Durbin-Watson test

data: OLS_Model

DW = 2.0825, p-value = 0.6685

alternative hypothesis: true autocorrelation is greater than 0

One-sample Kolmogorov-Smirnov test

data: ResidualsOLS

D = 0.088908, p-value = 0.4496

alternative hypothesis: two-sided 2.5 % 97.5 %

(Intercept) 5.401937 71.41393

ShortSalerRatio_change -44.179109 -20.03574

Box-Ljung test

data: ResidualsOLS

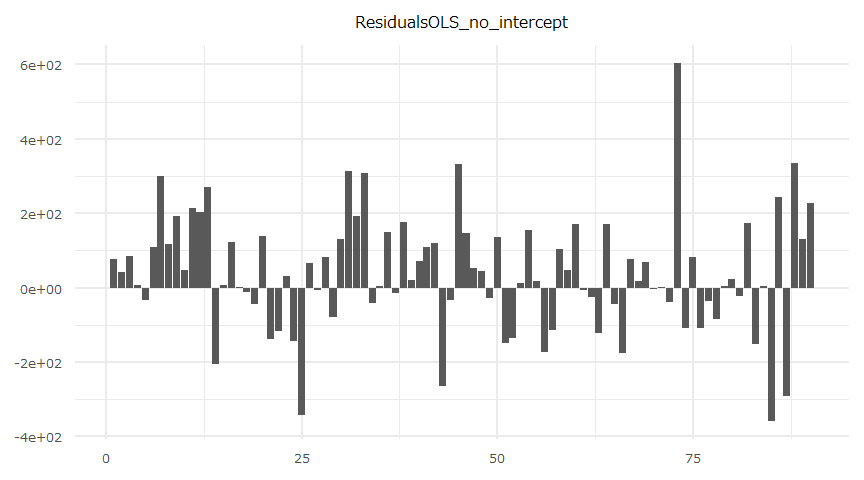

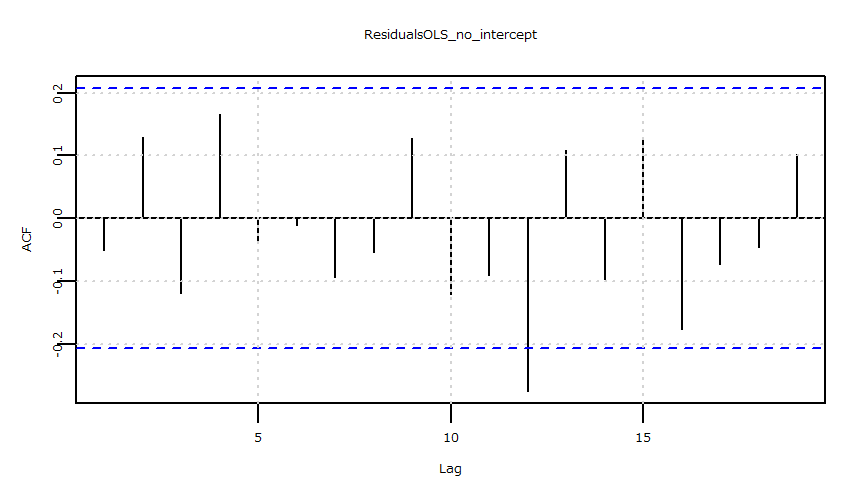

X-squared = 23.312, df = 15, p-value = 0.07773- 切片項\(=0\)

Call:

lm(formula = NIKKEI225.close_change ~ ShortSalerRatio_change -

1, data = datadf)

Residuals:

Min 1Q Median 3Q Max

-358.07 -37.91 21.26 130.87 604.75

Coefficients:

Estimate Std. Error t value Pr(>|t|)

ShortSalerRatio_change -32.31 6.22 -5.194 0.00000129 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 161.3 on 89 degrees of freedom

Multiple R-squared: 0.2326, Adjusted R-squared: 0.224

F-statistic: 26.97 on 1 and 89 DF, p-value: 0.000001294

Durbin-Watson test

data: OLS_Model_no_intercept

DW = 1.964, p-value = 0.4919

alternative hypothesis: true autocorrelation is greater than 0

One-sample Kolmogorov-Smirnov test

data: ResidualsOLS_no_intercept

D = 0.18037, p-value = 0.004928

alternative hypothesis: two-sided 2.5 % 97.5 %

ShortSalerRatio_change -44.66707 -19.94738

Box-Ljung test

data: ResidualsOLS_no_intercept

X-squared = 23.293, df = 15, p-value = 0.07812一般化最小二乗法

- gls {nlme}

- corARMA {nlme}

- ks.test {stats}

- confint {stats}

- Box.test {stats}

- 残差の系列相関の有無に拘わらず一般化最小二乗法による回帰係数を求めています。

- 最小二乗法の残差に系列相関が見られない場合、ここではAR(p=0,q=0)の結果(AIC最小)が表示されます。

- http://user.keio.ac.jp/~nagakura/zemi/GLS.pdf

- http://tokyox.matrix.jp/wiki/index.php?%E4%B8%80%E8%88%AC%E5%8C%96%E6%9C%80%E5%B0%8F%E4%BA%8C%E4%B9%97%E6%B3%95

- Ljung-Box 検定のラグは15としている。

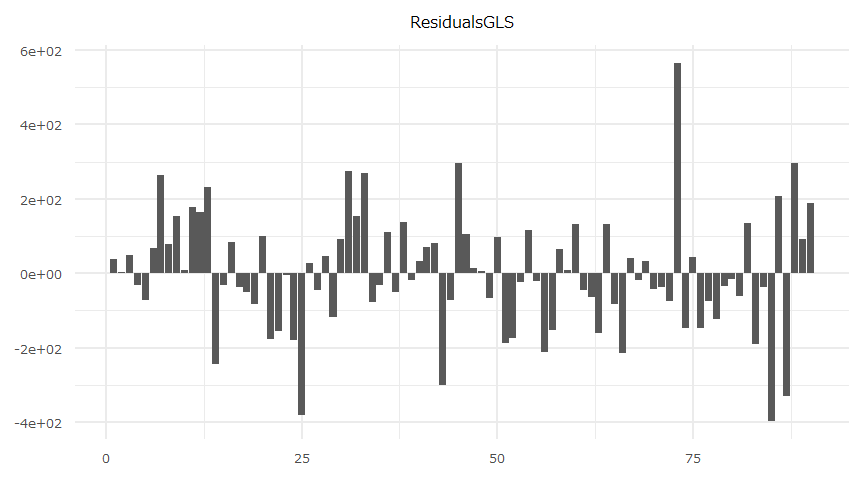

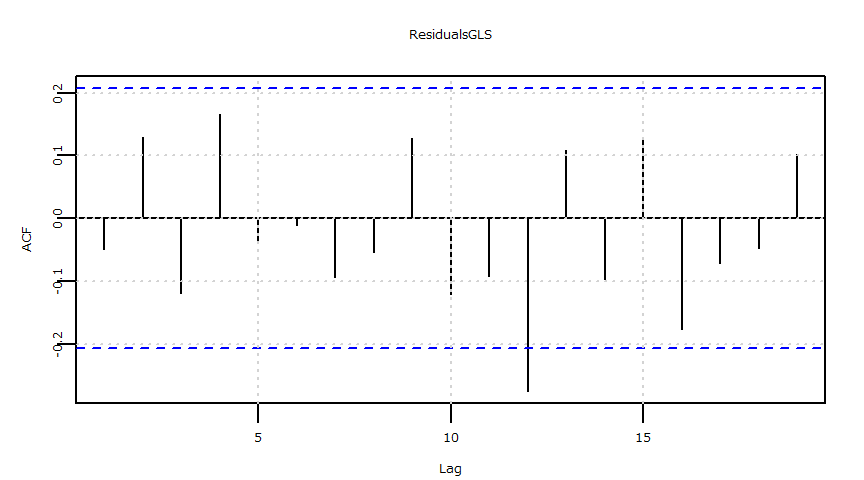

- 切片項\(\neq0\)

Generalized least squares fit by REML

Model: NIKKEI225.close_change ~ ShortSalerRatio_change

Data: datadf

AIC BIC logLik

1157.255 1164.687 -575.6276

Coefficients:

Value Std.Error t-value p-value

(Intercept) 38.40793 16.608547 2.312540 0.0231

ShortSalerRatio_change -32.10742 6.074446 -5.285655 0.0000

Correlation:

(Intr)

ShortSalerRatio_change 0.014

Standardized residuals:

Min Q1 Med Q3 Max

-2.5202478 -0.4826562 -0.1085063 0.5856795 3.5945152

Residual standard error: 157.5466

Degrees of freedom: 90 total; 88 residual

One-sample Kolmogorov-Smirnov test

data: ResidualsGLS

D = 0.088908, p-value = 0.4496

alternative hypothesis: two-sided 2.5 % 97.5 %

(Intercept) 5.85578 70.96009

ShortSalerRatio_change -44.01312 -20.20173

Box-Ljung test

data: ResidualsGLS

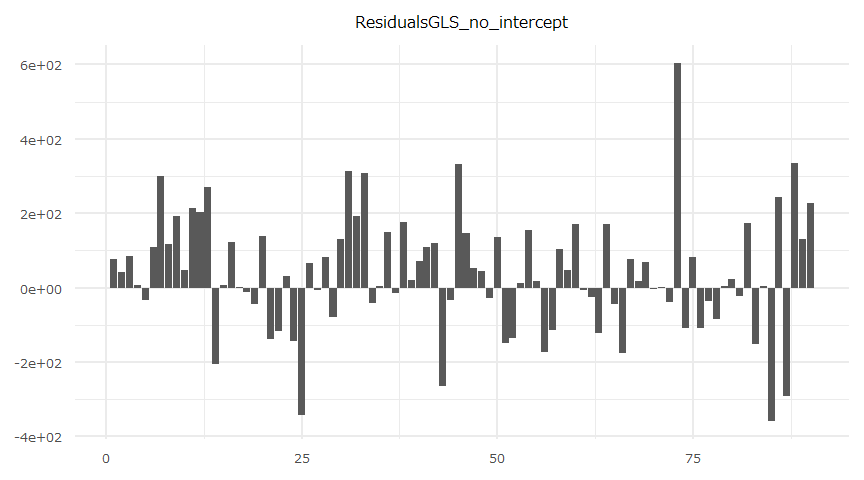

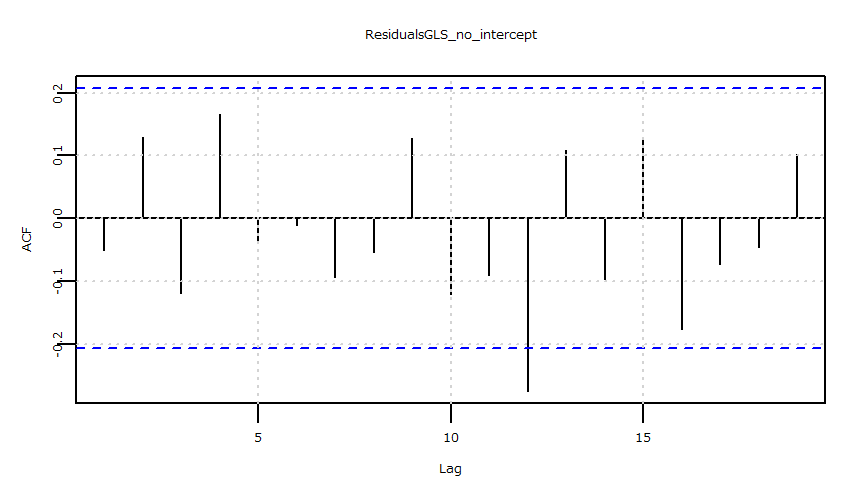

X-squared = 23.312, df = 15, p-value = 0.07773- 切片項\(=0\)

Generalized least squares fit by REML

Model: NIKKEI225.close_change ~ ShortSalerRatio_change - 1

Data: datadf

AIC BIC logLik

1167.958 1172.935 -581.9789

Coefficients:

Value Std.Error t-value p-value

ShortSalerRatio_change -32.30722 6.220422 -5.193735 0

Standardized residuals:

Min Q1 Med Q3 Max

-2.2192217 -0.2349728 0.1317839 0.8111274 3.7480970

Residual standard error: 161.3489

Degrees of freedom: 90 total; 89 residual

One-sample Kolmogorov-Smirnov test

data: ResidualsGLS_no_intercept

D = 0.18037, p-value = 0.004928

alternative hypothesis: two-sided 2.5 % 97.5 %

ShortSalerRatio_change -44.49903 -20.11542

Box-Ljung test

data: ResidualsGLS_no_intercept

X-squared = 23.293, df = 15, p-value = 0.07812残差

- 時系列推移

- 自己相関

- 時系列推移

- 自己相関

業種別空売り集計