Analysis

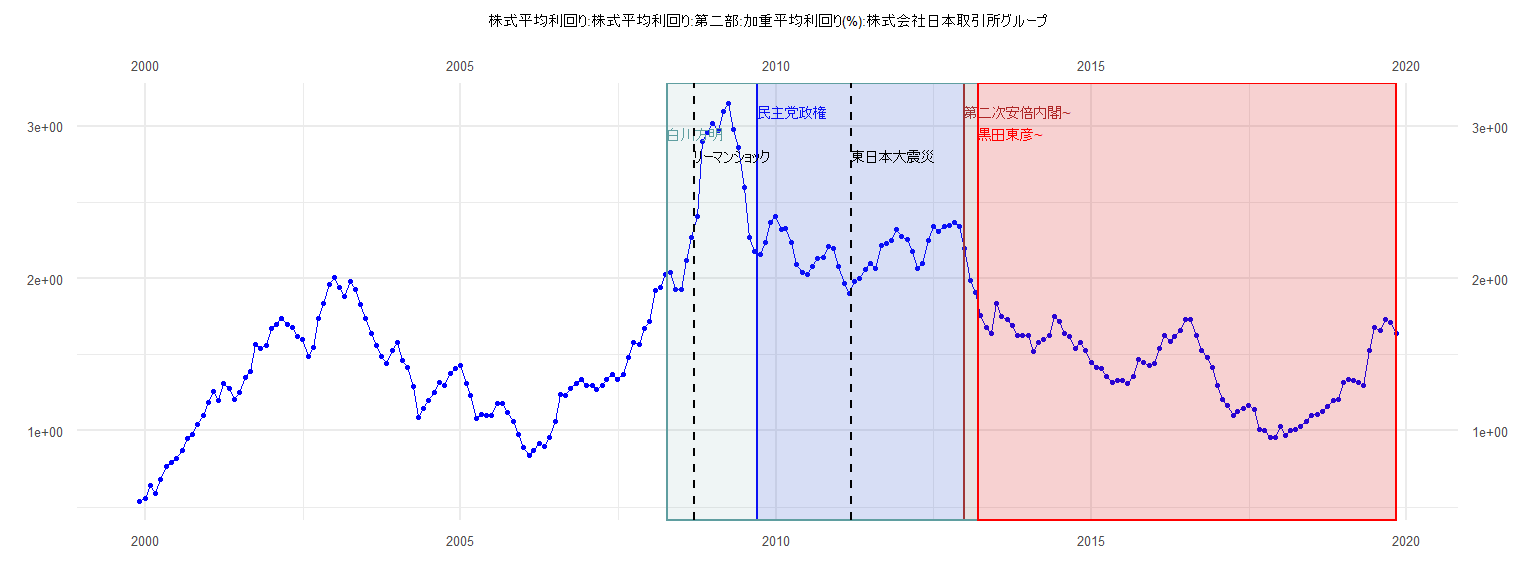

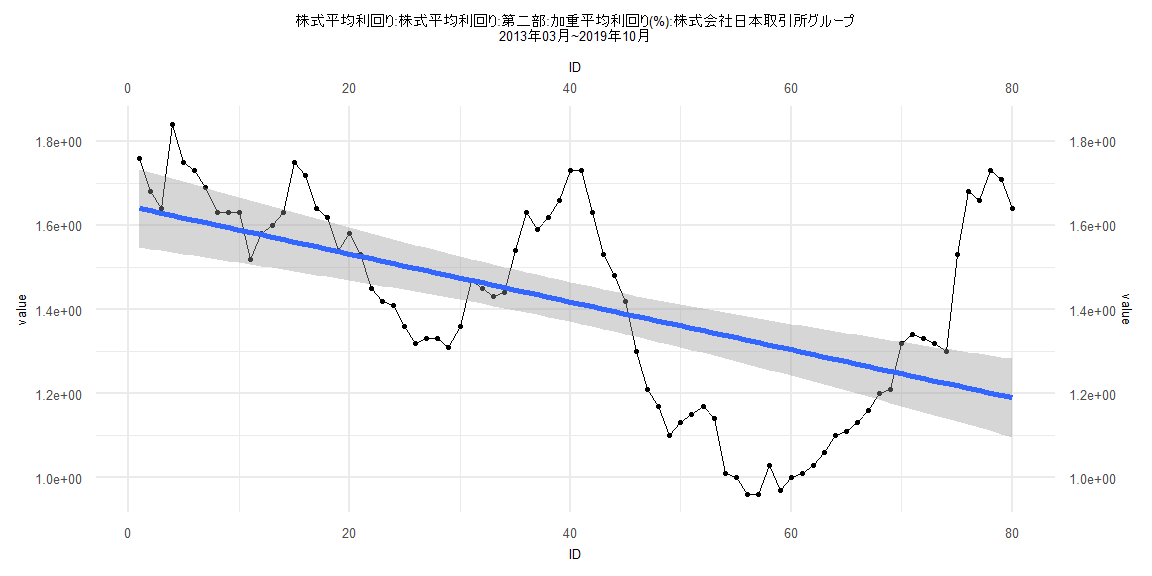

[1] "株式平均利回り:株式平均利回り:第二部:加重平均利回り(%):株式会社日本取引所グループ"

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

1999 0.54 0.56

2000 0.64 0.59 0.68 0.77 0.79 0.82 0.87 0.95 0.98 1.04 1.10 1.19

2001 1.26 1.20 1.31 1.28 1.21 1.25 1.35 1.39 1.57 1.54 1.56 1.67

2002 1.70 1.74 1.70 1.68 1.62 1.60 1.49 1.55 1.74 1.84 1.96 2.01

2003 1.94 1.88 1.98 1.93 1.83 1.74 1.64 1.56 1.49 1.44 1.53 1.58

2004 1.46 1.42 1.29 1.09 1.15 1.20 1.25 1.32 1.30 1.38 1.41 1.43

2005 1.31 1.23 1.08 1.11 1.10 1.10 1.18 1.18 1.12 1.06 0.98 0.89

2006 0.84 0.87 0.92 0.90 0.96 1.06 1.24 1.23 1.28 1.31 1.34 1.30

2007 1.30 1.27 1.30 1.34 1.37 1.34 1.37 1.48 1.58 1.57 1.67 1.72

2008 1.92 1.94 2.03 2.04 1.93 1.93 2.12 2.27 2.41 2.90 2.96 3.02

2009 2.97 3.10 3.15 2.98 2.86 2.60 2.27 2.18 2.16 2.24 2.37 2.41

2010 2.32 2.33 2.24 2.09 2.04 2.03 2.08 2.13 2.14 2.21 2.20 2.08

2011 1.97 1.90 1.98 2.00 2.06 2.10 2.07 2.22 2.23 2.25 2.32 2.28

2012 2.26 2.18 2.07 2.10 2.25 2.34 2.31 2.34 2.35 2.37 2.34 2.20

2013 1.99 1.91 1.76 1.68 1.64 1.84 1.75 1.73 1.69 1.63 1.63 1.63

2014 1.52 1.58 1.60 1.63 1.75 1.72 1.64 1.62 1.54 1.58 1.53 1.45

2015 1.42 1.41 1.36 1.32 1.33 1.33 1.31 1.36 1.47 1.45 1.43 1.44

2016 1.54 1.63 1.59 1.62 1.66 1.73 1.73 1.63 1.53 1.48 1.42 1.30

2017 1.21 1.17 1.10 1.13 1.15 1.17 1.14 1.01 1.00 0.96 0.96 1.03

2018 0.97 1.00 1.01 1.03 1.06 1.10 1.11 1.13 1.16 1.20 1.21 1.32

2019 1.34 1.33 1.32 1.30 1.53 1.68 1.66 1.73 1.71 1.64

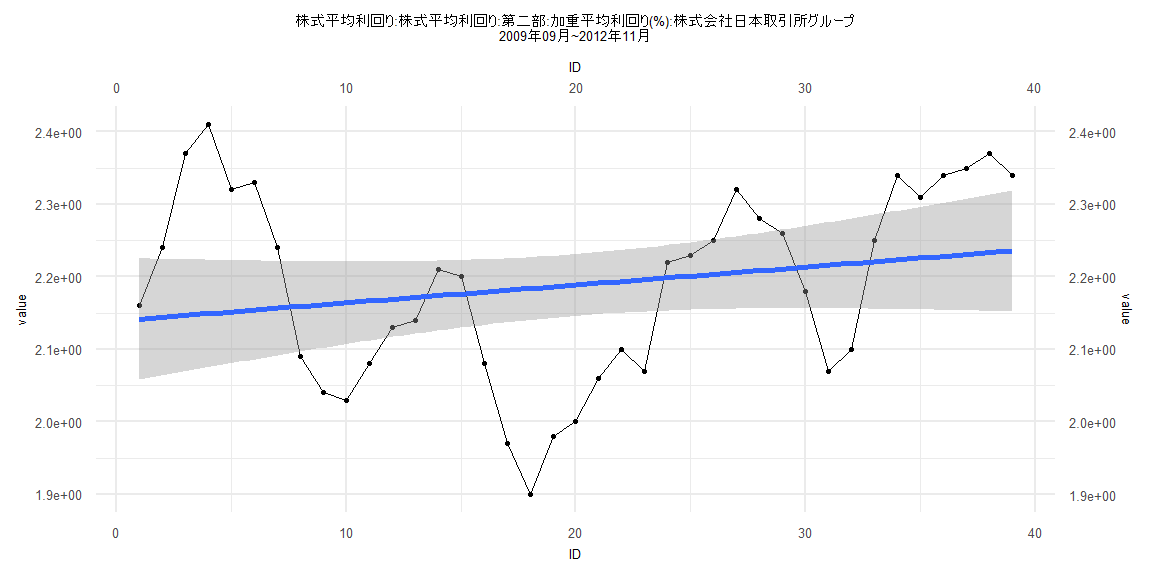

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.28379 -0.10858 0.02361 0.10005 0.26073

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 2.139406 0.042816 49.968 <0.0000000000000002 ***

ID 0.002466 0.001866 1.322 0.194

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.1311 on 37 degrees of freedom

Multiple R-squared: 0.04508, Adjusted R-squared: 0.01927

F-statistic: 1.747 on 1 and 37 DF, p-value: 0.1944

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.17949, p-value = 0.5622

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.3193, p-value = 0.0000000000002655

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 2.2632, df = 1, p-value = 0.1325

Box-Ljung test

data: lm_residuals

X-squared = 29.094, df = 1, p-value = 0.00000006894

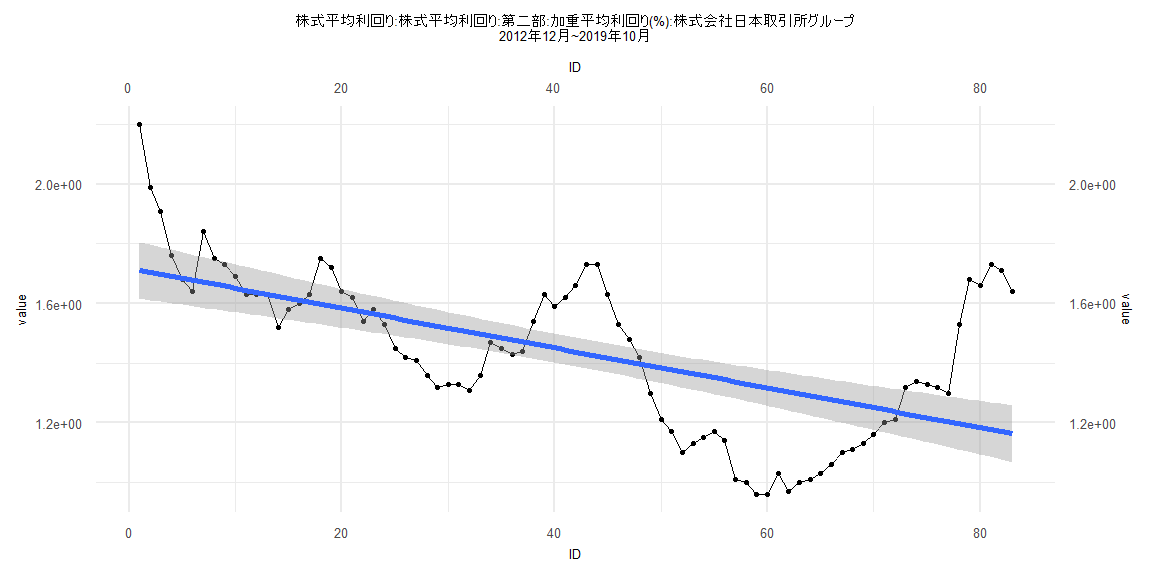

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.36385 -0.17238 -0.02076 0.11463 0.55302

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.717752 0.048667 35.296 < 0.0000000000000002 ***

ID -0.006676 0.001006 -6.633 0.00000000341 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.2197 on 81 degrees of freedom

Multiple R-squared: 0.352, Adjusted R-squared: 0.344

F-statistic: 44 on 1 and 81 DF, p-value: 0.000000003411

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.084337, p-value = 0.9317

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.10897, p-value < 0.00000000000000022

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 15.964, df = 1, p-value = 0.00006456

Box-Ljung test

data: lm_residuals

X-squared = 67.526, df = 1, p-value = 0.000000000000000222

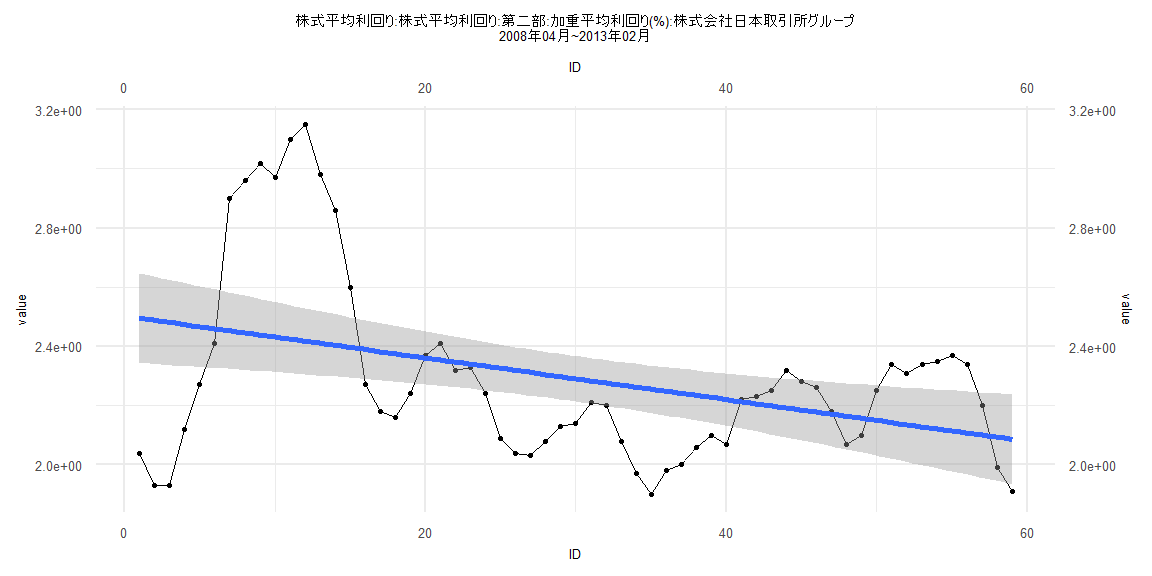

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.55802 -0.19321 -0.05677 0.15118 0.73246

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 2.502116 0.077684 32.21 < 0.0000000000000002 ***

ID -0.007048 0.002252 -3.13 0.00276 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.2946 on 57 degrees of freedom

Multiple R-squared: 0.1466, Adjusted R-squared: 0.1317

F-statistic: 9.795 on 1 and 57 DF, p-value: 0.002758

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.10169, p-value = 0.9239

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.17444, p-value < 0.00000000000000022

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 19.041, df = 1, p-value = 0.0000128

Box-Ljung test

data: lm_residuals

X-squared = 49.008, df = 1, p-value = 0.000000000002549

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.36650 -0.16580 0.00296 0.10386 0.52912

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.646247 0.047757 34.471 < 0.0000000000000002 ***

ID -0.005710 0.001024 -5.574 0.000000343 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.2116 on 78 degrees of freedom

Multiple R-squared: 0.2849, Adjusted R-squared: 0.2757

F-statistic: 31.07 on 1 and 78 DF, p-value: 0.0000003434

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.2, p-value = 0.08141

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.10253, p-value < 0.00000000000000022

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 24.667, df = 1, p-value = 0.0000006816

Box-Ljung test

data: lm_residuals

X-squared = 69.921, df = 1, p-value < 0.00000000000000022