Analysis

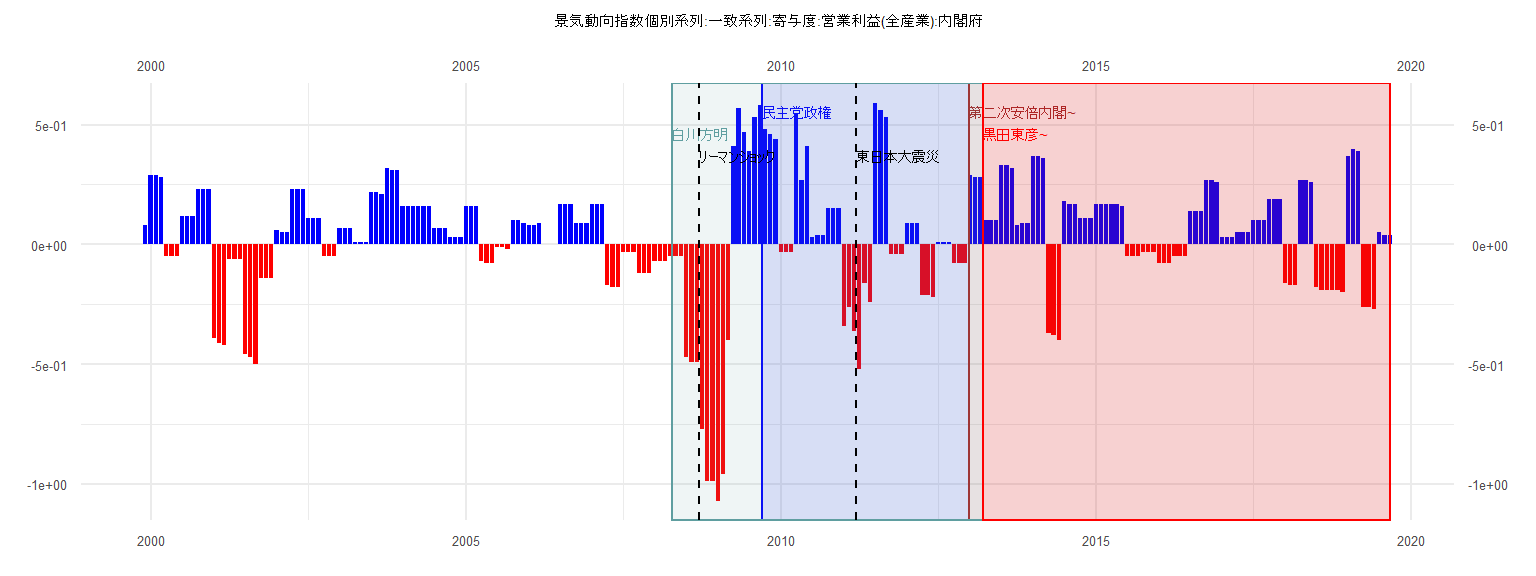

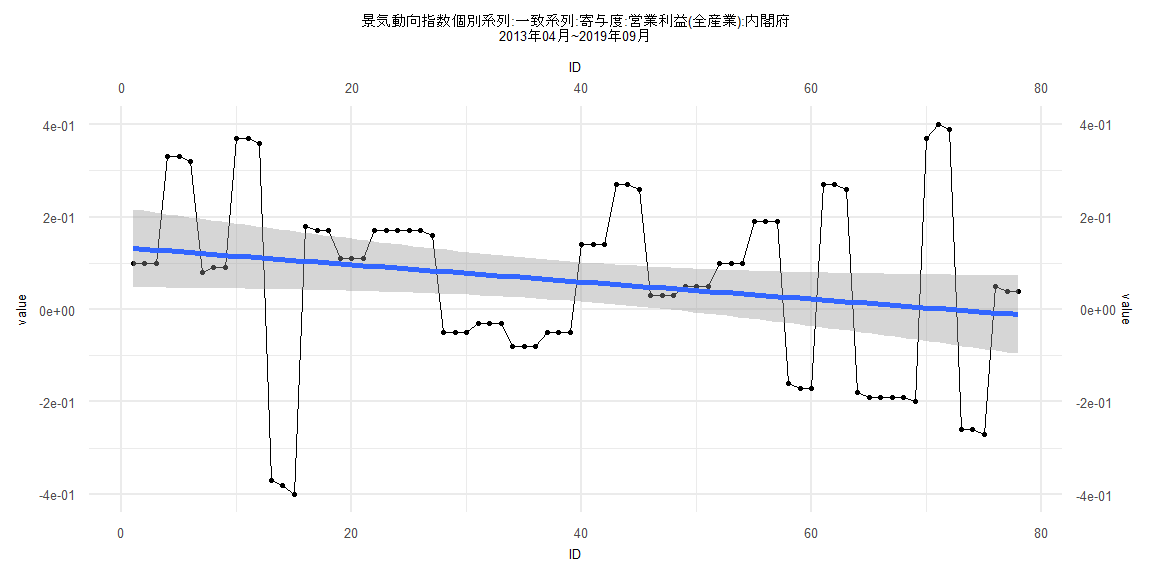

[1] "景気動向指数個別系列:一致系列:寄与度:営業利益(全産業):内閣府"

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

1999 0.08

2000 0.29 0.29 0.28 -0.05 -0.05 -0.05 0.12 0.12 0.12 0.23 0.23 0.23

2001 -0.39 -0.41 -0.42 -0.06 -0.06 -0.06 -0.46 -0.47 -0.50 -0.14 -0.14 -0.14

2002 0.06 0.05 0.05 0.23 0.23 0.23 0.11 0.11 0.11 -0.05 -0.05 -0.05

2003 0.07 0.07 0.07 0.01 0.01 0.01 0.22 0.22 0.21 0.32 0.31 0.31

2004 0.16 0.16 0.16 0.16 0.16 0.16 0.07 0.07 0.07 0.03 0.03 0.03

2005 0.16 0.16 0.16 -0.07 -0.08 -0.08 -0.01 -0.01 -0.02 0.10 0.10 0.09

2006 0.08 0.08 0.09 0.00 0.00 0.00 0.17 0.17 0.17 0.09 0.09 0.09

2007 0.17 0.17 0.17 -0.17 -0.18 -0.18 -0.03 -0.03 -0.03 -0.12 -0.12 -0.12

2008 -0.07 -0.07 -0.07 -0.05 -0.05 -0.05 -0.47 -0.49 -0.49 -0.77 -0.99 -0.99

2009 -1.07 -0.96 -0.40 0.41 0.57 0.47 0.39 0.53 0.58 0.48 0.46 0.44

2010 -0.03 -0.03 -0.03 0.55 0.27 0.41 0.03 0.04 0.04 0.15 0.15 0.15

2011 -0.34 -0.26 -0.36 -0.52 -0.16 -0.24 0.59 0.56 0.53 -0.04 -0.04 -0.04

2012 0.09 0.09 0.09 -0.21 -0.21 -0.22 0.01 0.01 0.01 -0.08 -0.08 -0.08

2013 0.29 0.28 0.28 0.10 0.10 0.10 0.33 0.33 0.32 0.08 0.09 0.09

2014 0.37 0.37 0.36 -0.37 -0.38 -0.40 0.18 0.17 0.17 0.11 0.11 0.11

2015 0.17 0.17 0.17 0.17 0.17 0.16 -0.05 -0.05 -0.05 -0.03 -0.03 -0.03

2016 -0.08 -0.08 -0.08 -0.05 -0.05 -0.05 0.14 0.14 0.14 0.27 0.27 0.26

2017 0.03 0.03 0.03 0.05 0.05 0.05 0.10 0.10 0.10 0.19 0.19 0.19

2018 -0.16 -0.17 -0.17 0.27 0.27 0.26 -0.18 -0.19 -0.19 -0.19 -0.19 -0.20

2019 0.37 0.40 0.39 -0.26 -0.26 -0.27 0.05 0.04 0.04

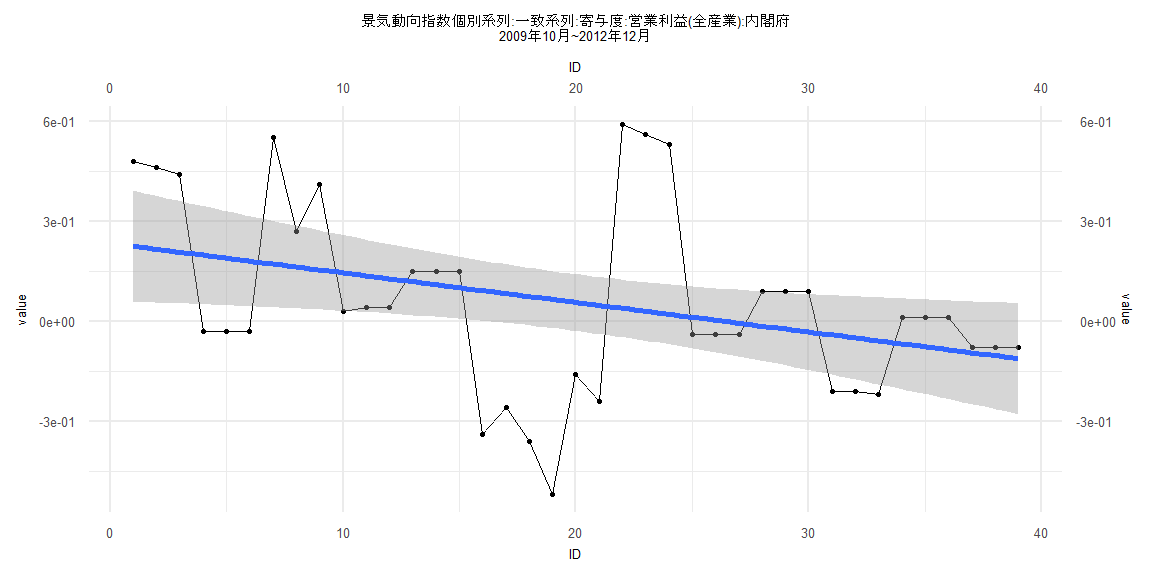

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.58477 -0.16440 0.02384 0.11079 0.55185

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.233387 0.085494 2.730 0.00964 **

ID -0.008874 0.003725 -2.382 0.02246 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.2618 on 37 degrees of freedom

Multiple R-squared: 0.133, Adjusted R-squared: 0.1095

F-statistic: 5.675 on 1 and 37 DF, p-value: 0.02246

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.28205, p-value = 0.08974

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.94905, p-value = 0.00008276

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 0.84866, df = 1, p-value = 0.3569

Box-Ljung test

data: lm_residuals

X-squared = 11.048, df = 1, p-value = 0.0008879

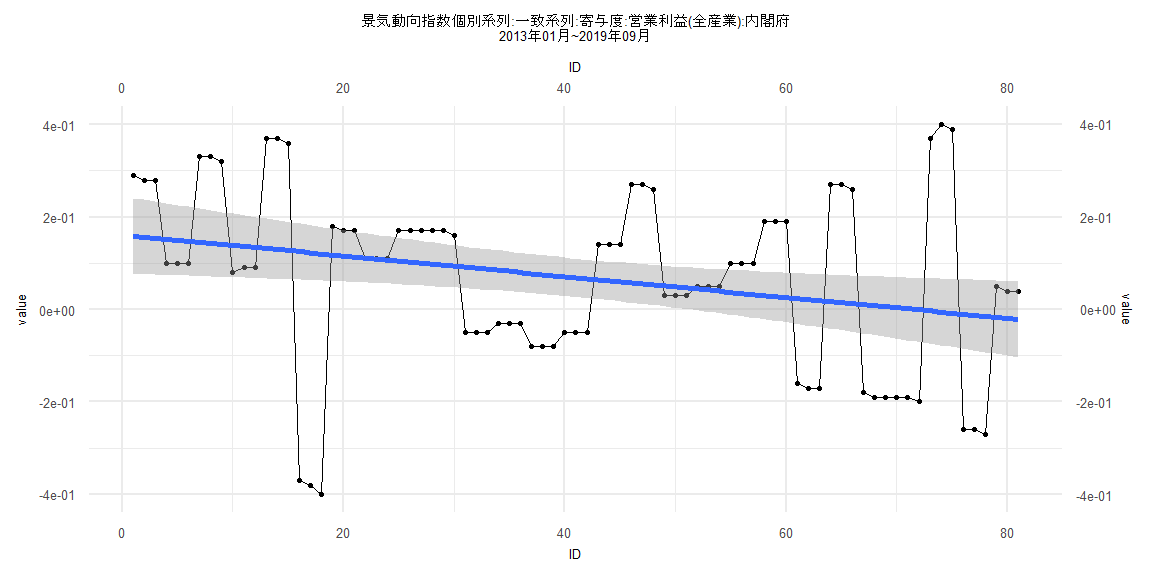

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.52042 -0.13665 0.00837 0.12356 0.40565

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.1609475 0.0420976 3.823 0.000261 ***

ID -0.0022514 0.0008919 -2.524 0.013603 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.1877 on 79 degrees of freedom

Multiple R-squared: 0.07463, Adjusted R-squared: 0.06292

F-statistic: 6.371 on 1 and 79 DF, p-value: 0.0136

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.11111, p-value = 0.7027

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.94296, p-value = 0.00000006081

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 0.49924, df = 1, p-value = 0.4798

Box-Ljung test

data: lm_residuals

X-squared = 23.14, df = 1, p-value = 0.000001506

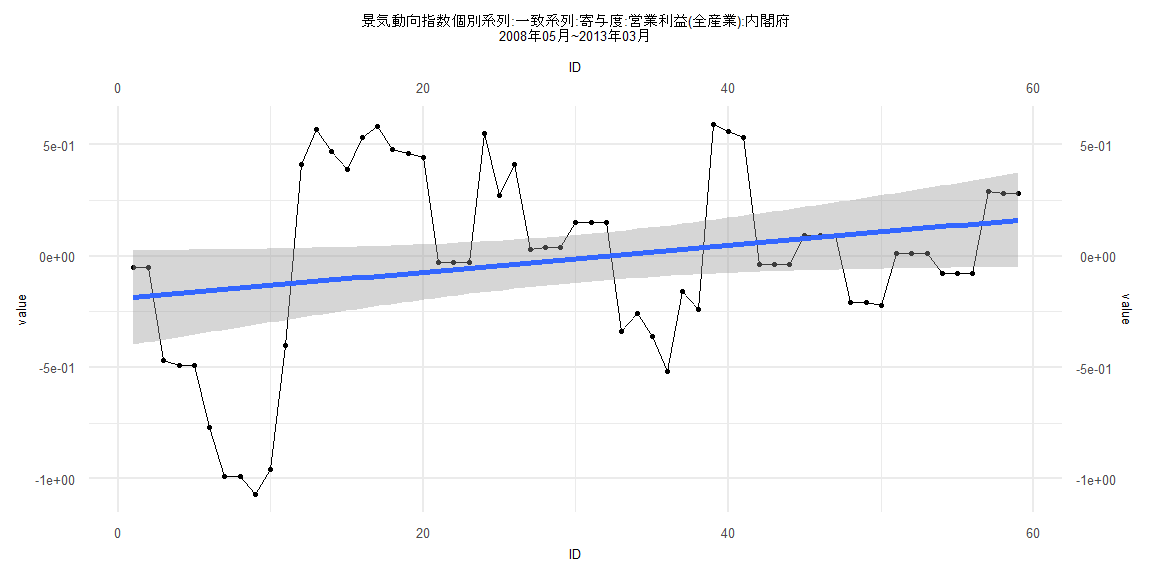

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.93131 -0.27429 0.01273 0.23771 0.68469

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.192677 0.108411 -1.777 0.0809 .

ID 0.005999 0.003143 1.909 0.0613 .

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.4111 on 57 degrees of freedom

Multiple R-squared: 0.06008, Adjusted R-squared: 0.04359

F-statistic: 3.644 on 1 and 57 DF, p-value: 0.06132

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.20339, p-value = 0.1748

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.40649, p-value = 0.000000000000001197

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 15.583, df = 1, p-value = 0.00007895

Box-Ljung test

data: lm_residuals

X-squared = 39.223, df = 1, p-value = 0.000000000378

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.50599 -0.12946 0.01124 0.08386 0.39825

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.1339061 0.0433096 3.092 0.00278 **

ID -0.0018613 0.0009526 -1.954 0.05438 .

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.1894 on 76 degrees of freedom

Multiple R-squared: 0.04783, Adjusted R-squared: 0.03531

F-statistic: 3.818 on 1 and 76 DF, p-value: 0.05438

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.11538, p-value = 0.6802

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.95076, p-value = 0.0000001279

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 0.30791, df = 1, p-value = 0.579

Box-Ljung test

data: lm_residuals

X-squared = 22.247, df = 1, p-value = 0.000002397