Analysis

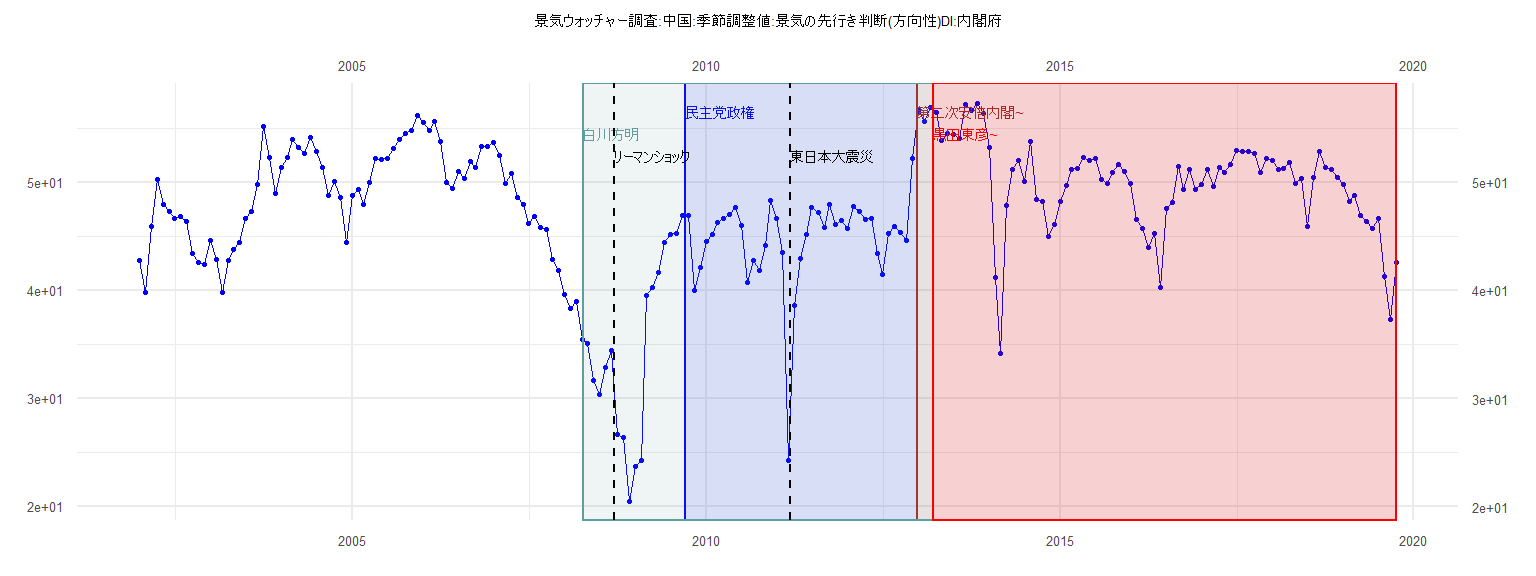

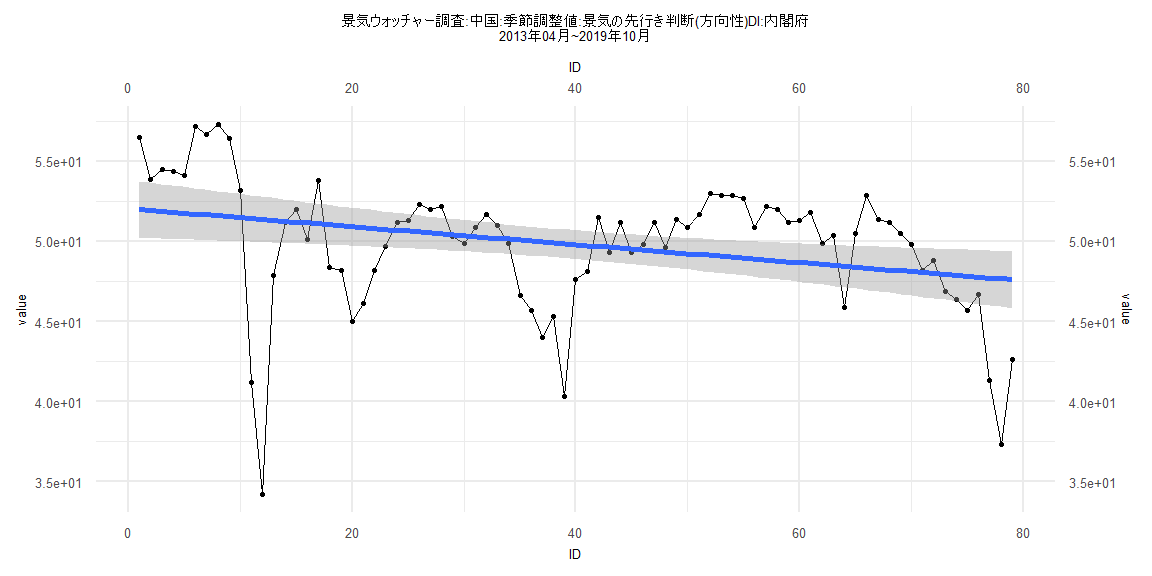

[1] "景気ウォッチャー調査:中国:季節調整値:景気の先行き判断(方向性)DI:内閣府"

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2002 42.8 39.8 45.9 50.3 48.0 47.3 46.7 46.8 46.4 43.4 42.6 42.4

2003 44.6 42.9 39.8 42.8 43.8 44.4 46.7 47.3 49.8 55.2 52.3 49.0

2004 51.4 52.3 54.0 53.2 52.7 54.2 52.9 51.4 48.8 50.1 48.6 44.4

2005 48.8 49.3 48.0 50.0 52.2 52.1 52.2 53.1 54.0 54.5 54.8 56.2

2006 55.5 54.8 55.6 53.8 50.0 49.4 51.0 50.4 51.9 51.4 53.3 53.3

2007 53.7 52.5 49.9 50.8 48.6 48.0 46.2 46.8 45.8 45.6 42.9 41.8

2008 39.6 38.3 39.0 35.5 35.1 31.7 30.4 32.9 34.4 26.7 26.4 20.5

2009 23.7 24.3 39.5 40.3 41.7 44.4 45.2 45.3 46.9 46.9 40.0 42.1

2010 44.5 45.2 46.3 46.7 47.0 47.7 46.0 40.7 42.8 41.8 44.2 48.3

2011 46.7 43.5 24.3 38.6 43.0 45.2 47.7 47.2 45.8 48.0 46.1 46.5

2012 45.7 47.8 47.3 46.6 46.7 43.4 41.5 45.3 45.9 45.4 44.6 52.2

2013 56.7 55.6 56.9 56.5 53.9 54.5 54.4 54.1 57.2 56.7 57.3 56.4

2014 53.2 41.2 34.2 47.9 51.2 52.0 50.1 53.8 48.4 48.2 45.0 46.1

2015 48.2 49.7 51.2 51.3 52.3 52.0 52.2 50.3 49.9 50.9 51.7 51.0

2016 49.9 46.6 45.7 44.0 45.3 40.3 47.6 48.1 51.5 49.3 51.2 49.3

2017 49.8 51.2 49.6 51.4 50.9 51.7 53.0 52.9 52.9 52.7 50.9 52.2

2018 52.0 51.2 51.3 51.8 49.9 50.4 45.9 50.5 52.9 51.4 51.2 50.5

2019 49.8 48.2 48.8 46.9 46.4 45.7 46.7 41.3 37.3 42.6

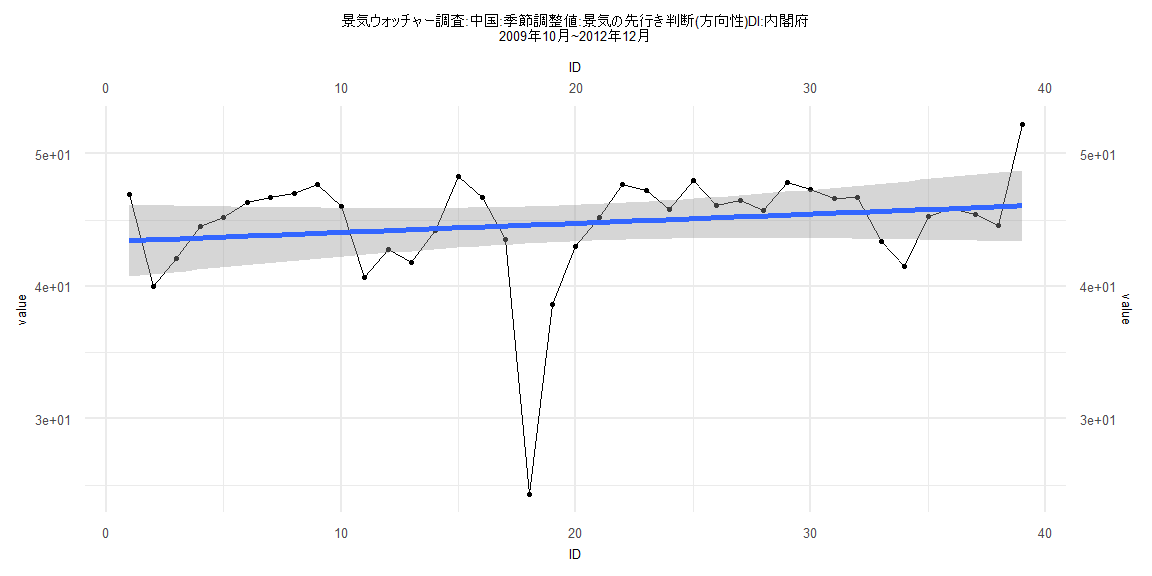

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-20.3105 -1.3944 0.8574 2.3365 6.1378

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 43.36613 1.38322 31.352 <0.0000000000000002 ***

ID 0.06913 0.06027 1.147 0.259

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 4.236 on 37 degrees of freedom

Multiple R-squared: 0.03433, Adjusted R-squared: 0.008234

F-statistic: 1.315 on 1 and 37 DF, p-value: 0.2588

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.17949, p-value = 0.5622

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 1.2644, p-value = 0.004941

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 0.036637, df = 1, p-value = 0.8482

Box-Ljung test

data: lm_residuals

X-squared = 4.5932, df = 1, p-value = 0.0321

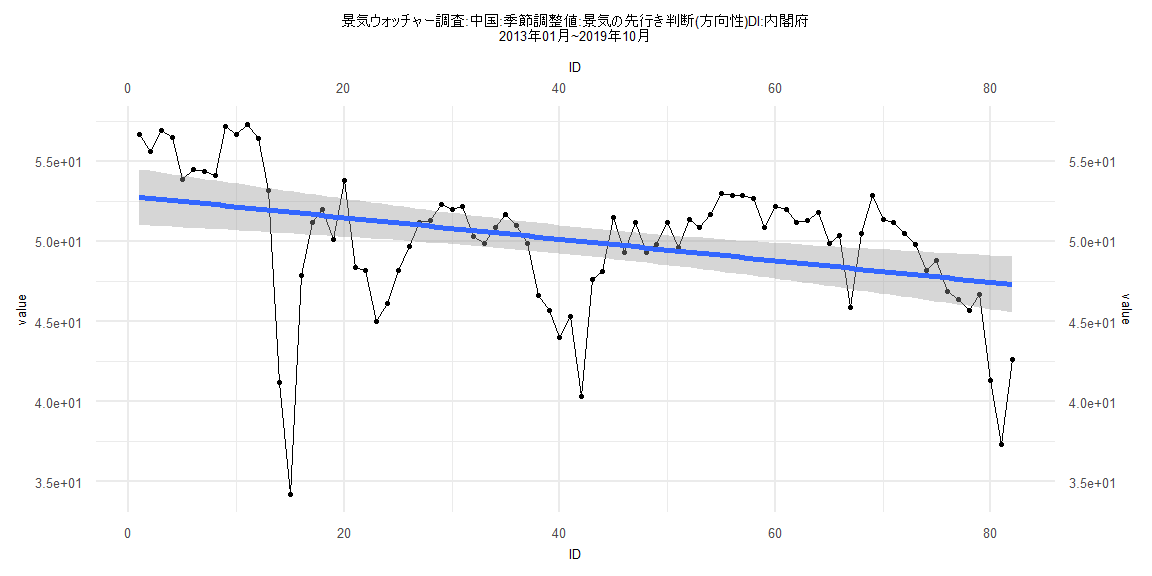

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-17.619 -1.432 1.209 2.515 5.212

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 52.82873 0.89295 59.162 < 0.0000000000000002 ***

ID -0.06731 0.01869 -3.601 0.000548 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 4.006 on 80 degrees of freedom

Multiple R-squared: 0.1395, Adjusted R-squared: 0.1287

F-statistic: 12.97 on 1 and 80 DF, p-value: 0.0005479

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.15854, p-value = 0.2552

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.59827, p-value = 0.00000000000001498

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 1.1308, df = 1, p-value = 0.2876

Box-Ljung test

data: lm_residuals

X-squared = 40.04, df = 1, p-value = 0.0000000002488

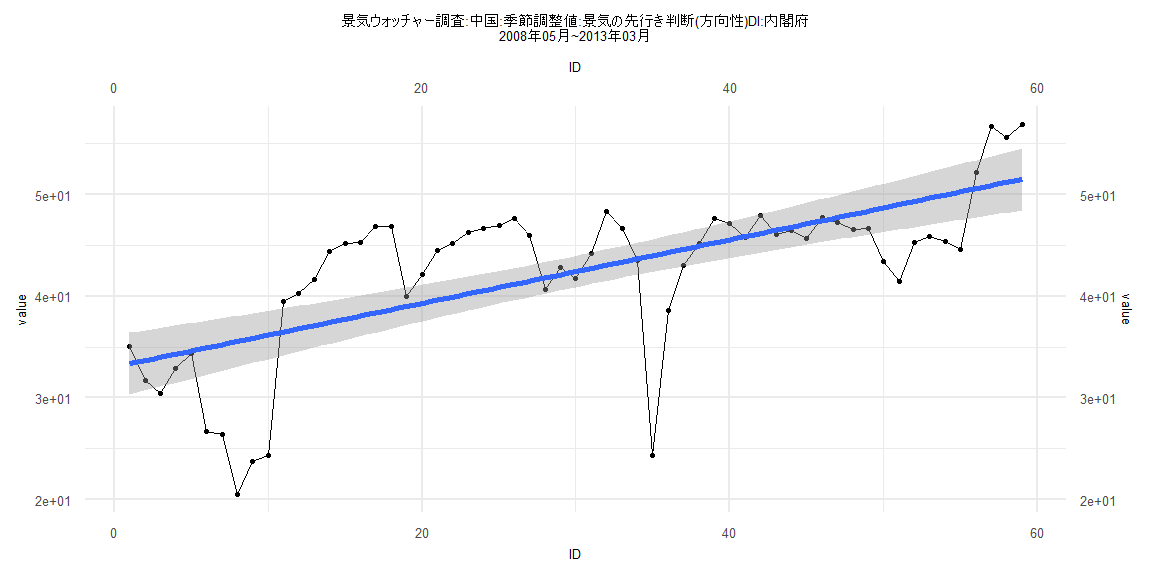

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-19.7019 -1.8291 0.3559 4.5420 8.5308

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 33.04944 1.56037 21.180 < 0.0000000000000002 ***

ID 0.31293 0.04523 6.918 0.00000000436 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 5.917 on 57 degrees of freedom

Multiple R-squared: 0.4564, Adjusted R-squared: 0.4469

F-statistic: 47.86 on 1 and 57 DF, p-value: 0.000000004355

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.23729, p-value = 0.07193

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.61441, p-value = 0.00000000007821

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 2.4559, df = 1, p-value = 0.1171

Box-Ljung test

data: lm_residuals

X-squared = 29.096, df = 1, p-value = 0.00000006886

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-17.1679 -1.5598 0.8128 2.4997 5.7072

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 52.04255 0.90982 57.201 < 0.0000000000000002 ***

ID -0.05622 0.01976 -2.845 0.00568 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 4.005 on 77 degrees of freedom

Multiple R-squared: 0.09513, Adjusted R-squared: 0.08338

F-statistic: 8.095 on 1 and 77 DF, p-value: 0.005683

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.13924, p-value = 0.4302

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.61962, p-value = 0.0000000000001376

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 1.3412, df = 1, p-value = 0.2468

Box-Ljung test

data: lm_residuals

X-squared = 37.027, df = 1, p-value = 0.000000001165