Analysis

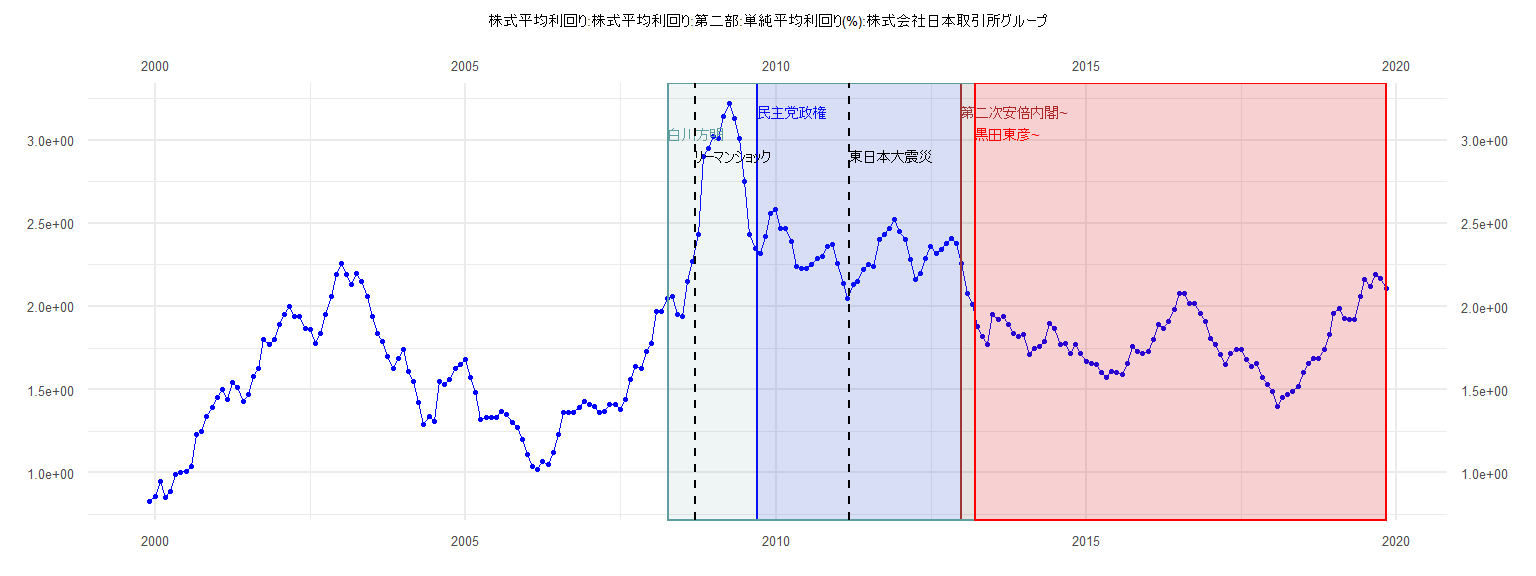

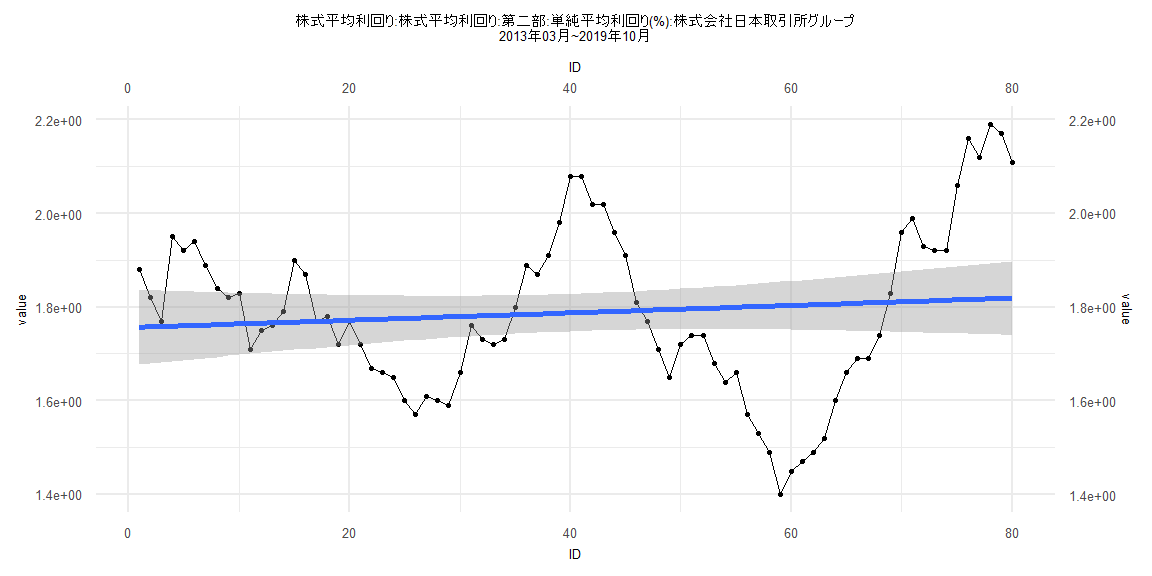

[1] "株式平均利回り:株式平均利回り:第二部:単純平均利回り(%):株式会社日本取引所グループ"

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

1999 0.83 0.86

2000 0.95 0.85 0.89 0.99 1.00 1.01 1.04 1.23 1.25 1.34 1.39 1.45

2001 1.50 1.44 1.54 1.51 1.43 1.47 1.58 1.63 1.80 1.77 1.80 1.89

2002 1.95 2.00 1.94 1.94 1.87 1.86 1.78 1.84 1.95 2.06 2.19 2.26

2003 2.19 2.13 2.20 2.15 2.06 1.94 1.84 1.79 1.70 1.63 1.69 1.74

2004 1.61 1.55 1.42 1.29 1.34 1.31 1.55 1.53 1.56 1.63 1.65 1.68

2005 1.57 1.48 1.32 1.33 1.33 1.33 1.37 1.35 1.30 1.27 1.20 1.11

2006 1.04 1.02 1.07 1.05 1.12 1.23 1.36 1.36 1.36 1.39 1.43 1.41

2007 1.40 1.36 1.37 1.41 1.41 1.38 1.44 1.56 1.64 1.63 1.73 1.78

2008 1.97 1.97 2.05 2.06 1.95 1.94 2.15 2.27 2.43 2.90 2.95 3.02

2009 3.01 3.14 3.22 3.13 3.01 2.75 2.43 2.35 2.32 2.42 2.56 2.58

2010 2.47 2.47 2.39 2.24 2.23 2.23 2.25 2.29 2.30 2.36 2.37 2.26

2011 2.14 2.05 2.13 2.15 2.22 2.25 2.24 2.40 2.43 2.47 2.52 2.45

2012 2.40 2.28 2.16 2.20 2.29 2.36 2.32 2.34 2.38 2.41 2.38 2.26

2013 2.08 2.01 1.88 1.82 1.77 1.95 1.92 1.94 1.89 1.84 1.82 1.83

2014 1.71 1.75 1.76 1.79 1.90 1.87 1.77 1.78 1.72 1.77 1.72 1.67

2015 1.66 1.65 1.60 1.57 1.61 1.60 1.59 1.66 1.76 1.73 1.72 1.73

2016 1.80 1.89 1.87 1.91 1.98 2.08 2.08 2.02 2.02 1.96 1.91 1.81

2017 1.77 1.71 1.65 1.72 1.74 1.74 1.68 1.64 1.66 1.57 1.53 1.49

2018 1.40 1.45 1.47 1.49 1.52 1.60 1.66 1.69 1.69 1.74 1.83 1.96

2019 1.99 1.93 1.92 1.92 2.06 2.16 2.12 2.19 2.17 2.11

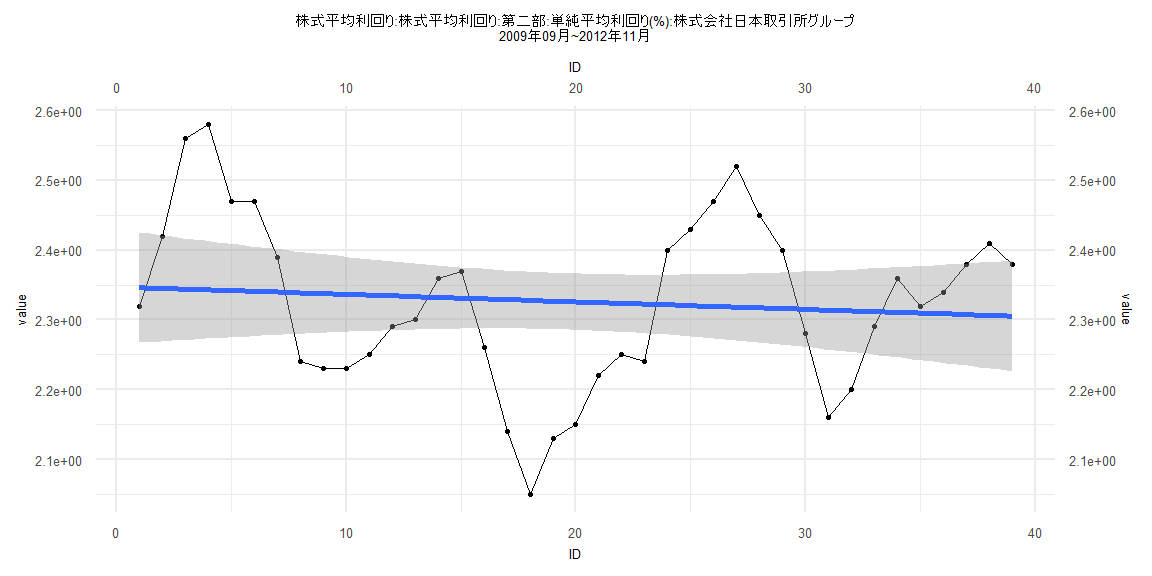

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.27804 -0.09216 0.01020 0.08108 0.23694

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 2.347355 0.040536 57.908 <0.0000000000000002 ***

ID -0.001073 0.001766 -0.607 0.547

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.1241 on 37 degrees of freedom

Multiple R-squared: 0.009873, Adjusted R-squared: -0.01689

F-statistic: 0.3689 on 1 and 37 DF, p-value: 0.5473

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.12821, p-value = 0.9114

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.37031, p-value = 0.000000000004823

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 1.4859, df = 1, p-value = 0.2229

Box-Ljung test

data: lm_residuals

X-squared = 27.565, df = 1, p-value = 0.0000001519

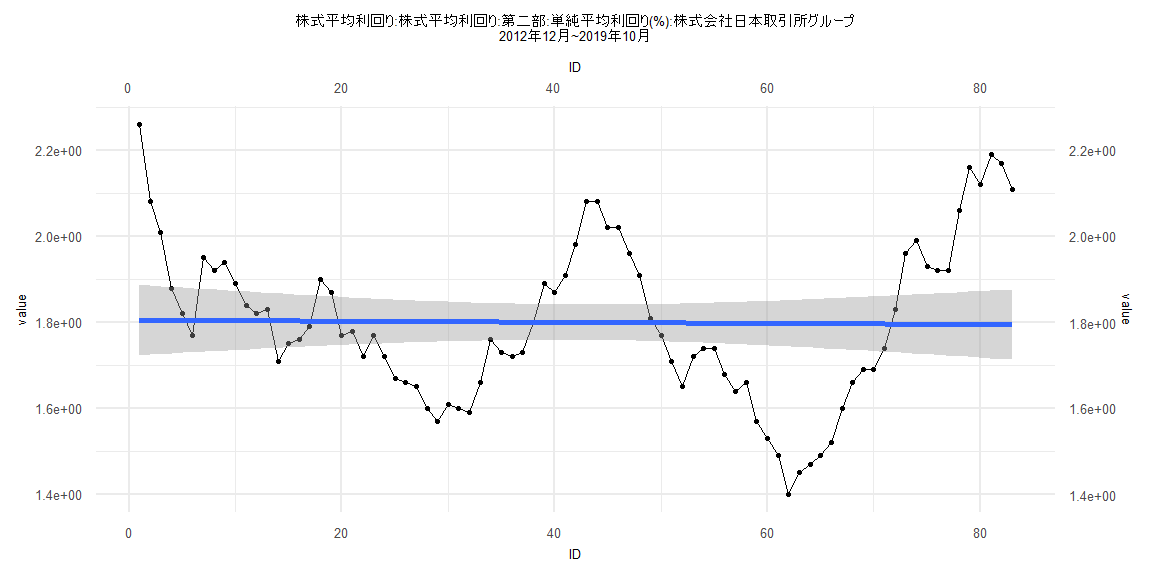

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.3975 -0.1344 -0.0324 0.1244 0.4548

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.8053071 0.0417864 43.203 <0.0000000000000002 ***

ID -0.0001264 0.0008642 -0.146 0.884

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.1886 on 81 degrees of freedom

Multiple R-squared: 0.0002639, Adjusted R-squared: -0.01208

F-statistic: 0.02138 on 1 and 81 DF, p-value: 0.8841

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.072289, p-value = 0.9829

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.12077, p-value < 0.00000000000000022

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 10.41, df = 1, p-value = 0.001253

Box-Ljung test

data: lm_residuals

X-squared = 67.614, df = 1, p-value = 0.000000000000000222

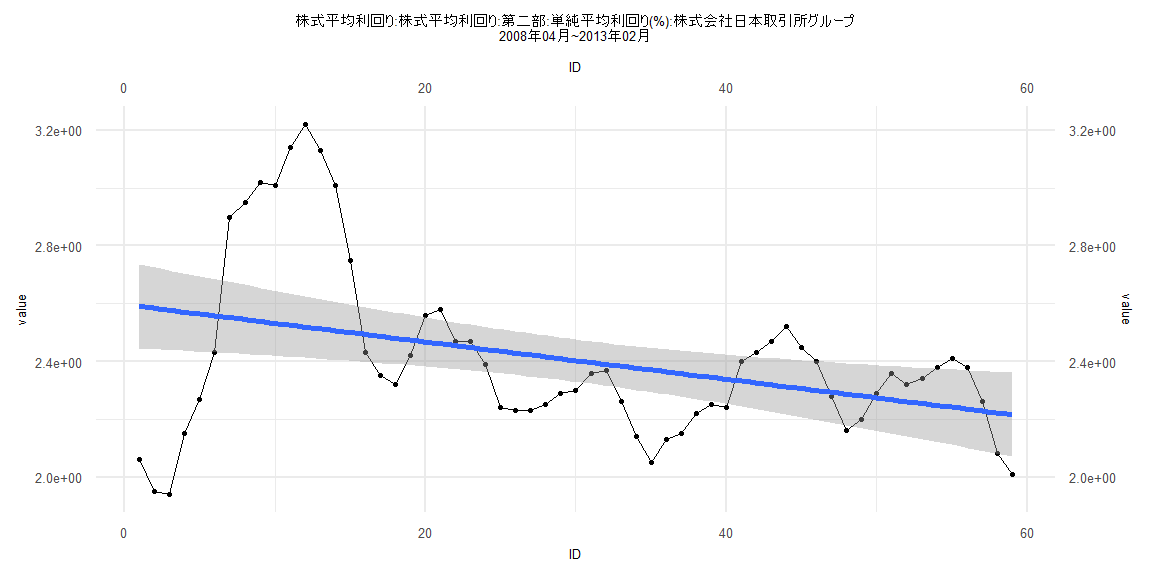

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.63725 -0.15122 -0.03642 0.12556 0.70087

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 2.596628 0.074264 34.97 <0.0000000000000002 ***

ID -0.006458 0.002153 -3.00 0.004 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.2816 on 57 degrees of freedom

Multiple R-squared: 0.1364, Adjusted R-squared: 0.1212

F-statistic: 8.999 on 1 and 57 DF, p-value: 0.004

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.22034, p-value = 0.1141

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.17971, p-value < 0.00000000000000022

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 21.918, df = 1, p-value = 0.000002845

Box-Ljung test

data: lm_residuals

X-squared = 47.441, df = 1, p-value = 0.000000000005669

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.40272 -0.11923 -0.00419 0.12324 0.37229

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 1.7561741 0.0404980 43.364 <0.0000000000000002 ***

ID 0.0007889 0.0008687 0.908 0.367

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.1794 on 78 degrees of freedom

Multiple R-squared: 0.01046, Adjusted R-squared: -0.002223

F-statistic: 0.8248 on 1 and 78 DF, p-value: 0.3666

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.1375, p-value = 0.4383

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.11693, p-value < 0.00000000000000022

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 20.377, df = 1, p-value = 0.000006359

Box-Ljung test

data: lm_residuals

X-squared = 70.542, df = 1, p-value < 0.00000000000000022