Analysis

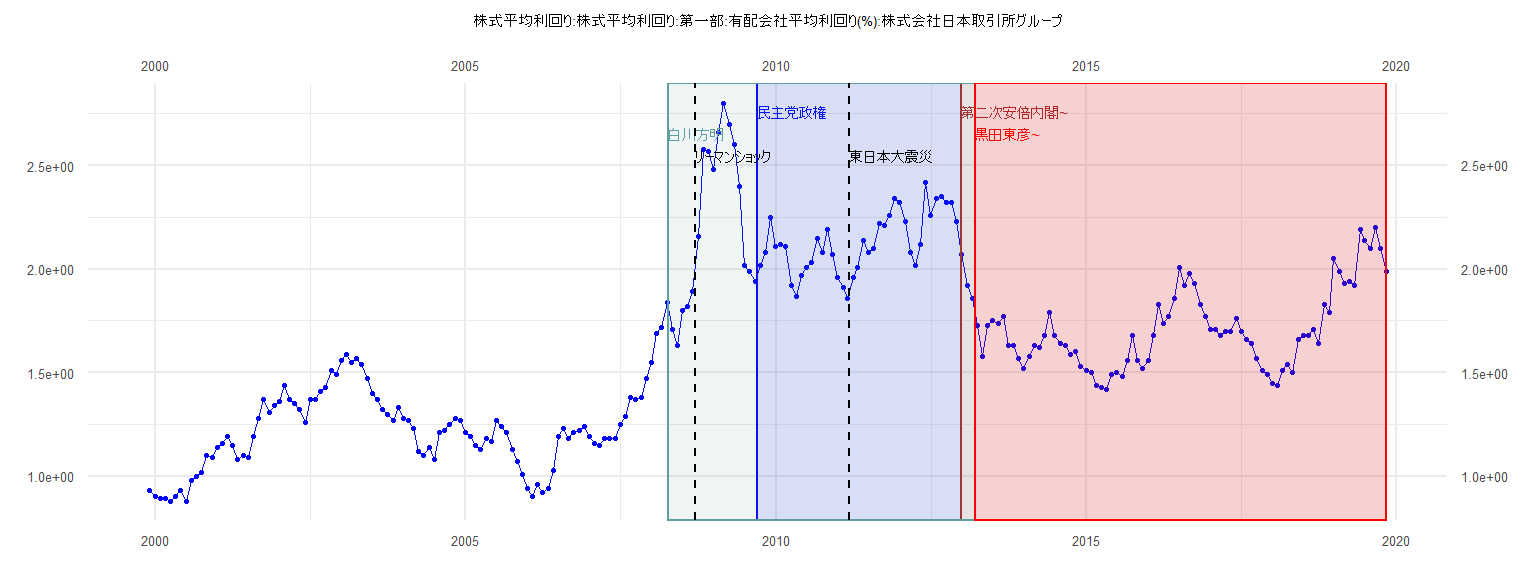

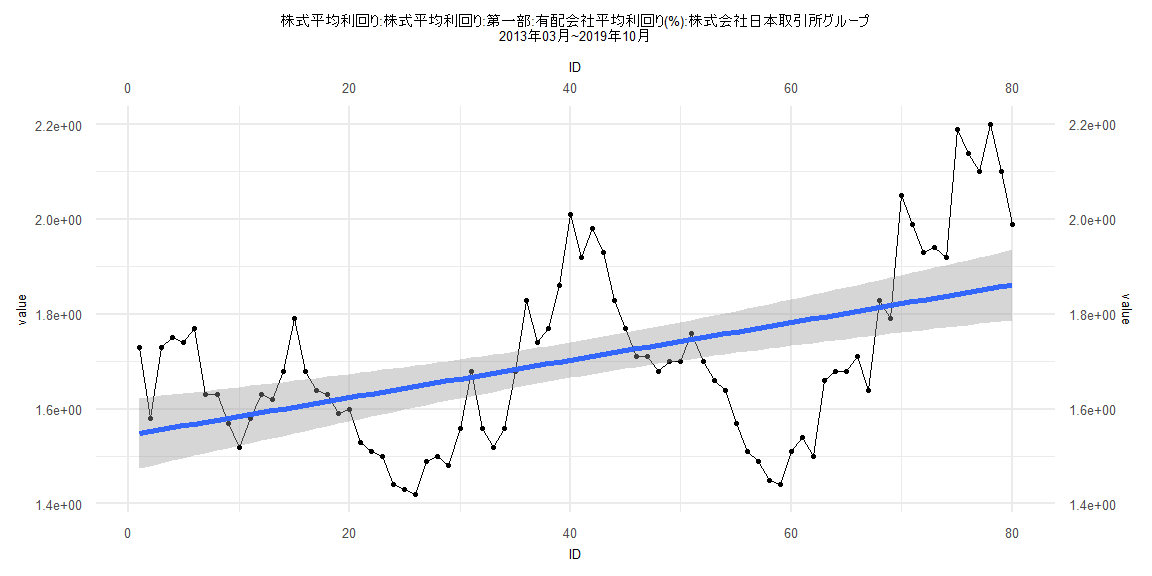

[1] "株式平均利回り:株式平均利回り:第一部:有配会社平均利回り(%):株式会社日本取引所グループ"

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

1999 0.93 0.90

2000 0.89 0.89 0.88 0.90 0.93 0.88 0.98 1.00 1.02 1.10 1.09 1.14

2001 1.16 1.19 1.15 1.08 1.10 1.09 1.19 1.28 1.37 1.31 1.34 1.36

2002 1.44 1.37 1.35 1.32 1.26 1.37 1.37 1.41 1.43 1.51 1.49 1.56

2003 1.59 1.55 1.57 1.54 1.47 1.40 1.37 1.32 1.30 1.27 1.33 1.28

2004 1.27 1.23 1.12 1.10 1.14 1.08 1.21 1.22 1.25 1.28 1.27 1.21

2005 1.19 1.15 1.13 1.18 1.17 1.27 1.24 1.21 1.13 1.07 1.01 0.94

2006 0.90 0.96 0.92 0.94 1.03 1.19 1.23 1.18 1.21 1.22 1.24 1.19

2007 1.16 1.15 1.18 1.18 1.18 1.25 1.29 1.38 1.37 1.38 1.47 1.55

2008 1.69 1.72 1.84 1.71 1.63 1.80 1.82 1.89 2.16 2.58 2.57 2.48

2009 2.66 2.80 2.70 2.60 2.40 2.02 1.99 1.94 2.02 2.08 2.25 2.11

2010 2.12 2.11 1.92 1.87 1.97 2.01 2.03 2.15 2.08 2.19 2.07 1.96

2011 1.91 1.86 1.96 2.01 2.14 2.08 2.10 2.22 2.21 2.26 2.34 2.32

2012 2.23 2.08 2.02 2.12 2.42 2.26 2.34 2.35 2.32 2.32 2.23 2.07

2013 1.92 1.86 1.73 1.58 1.73 1.75 1.74 1.77 1.63 1.63 1.57 1.52

2014 1.58 1.63 1.62 1.68 1.79 1.68 1.64 1.63 1.59 1.60 1.53 1.51

2015 1.50 1.44 1.43 1.42 1.49 1.50 1.48 1.56 1.68 1.56 1.52 1.56

2016 1.68 1.83 1.74 1.77 1.86 2.01 1.92 1.98 1.93 1.83 1.77 1.71

2017 1.71 1.68 1.70 1.70 1.76 1.70 1.66 1.64 1.57 1.51 1.49 1.45

2018 1.44 1.51 1.54 1.50 1.66 1.68 1.68 1.71 1.64 1.83 1.79 2.05

2019 1.99 1.93 1.94 1.92 2.19 2.14 2.10 2.20 2.10 1.99

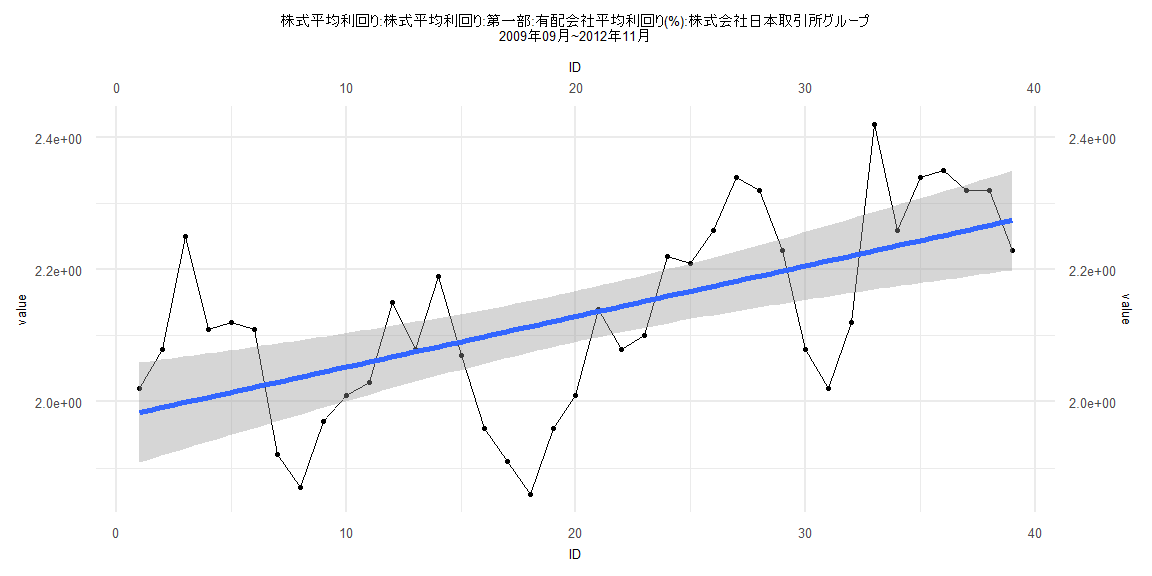

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.25392 -0.08806 0.02359 0.08826 0.25092

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.976113 0.038751 50.996 < 0.0000000000000002 ***

ID 0.007656 0.001689 4.534 0.0000589 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.1187 on 37 degrees of freedom

Multiple R-squared: 0.3572, Adjusted R-squared: 0.3398

F-statistic: 20.56 on 1 and 37 DF, p-value: 0.0000589

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.20513, p-value = 0.3888

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.7624, p-value = 0.000002439

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 0.41919, df = 1, p-value = 0.5173

Box-Ljung test

data: lm_residuals

X-squared = 15.948, df = 1, p-value = 0.00006512

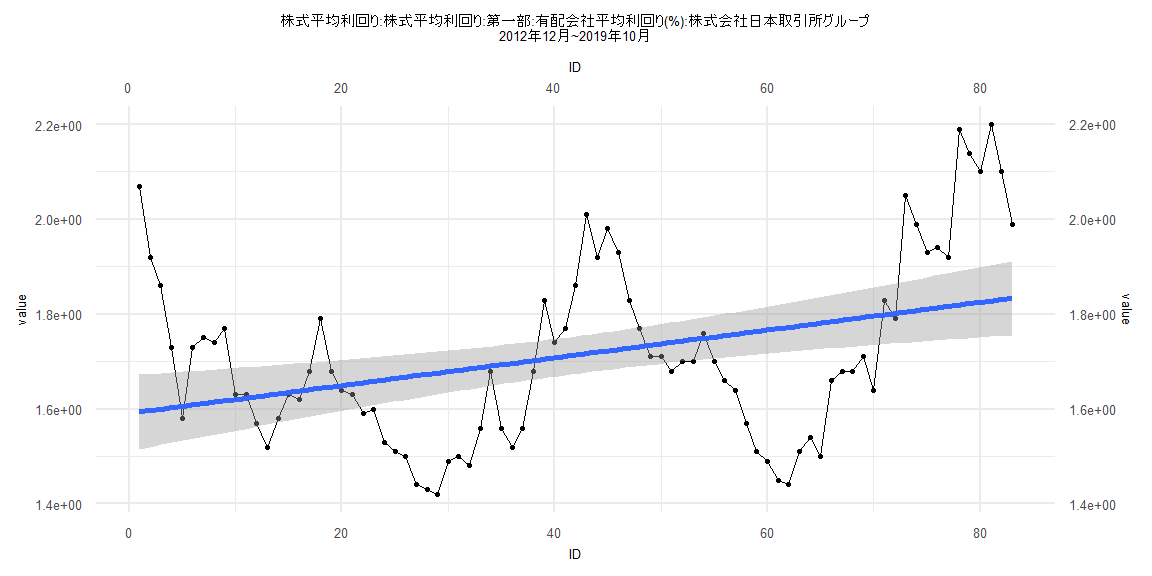

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.33238 -0.12935 -0.02215 0.12614 0.47613

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.5909462 0.0401004 39.674 < 0.0000000000000002 ***

ID 0.0029264 0.0008293 3.529 0.000692 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.181 on 81 degrees of freedom

Multiple R-squared: 0.1332, Adjusted R-squared: 0.1225

F-statistic: 12.45 on 1 and 81 DF, p-value: 0.0006915

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.13253, p-value = 0.4619

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.22492, p-value < 0.00000000000000022

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 2.5078, df = 1, p-value = 0.1133

Box-Ljung test

data: lm_residuals

X-squared = 60.742, df = 1, p-value = 0.00000000000000655

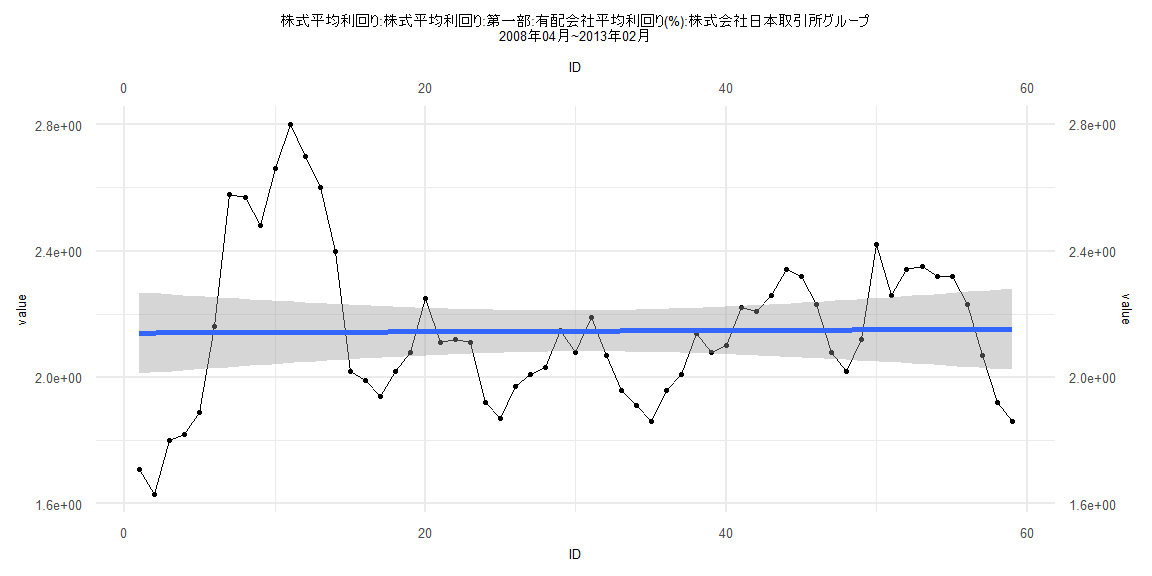

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.5107 -0.1646 -0.0350 0.1397 0.6575

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 2.1402864 0.0657170 32.568 <0.0000000000000002 ***

ID 0.0002051 0.0019050 0.108 0.915

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.2492 on 57 degrees of freedom

Multiple R-squared: 0.0002034, Adjusted R-squared: -0.01734

F-statistic: 0.0116 on 1 and 57 DF, p-value: 0.9146

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.13559, p-value = 0.6544

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.28655, p-value < 0.00000000000000022

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 15.441, df = 1, p-value = 0.0000851

Box-Ljung test

data: lm_residuals

X-squared = 41.568, df = 1, p-value = 0.0000000001139

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.33830 -0.11986 -0.00566 0.11547 0.34830

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.5445285 0.0378691 40.786 < 0.0000000000000002 ***

ID 0.0039623 0.0008123 4.878 0.00000555 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.1678 on 78 degrees of freedom

Multiple R-squared: 0.2338, Adjusted R-squared: 0.2239

F-statistic: 23.79 on 1 and 78 DF, p-value: 0.00000555

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.1125, p-value = 0.6953

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.25142, p-value < 0.00000000000000022

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 11.307, df = 1, p-value = 0.0007723

Box-Ljung test

data: lm_residuals

X-squared = 61.848, df = 1, p-value = 0.000000000000003664