日経平均株価と東京市場ドル円レート

Updated time:2020-01-15 09:20:34

- Source:日本銀行,日本経済新聞社

[1] "USDJPY"

Date Open High Low Close Center Index CloseToOpen HighToLow MA25 DeviationRate Close:Diff(lag=1) Close:Ratio(lag=1)

56 2019-12-18 109.53 109.57 109.42 109.44 109.44 103.47 -0.082 0.137 108.9536 0.45 -0.16 -0.146

57 2019-12-19 109.55 109.72 109.55 109.58 109.58 103.62 0.027 0.155 108.9868 0.54 0.14 0.128

58 2019-12-20 109.39 109.40 109.26 109.37 109.39 103.61 -0.018 0.128 109.0192 0.32 -0.21 -0.192

59 2019-12-23 109.50 109.54 109.37 109.40 109.42 103.69 -0.091 0.155 109.0384 0.33 0.03 0.027

60 2019-12-24 109.40 109.45 109.37 109.40 109.40 103.65 0.000 0.073 109.0676 0.30 0.00 0.000

61 2019-12-25 109.38 109.44 109.31 109.35 109.38 103.57 -0.027 0.119 109.1040 0.23 -0.05 -0.046

62 2019-12-26 109.38 109.57 109.37 109.56 109.55 103.32 0.165 0.183 109.1432 0.38 0.21 0.192

63 2019-12-27 109.53 109.59 109.43 109.51 109.49 103.32 -0.018 0.146 109.1792 0.30 -0.05 -0.046

64 2019-12-30 109.44 109.46 109.07 109.15 109.12 103.71 -0.265 0.358 109.1916 -0.04 -0.36 -0.329

65 2020-01-06 107.98 108.17 107.77 108.11 108.05 104.24 0.120 0.371 109.1576 -0.96 -1.04 -0.953

66 2020-01-07 108.42 108.51 108.28 108.33 108.44 104.15 -0.083 0.212 109.1232 -0.73 0.22 0.203

67 2020-01-08 108.01 108.50 107.65 108.42 107.82 103.49 0.380 0.790 109.0832 -0.61 0.09 0.083

68 2020-01-09 109.04 109.35 109.02 109.35 109.22 103.02 0.284 0.303 109.0772 0.25 0.93 0.858

69 2020-01-10 109.50 109.60 109.46 109.57 109.54 102.95 0.064 0.128 109.0760 0.45 0.22 0.201

70 2020-01-14 110.02 110.21 109.92 109.99 110.08 NA -0.027 0.264 109.1116 0.81 0.42 0.383[1] "NIKKEI"

Date Open High Low Close CloseToOpen HighToLow MA25 DeviationRate Close:Diff(lag=1) Close:Ratio(lag=1)

56 2019-12-18 24023.27 24046.09 23919.36 23934.43 -0.370 0.530 23423.75 2.18 -131.69 -0.547

57 2019-12-19 23911.46 23945.53 23835.29 23864.85 -0.195 0.463 23452.69 1.76 -69.58 -0.291

58 2019-12-20 23893.45 23908.77 23746.63 23816.63 -0.322 0.683 23473.22 1.46 -48.22 -0.202

59 2019-12-23 23921.29 23923.09 23810.82 23821.11 -0.419 0.472 23489.39 1.41 4.48 0.019

60 2019-12-24 23839.18 23853.56 23796.35 23830.58 -0.036 0.240 23510.91 1.36 9.47 0.040

61 2019-12-25 23813.59 23824.85 23782.87 23782.87 -0.129 0.177 23536.28 1.05 -47.71 -0.200

62 2019-12-26 23787.70 23931.51 23775.40 23924.92 0.577 0.657 23571.74 1.50 142.05 0.597

63 2019-12-27 23953.75 23967.18 23837.72 23837.72 -0.484 0.543 23600.73 1.00 -87.20 -0.364

64 2019-12-30 23770.93 23782.49 23656.62 23656.62 -0.481 0.532 23615.28 0.18 -181.10 -0.760

65 2020-01-06 23319.76 23365.36 23148.53 23204.86 -0.493 0.937 23608.54 -1.71 -451.76 -1.910

66 2020-01-07 23320.12 23577.44 23299.92 23575.72 1.096 1.191 23614.06 -0.16 370.86 1.598

67 2020-01-08 23217.49 23303.21 22951.18 23204.76 -0.055 1.534 23605.89 -1.70 -370.96 -1.573

68 2020-01-09 23530.29 23767.09 23506.15 23739.87 0.891 1.110 23623.72 0.49 535.11 2.306

69 2020-01-10 23813.28 23903.29 23761.08 23850.57 0.157 0.598 23636.57 0.91 110.70 0.466

70 2020-01-14 23969.04 24059.86 23951.66 24025.17 0.234 0.452 23662.38 1.53 174.60 0.732単位根検定・共和分検定

- CADFtest {CADFtest}

- ca.po {urca}

$USDJPY_CloseToOpen

ADF test

data: x

ADF(0) = -7.9285, p-value = 0.00000004952

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-1.067027

$NIKKEI_CloseToOpen

ADF test

data: x

ADF(1) = -6.4913, p-value = 0.000005539

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-1.26852

########################################

# Phillips and Ouliaris Unit Root Test #

########################################

Test of type Pu

detrending of series none

Call:

lm(formula = z[, 1] ~ z[, -1] - 1)

Residuals:

Min 1Q Median 3Q Max

-0.21507 -0.03567 0.01568 0.07360 0.38571

Coefficients:

Estimate Std. Error t value Pr(>|t|)

z[, -1] 0.10380 0.03231 3.213 0.00213 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.1066 on 59 degrees of freedom

Multiple R-squared: 0.1489, Adjusted R-squared: 0.1345

F-statistic: 10.32 on 1 and 59 DF, p-value: 0.002131

Value of test-statistic is: 68.3317

Critical values of Pu are:

10pct 5pct 1pct

critical values 20.3933 25.9711 38.3413最小二乗法

- lm {stats}

- dwtest {lmtest}

- ks.test {stats}

- confint {stats}

- Box.test {stats}

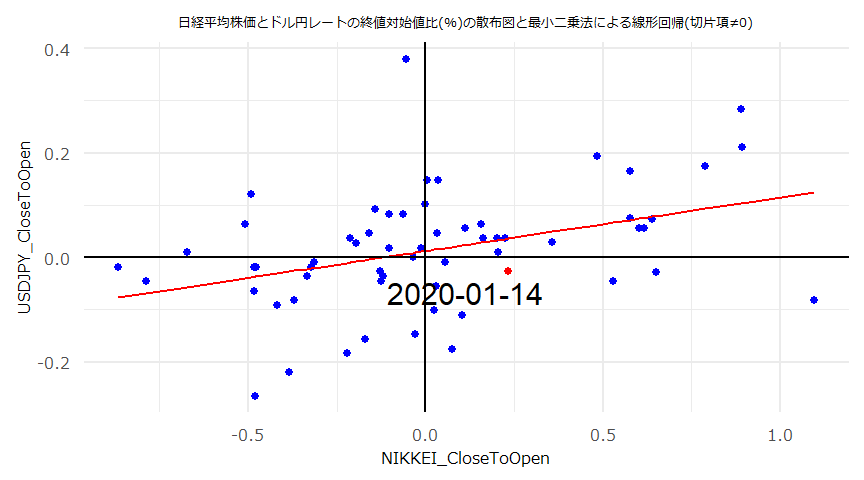

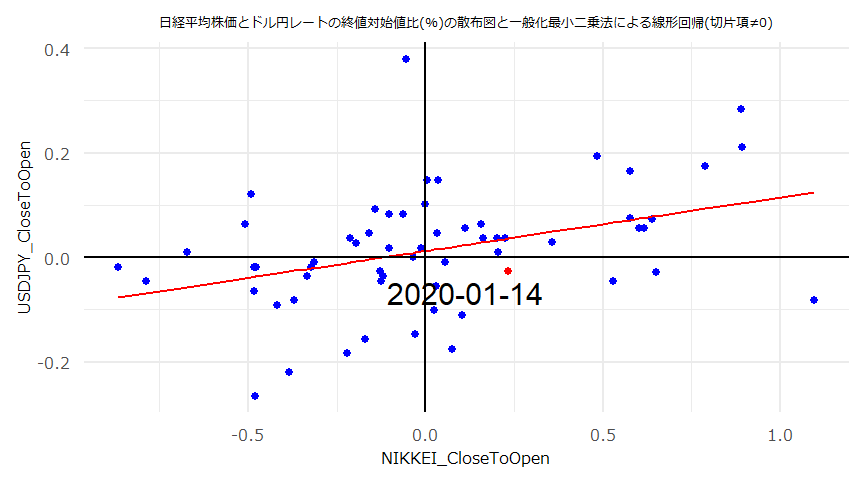

- 切片項\(\neq0\)

MODEL INFO:

Observations: 60

Dependent Variable: USDJPY_CloseToOpen

Type: OLS linear regression

MODEL FIT:

F(1,58) = 10.03, p = 0.00

R2 = 0.15

Adj. R2 = 0.13

Standard errors: OLS

---------------------------------------------------------------

Est. 2.5% 97.5% t val. p

------------------------ ------ ------- ------- -------- ------

(Intercept) 0.01 -0.02 0.04 0.90 0.37

NIKKEI_CloseToOpen 0.10 0.04 0.17 3.17 0.00

---------------------------------------------------------------

Durbin-Watson test

data: OLS_Model

DW = 2.2899, p-value = 0.8723

alternative hypothesis: true autocorrelation is greater than 0

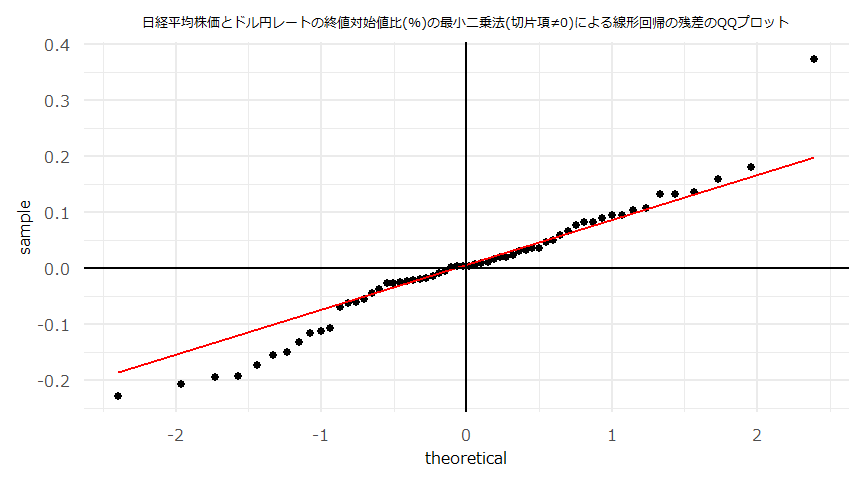

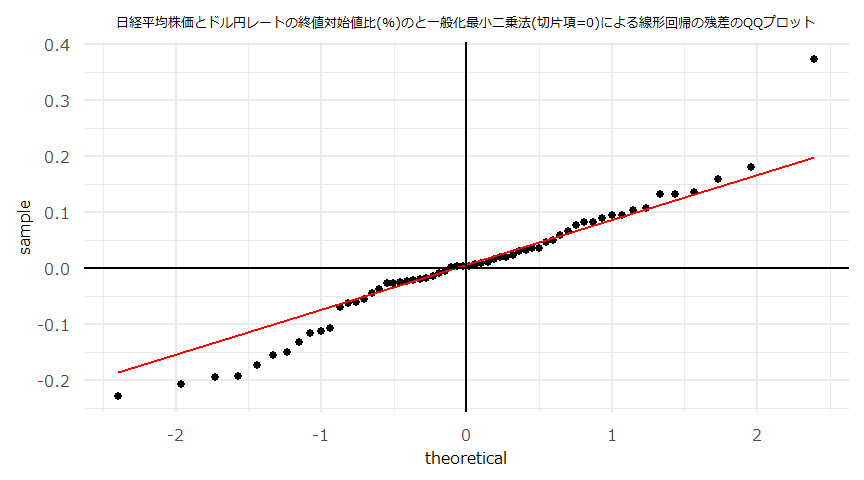

One-sample Kolmogorov-Smirnov test

data: ResidualsOLS

D = 0.11564, p-value = 0.3702

alternative hypothesis: two-sided 2.5 % 97.5 %

(Intercept) -0.01525922 0.03996375

NIKKEI_CloseToOpen 0.03774370 0.16741850

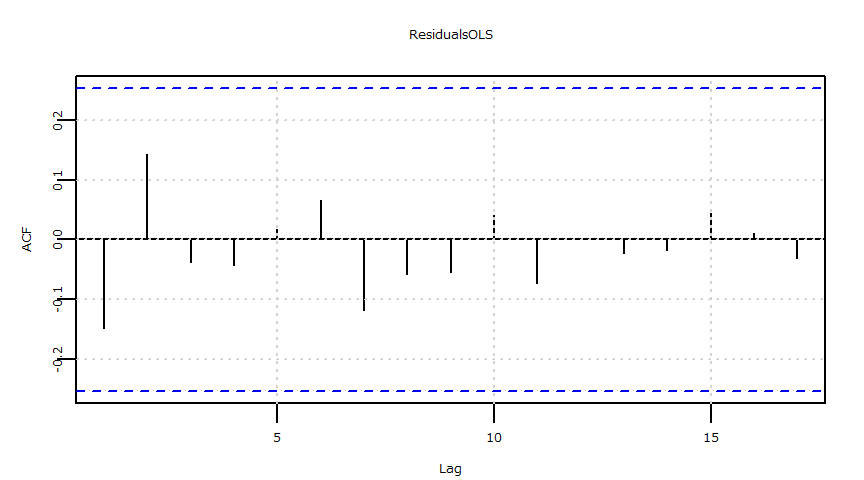

Box-Ljung test

data: ResidualsOLS

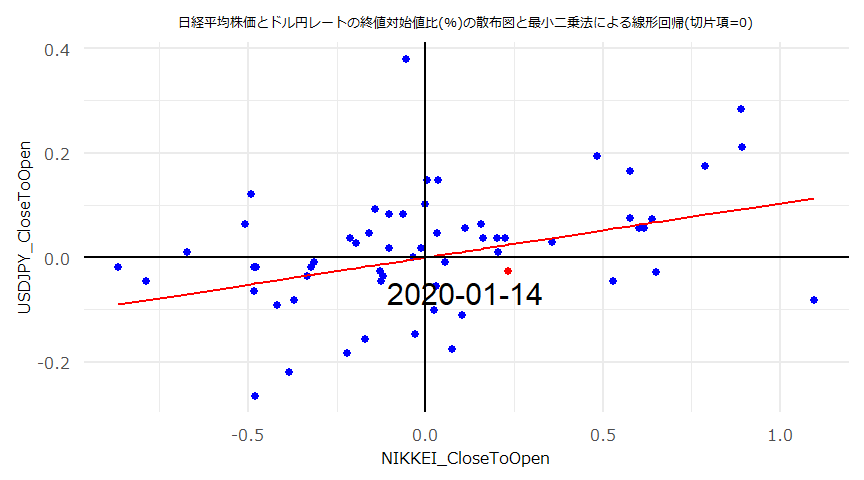

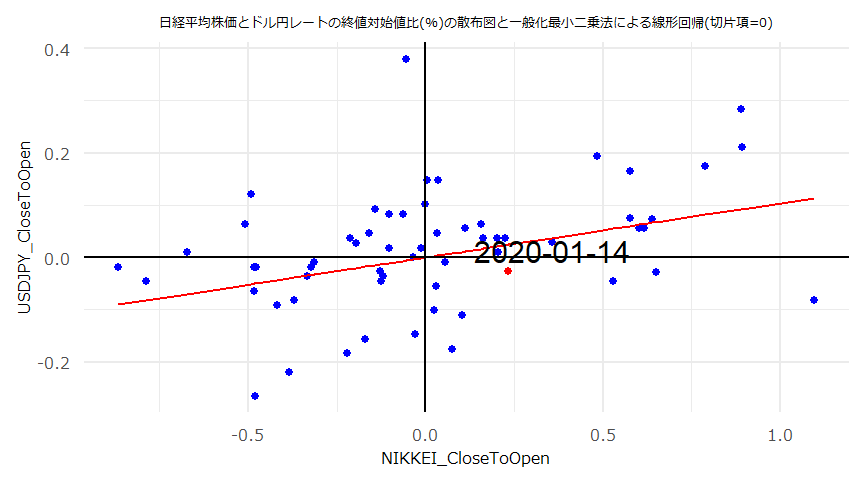

X-squared = 4.8204, df = 10, p-value = 0.9028- 切片項\(=0\)

MODEL INFO:

Observations: 60

Dependent Variable: USDJPY_CloseToOpen

Type: OLS linear regression

MODEL FIT:

F(1,59) = 10.32, p = 0.00

R2 = 0.15

Adj. R2 = 0.13

Standard errors: OLS

--------------------------------------------------------------

Est. 2.5% 97.5% t val. p

------------------------ ------ ------ ------- -------- ------

NIKKEI_CloseToOpen 0.10 0.04 0.17 3.21 0.00

--------------------------------------------------------------

Durbin-Watson test

data: OLS_Model_no_intercept

DW = 2.2613, p-value = 0.8764

alternative hypothesis: true autocorrelation is greater than 0

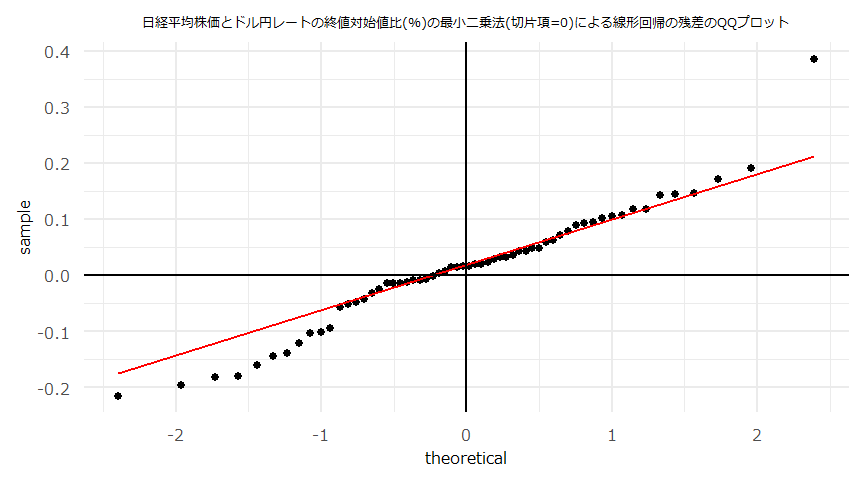

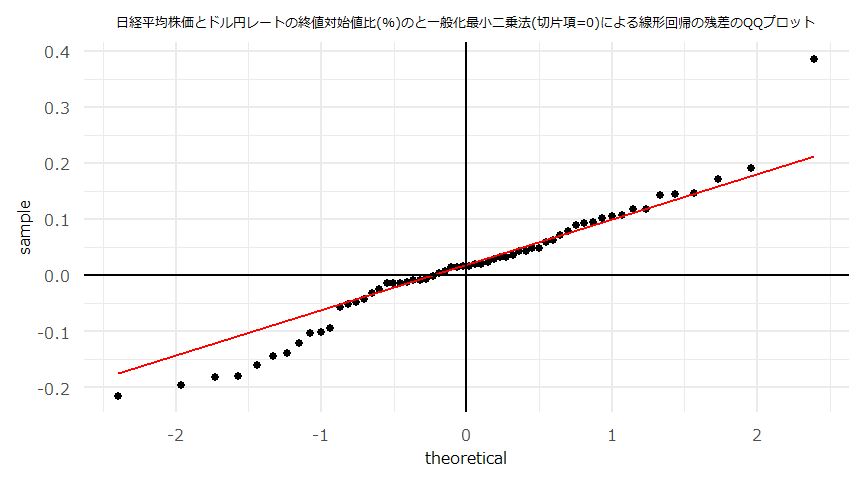

One-sample Kolmogorov-Smirnov test

data: ResidualsOLS_no_intercept

D = 0.16102, p-value = 0.07945

alternative hypothesis: two-sided 2.5 % 97.5 %

NIKKEI_CloseToOpen 0.03914864 0.1684451

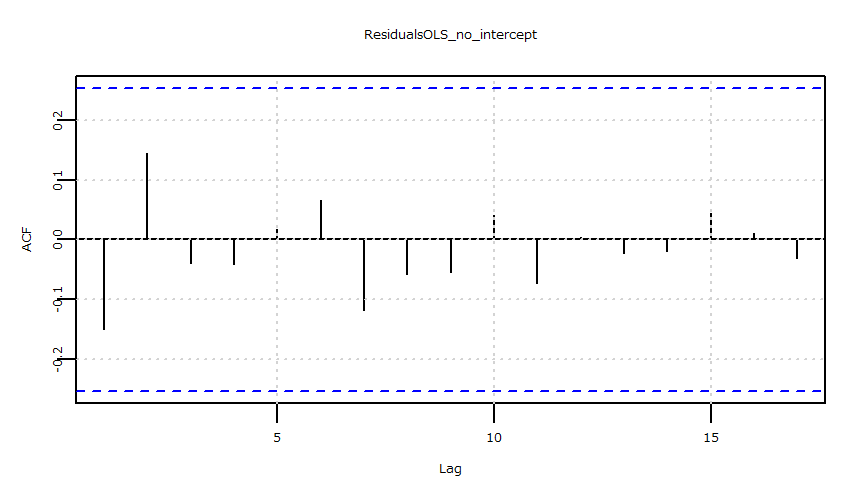

Box-Ljung test

data: ResidualsOLS_no_intercept

X-squared = 4.8675, df = 10, p-value = 0.8999一般化最小二乗法

- gls {nlme}

- corARMA {nlme}

- ks.test {stats}

- confint {stats}

- Box.test {stats}

- 残差の系列相関の有無に拘わらず一般化最小二乗法による回帰係数を求めています。

- 最小二乗法の残差に系列相関が見られない場合、ここではAR(\(p=0,q=0\))の結果(AIC最小)が表示されます。

- http://user.keio.ac.jp/~nagakura/zemi/GLS.pdf

- http://tokyox.matrix.jp/wiki/index.php?%E4%B8%80%E8%88%AC%E5%8C%96%E6%9C%80%E5%B0%8F%E4%BA%8C%E4%B9%97%E6%B3%95

- 切片項\(\neq0\)

Generalized least squares fit by REML

Model: USDJPY_CloseToOpen ~ NIKKEI_CloseToOpen

Data: USDJPY_NIKKEI

AIC BIC logLik

-82.44287 -76.26154 44.22144

Coefficients:

Value Std.Error t-value p-value

(Intercept) 0.01235226 0.01379390 0.895487 0.3742

NIKKEI_CloseToOpen 0.10258110 0.03239088 3.166974 0.0025

Correlation:

(Intr)

NIKKEI_CloseToOpen -0.042

Standardized residuals:

Min Q1 Med Q3 Max

-2.13586877 -0.45194474 0.03045638 0.56445902 3.49675532

Residual standard error: 0.1067532

Degrees of freedom: 60 total; 58 residual

One-sample Kolmogorov-Smirnov test

data: ResidualsGLS

D = 0.11564, p-value = 0.3702

alternative hypothesis: two-sided 2.5 % 97.5 %

(Intercept) -0.01468328 0.0393878

NIKKEI_CloseToOpen 0.03909613 0.1660661

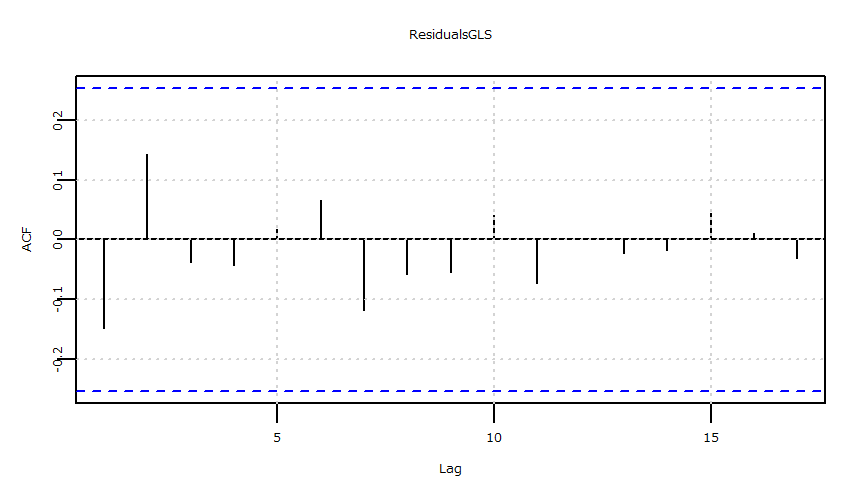

Box-Ljung test

data: ResidualsGLS

X-squared = 4.8204, df = 10, p-value = 0.9028- 切片項\(=0\)

Generalized least squares fit by REML

Model: USDJPY_CloseToOpen ~ NIKKEI_CloseToOpen - 1

Data: USDJPY_NIKKEI

AIC BIC logLik

-90.37049 -86.21542 47.18525

Coefficients:

Value Std.Error t-value p-value

NIKKEI_CloseToOpen 0.1037969 0.03230804 3.212726 0.0021

Standardized residuals:

Min Q1 Med Q3 Max

-2.0180730 -0.3346773 0.1470898 0.6906384 3.6191714

Residual standard error: 0.1065738

Degrees of freedom: 60 total; 59 residual

One-sample Kolmogorov-Smirnov test

data: ResidualsGLS_no_intercept

D = 0.16102, p-value = 0.07945

alternative hypothesis: two-sided 2.5 % 97.5 %

NIKKEI_CloseToOpen 0.04047429 0.1671195

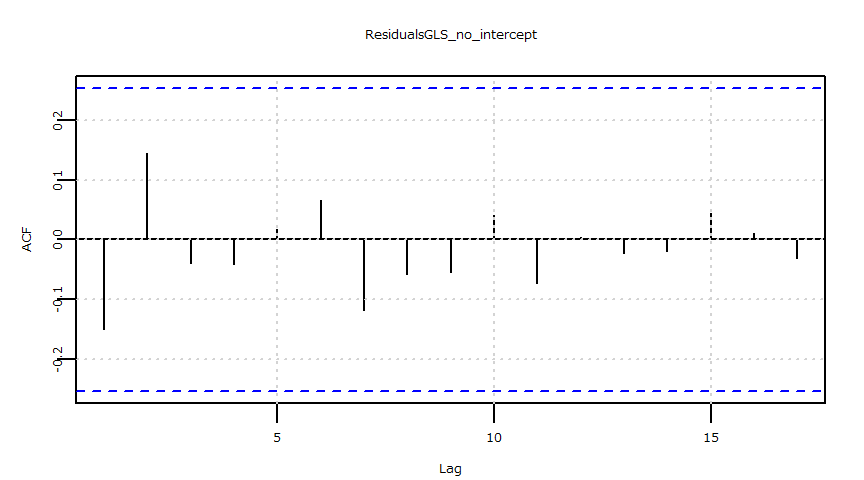

Box-Ljung test

data: ResidualsGLS_no_intercept

X-squared = 4.8675, df = 10, p-value = 0.8999散布図・QQプロット・残差の時系列推移

- (注意)線形回帰の傾き(\(a\))、切片(\(b\))それぞれの検定統計量、p値に関わらず\(y=ax+b\)とした回帰直線やその残差を散布図、QQプロット等にプロットしています。

- 散布図とQQプロット

- 残差の自己相関(ACF)

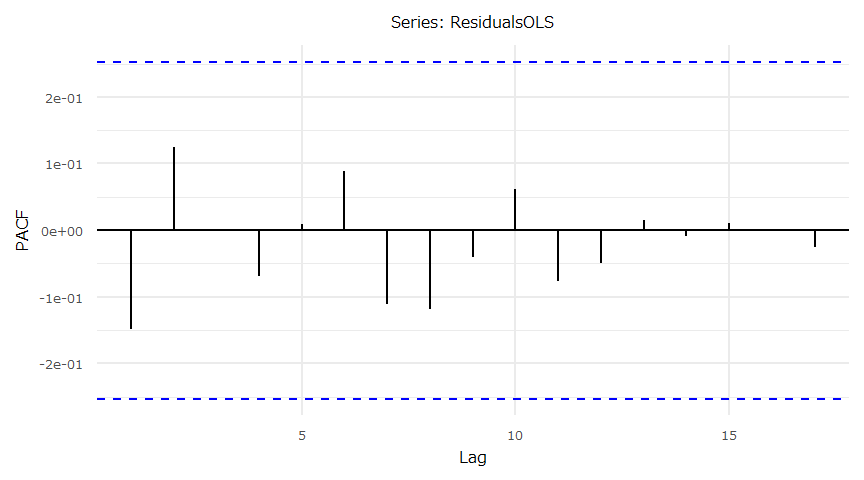

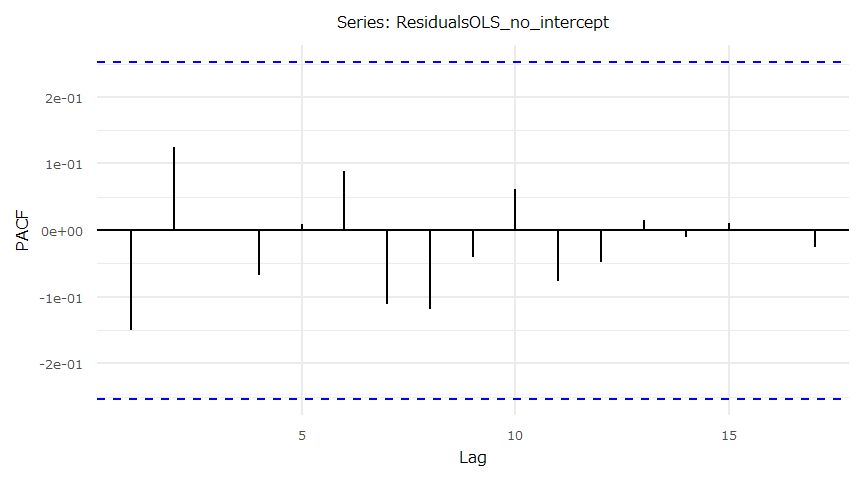

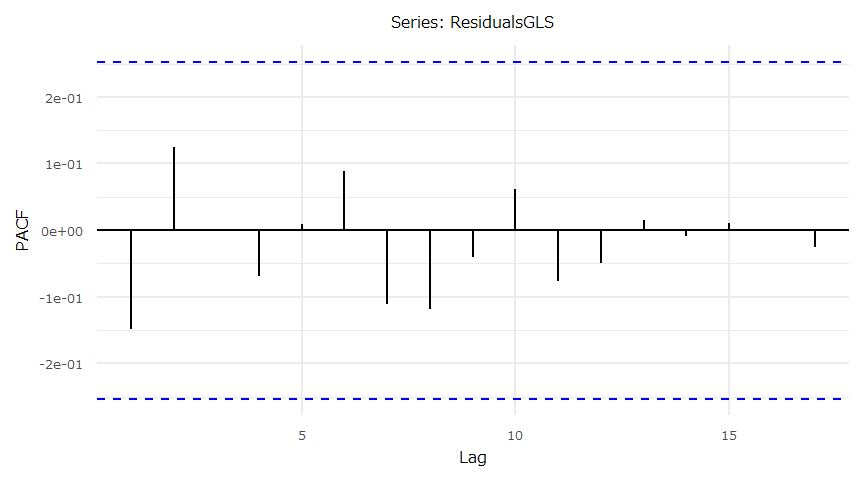

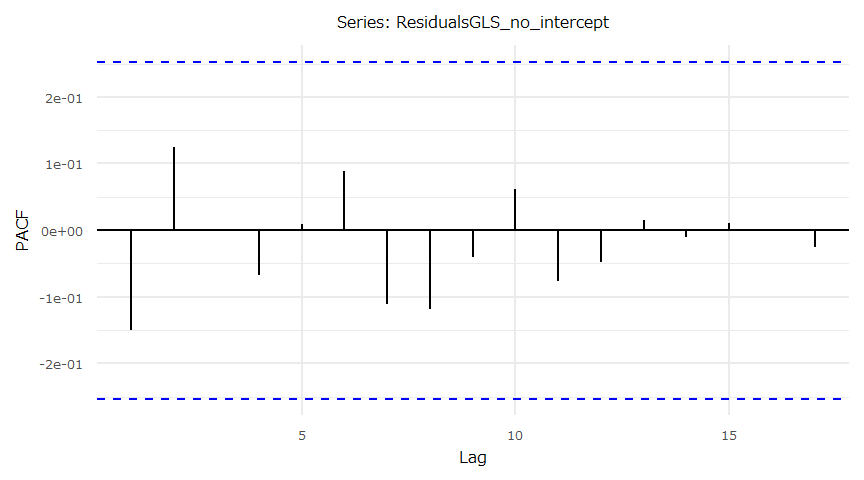

- 残差の自己相関(PACF)

分析設計