Analysis

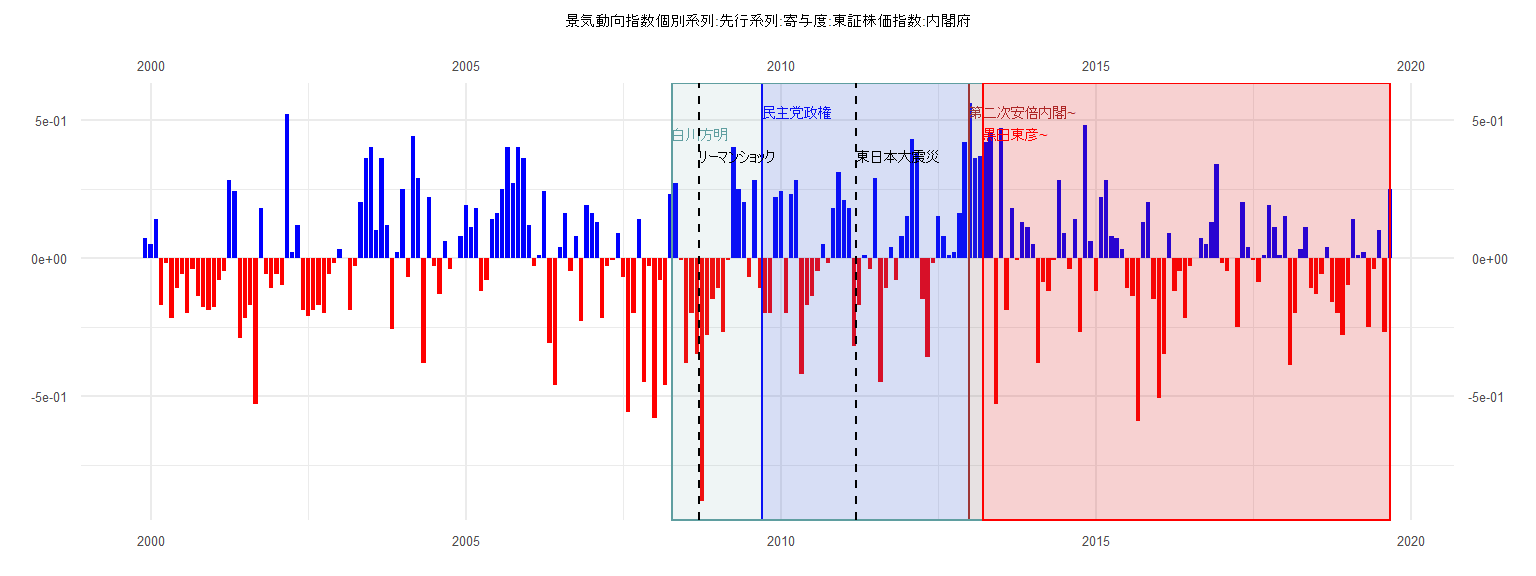

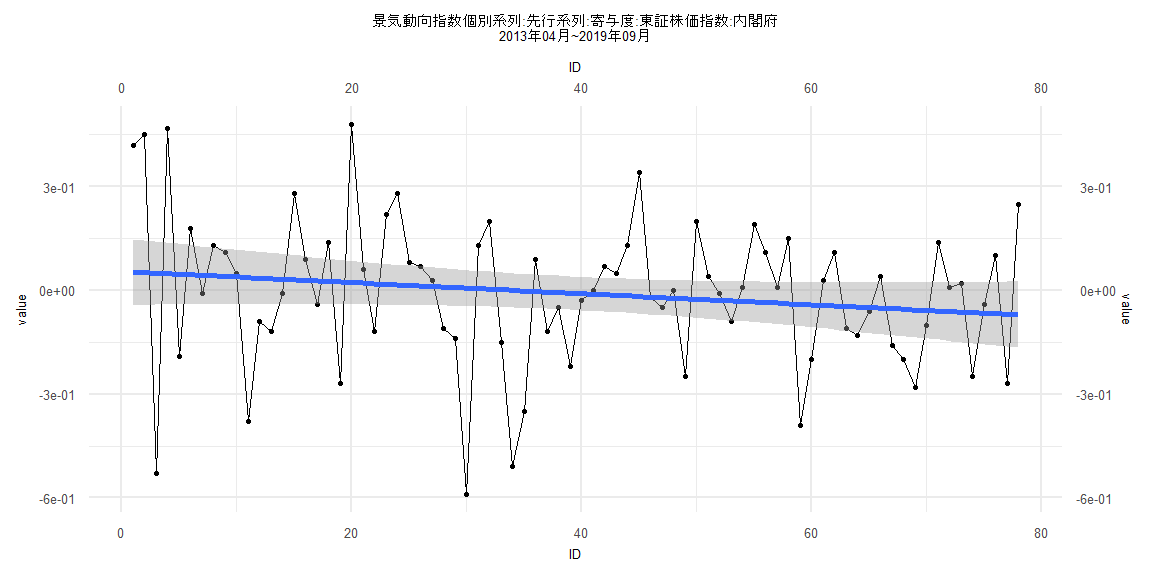

[1] "景気動向指数個別系列:先行系列:寄与度:東証株価指数:内閣府"

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

1999 0.07

2000 0.05 0.14 -0.17 -0.02 -0.22 -0.11 -0.06 -0.20 -0.04 -0.14 -0.18 -0.19

2001 -0.18 -0.08 -0.05 0.28 0.24 -0.29 -0.22 -0.17 -0.53 0.18 -0.06 -0.11

2002 -0.06 -0.10 0.52 0.02 0.12 -0.19 -0.21 -0.19 -0.17 -0.20 -0.06 -0.02

2003 0.03 0.00 -0.19 -0.03 0.20 0.36 0.40 0.10 0.36 0.12 -0.26 0.02

2004 0.25 -0.07 0.44 0.29 -0.38 0.22 -0.03 -0.13 0.06 -0.04 0.00 0.08

2005 0.19 0.11 0.18 -0.12 -0.08 0.14 0.16 0.25 0.40 0.27 0.40 0.36

2006 0.12 -0.03 0.01 0.24 -0.31 -0.46 0.04 0.16 -0.05 0.08 -0.23 0.19

2007 0.16 0.13 -0.22 -0.03 -0.01 0.09 -0.07 -0.56 -0.20 0.14 -0.45 -0.03

2008 -0.58 -0.08 -0.46 0.23 0.27 -0.01 -0.38 -0.20 -0.35 -0.88 -0.28 -0.15

2009 -0.11 -0.27 -0.01 0.40 0.25 0.20 -0.07 0.28 -0.11 -0.20 -0.20 0.22

2010 0.24 -0.20 0.23 0.28 -0.42 -0.17 -0.14 -0.05 0.05 -0.02 0.18 0.31

2011 0.21 0.18 -0.32 -0.17 0.01 -0.04 0.29 -0.45 -0.11 0.04 -0.08 0.08

2012 0.15 0.43 0.38 -0.15 -0.36 -0.02 0.15 0.08 0.01 0.02 0.16 0.42

2013 0.56 0.36 0.37 0.42 0.45 -0.53 0.47 -0.19 0.18 -0.01 0.13 0.11

2014 0.05 -0.38 -0.09 -0.12 -0.01 0.28 0.09 -0.04 0.14 -0.27 0.48 0.06

2015 -0.12 0.22 0.28 0.08 0.07 0.03 -0.11 -0.14 -0.59 0.13 0.20 -0.15

2016 -0.51 -0.35 0.09 -0.12 -0.05 -0.22 -0.03 0.00 0.07 0.05 0.13 0.34

2017 -0.02 -0.05 0.00 -0.25 0.20 0.04 -0.01 -0.09 0.01 0.19 0.11 0.01

2018 0.15 -0.39 -0.20 0.03 0.11 -0.11 -0.13 -0.06 0.04 -0.16 -0.20 -0.28

2019 -0.10 0.14 0.01 0.02 -0.25 -0.04 0.10 -0.27 0.25

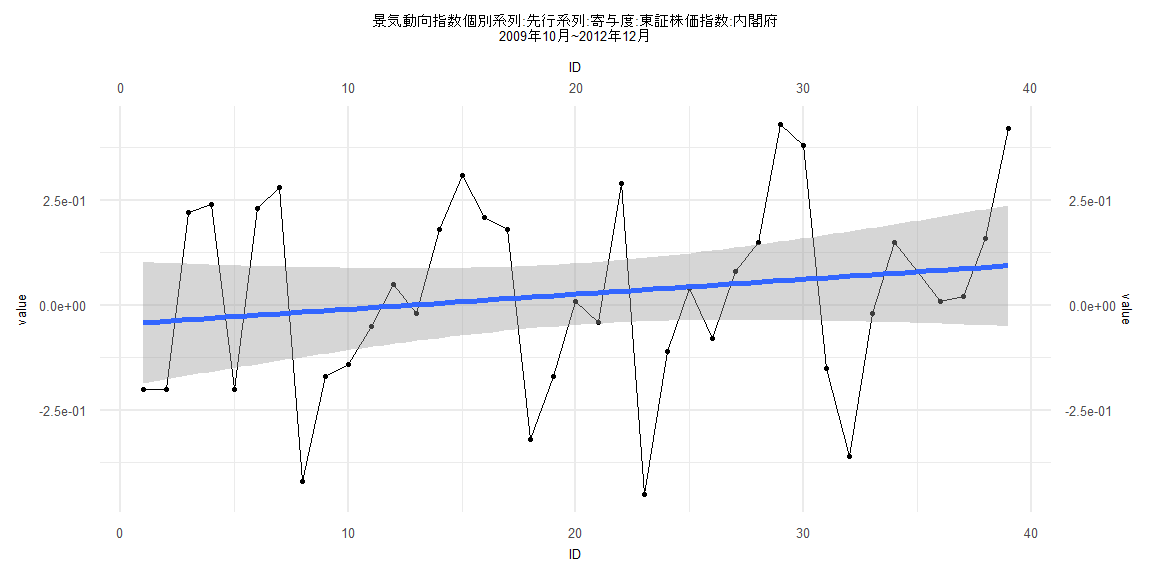

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.48684 -0.15369 -0.01615 0.18665 0.37180

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.045061 0.073700 -0.611 0.545

ID 0.003561 0.003211 1.109 0.275

Residual standard error: 0.2257 on 37 degrees of freedom

Multiple R-squared: 0.03216, Adjusted R-squared: 0.005999

F-statistic: 1.229 on 1 and 37 DF, p-value: 0.2747

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.17949, p-value = 0.5622

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 1.5874, p-value = 0.06837

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 0.03834, df = 1, p-value = 0.8448

Box-Ljung test

data: lm_residuals

X-squared = 1.2361, df = 1, p-value = 0.2662

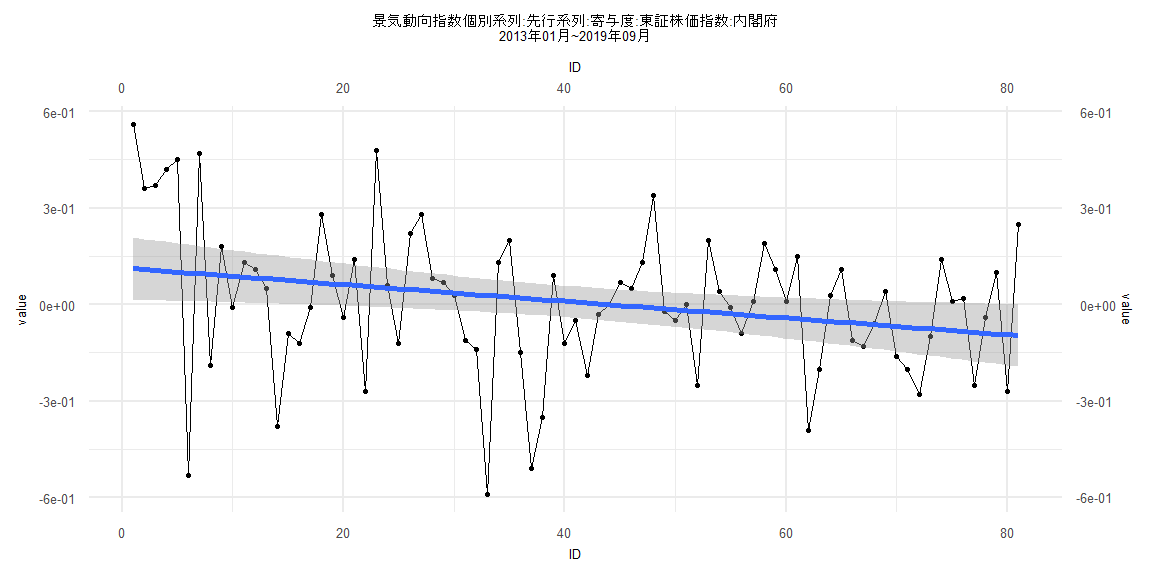

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.62850 -0.13013 0.01886 0.13806 0.44850

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.114096 0.049561 2.302 0.0240 *

ID -0.002599 0.001050 -2.475 0.0155 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.221 on 79 degrees of freedom

Multiple R-squared: 0.07197, Adjusted R-squared: 0.06022

F-statistic: 6.127 on 1 and 79 DF, p-value: 0.01546

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.14815, p-value = 0.338

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 1.8759, p-value = 0.2494

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 7.0145, df = 1, p-value = 0.008085

Box-Ljung test

data: lm_residuals

X-squared = 0.035048, df = 1, p-value = 0.8515

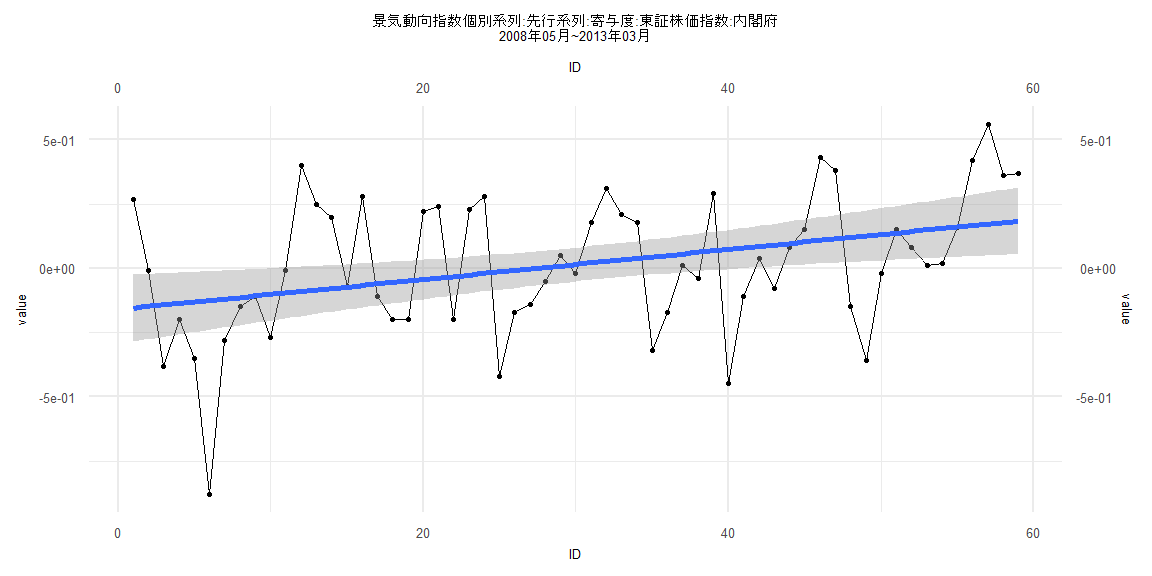

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.75483 -0.15632 -0.03508 0.20388 0.49011

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.160234 0.066781 -2.399 0.01971 *

ID 0.005844 0.001936 3.019 0.00379 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.2532 on 57 degrees of freedom

Multiple R-squared: 0.1378, Adjusted R-squared: 0.1227

F-statistic: 9.113 on 1 and 57 DF, p-value: 0.003792

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.11864, p-value = 0.8052

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 1.2663, p-value = 0.00105

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 1.3045, df = 1, p-value = 0.2534

Box-Ljung test

data: lm_residuals

X-squared = 7.0674, df = 1, p-value = 0.00785

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.5966 -0.1241 0.0206 0.1223 0.4574

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.054789 0.048876 1.121 0.266

ID -0.001608 0.001075 -1.496 0.139

Residual standard error: 0.2138 on 76 degrees of freedom

Multiple R-squared: 0.02859, Adjusted R-squared: 0.01581

F-statistic: 2.237 on 1 and 76 DF, p-value: 0.1389

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.16667, p-value = 0.2297

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 2.0715, p-value = 0.5792

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 6.1737, df = 1, p-value = 0.01297

Box-Ljung test

data: lm_residuals

X-squared = 0.39643, df = 1, p-value = 0.5289