Analysis

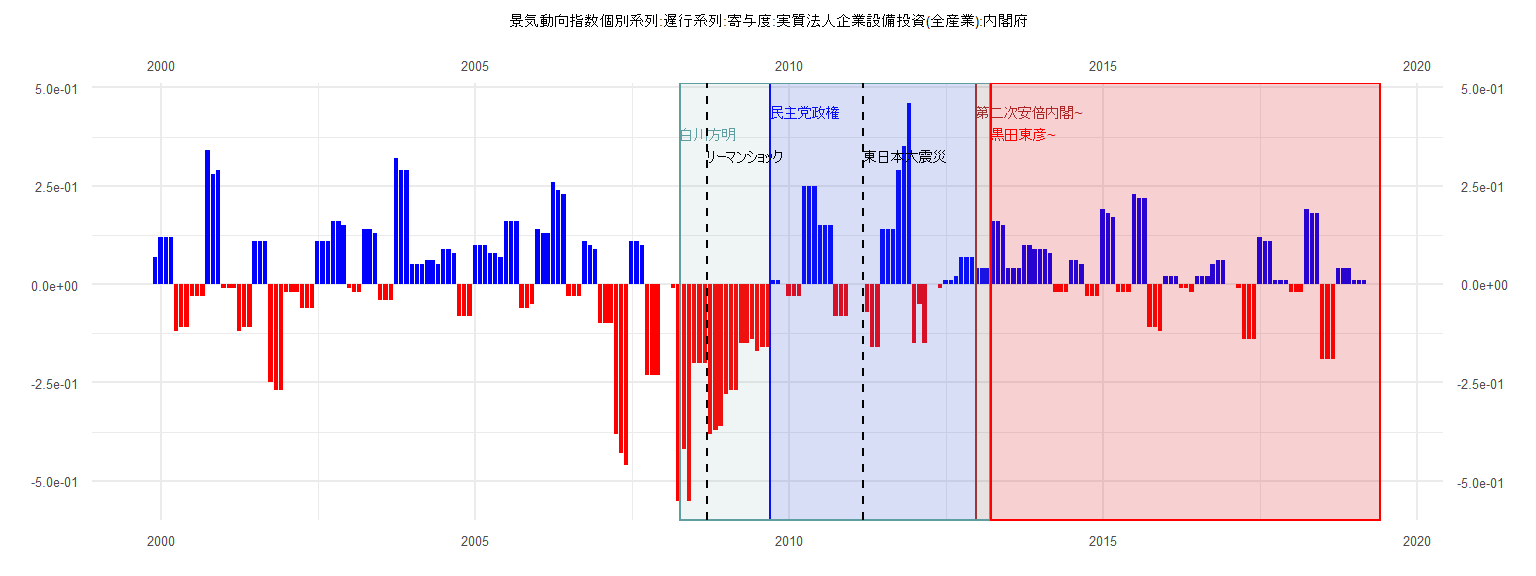

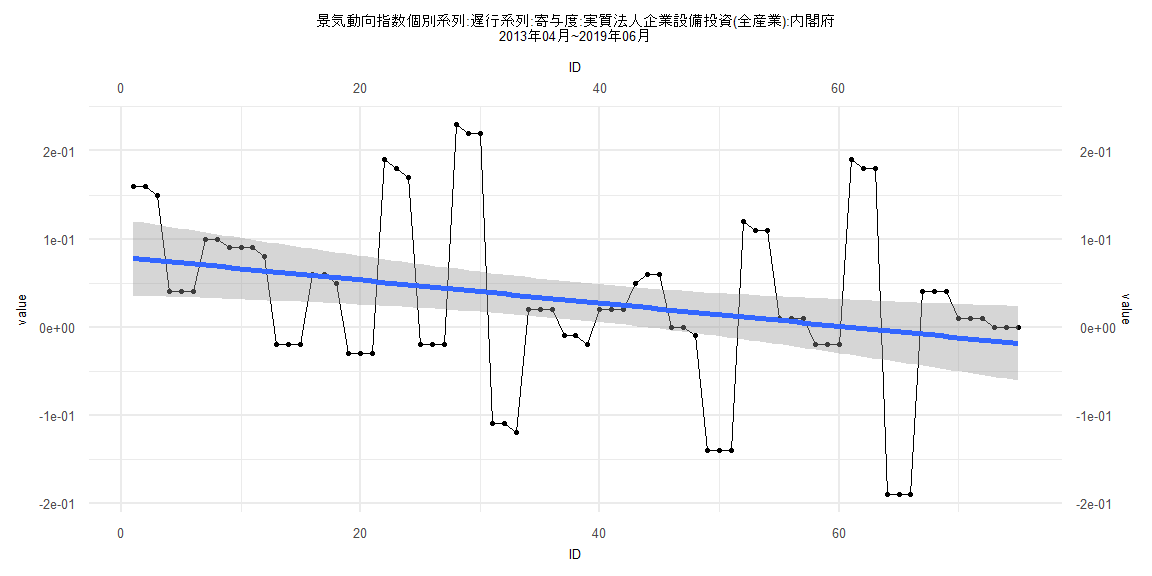

[1] "景気動向指数個別系列:遅行系列:寄与度:実質法人企業設備投資(全産業):内閣府"

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

1999 0.07

2000 0.12 0.12 0.12 -0.12 -0.11 -0.11 -0.03 -0.03 -0.03 0.34 0.28 0.29

2001 -0.01 -0.01 -0.01 -0.12 -0.11 -0.11 0.11 0.11 0.11 -0.25 -0.27 -0.27

2002 -0.02 -0.02 -0.02 -0.06 -0.06 -0.06 0.11 0.11 0.11 0.16 0.16 0.15

2003 -0.01 -0.02 -0.02 0.14 0.14 0.13 -0.04 -0.04 -0.04 0.32 0.29 0.29

2004 0.05 0.05 0.05 0.06 0.06 0.05 0.09 0.09 0.08 -0.08 -0.08 -0.08

2005 0.10 0.10 0.10 0.08 0.08 0.07 0.16 0.16 0.16 -0.06 -0.06 -0.05

2006 0.14 0.13 0.13 0.26 0.24 0.23 -0.03 -0.03 -0.03 0.11 0.10 0.09

2007 -0.10 -0.10 -0.10 -0.38 -0.43 -0.46 0.11 0.11 0.10 -0.23 -0.23 -0.23

2008 0.00 0.00 -0.01 -0.55 -0.42 -0.55 -0.20 -0.20 -0.20 -0.38 -0.37 -0.36

2009 -0.28 -0.27 -0.27 -0.15 -0.15 -0.14 -0.17 -0.16 -0.16 0.01 0.01 0.00

2010 -0.03 -0.03 -0.03 0.25 0.25 0.25 0.15 0.15 0.15 -0.08 -0.08 -0.08

2011 0.00 0.00 0.00 -0.07 -0.16 -0.16 0.14 0.14 0.14 0.29 0.35 0.46

2012 -0.15 -0.05 -0.15 0.00 0.00 -0.01 0.01 0.01 0.02 0.07 0.07 0.07

2013 0.04 0.04 0.04 0.16 0.16 0.15 0.04 0.04 0.04 0.10 0.10 0.09

2014 0.09 0.09 0.08 -0.02 -0.02 -0.02 0.06 0.06 0.05 -0.03 -0.03 -0.03

2015 0.19 0.18 0.17 -0.02 -0.02 -0.02 0.23 0.22 0.22 -0.11 -0.11 -0.12

2016 0.02 0.02 0.02 -0.01 -0.01 -0.02 0.02 0.02 0.02 0.05 0.06 0.06

2017 0.00 0.00 -0.01 -0.14 -0.14 -0.14 0.12 0.11 0.11 0.01 0.01 0.01

2018 -0.02 -0.02 -0.02 0.19 0.18 0.18 -0.19 -0.19 -0.19 0.04 0.04 0.04

2019 0.01 0.01 0.01 0.00 0.00 0.00

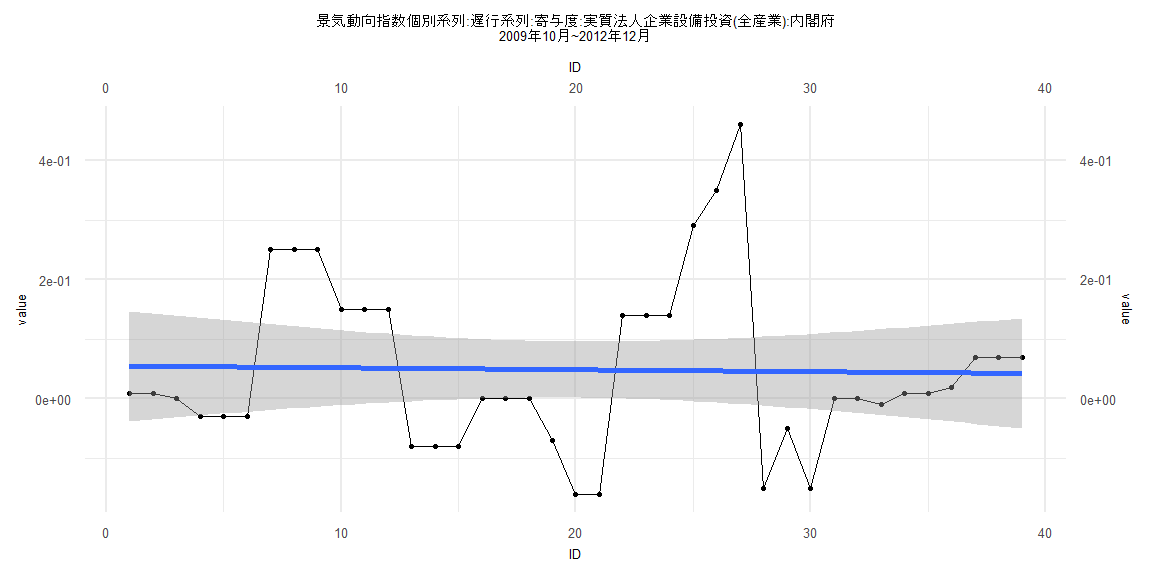

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.20897 -0.08393 -0.04505 0.09215 0.41326

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.0553711 0.0473791 1.169 0.250

ID -0.0003198 0.0020645 -0.155 0.878

Residual standard error: 0.1451 on 37 degrees of freedom

Multiple R-squared: 0.0006482, Adjusted R-squared: -0.02636

F-statistic: 0.024 on 1 and 37 DF, p-value: 0.8777

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.33333, p-value = 0.02558

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.90834, p-value = 0.00004184

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 0.088426, df = 1, p-value = 0.7662

Box-Ljung test

data: lm_residuals

X-squared = 12.455, df = 1, p-value = 0.0004168

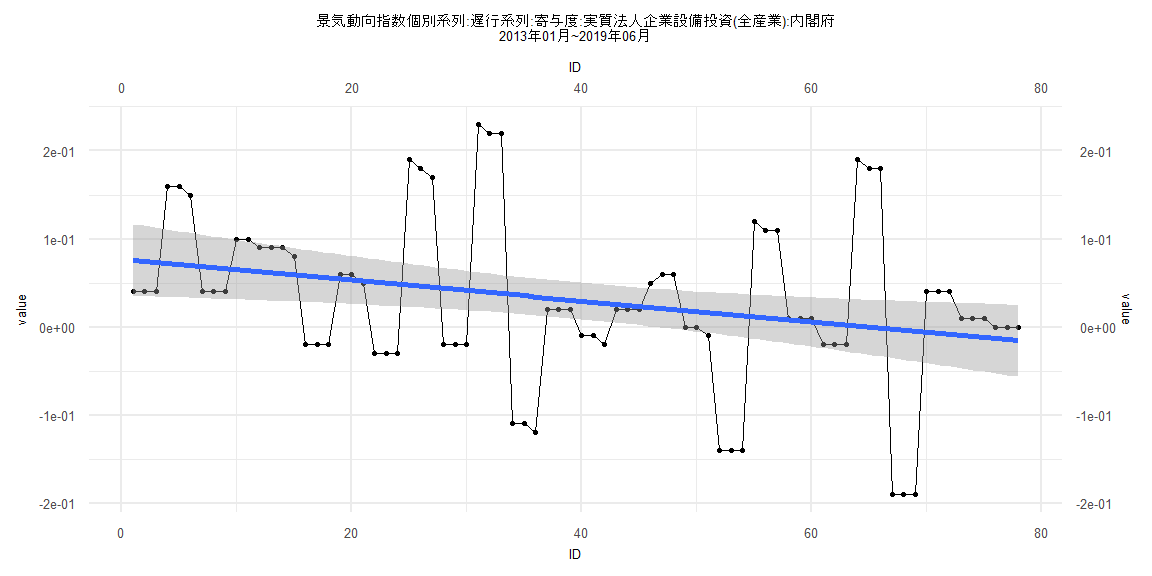

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.187387 -0.039235 -0.002867 0.038086 0.189752

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.0771562 0.0208781 3.696 0.000412 ***

ID -0.0011906 0.0004592 -2.593 0.011416 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.09131 on 76 degrees of freedom

Multiple R-squared: 0.08126, Adjusted R-squared: 0.06917

F-statistic: 6.722 on 1 and 76 DF, p-value: 0.01142

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.11538, p-value = 0.6802

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 1.0527, p-value = 0.000002206

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 2.5415, df = 1, p-value = 0.1109

Box-Ljung test

data: lm_residuals

X-squared = 18.089, df = 1, p-value = 0.00002108

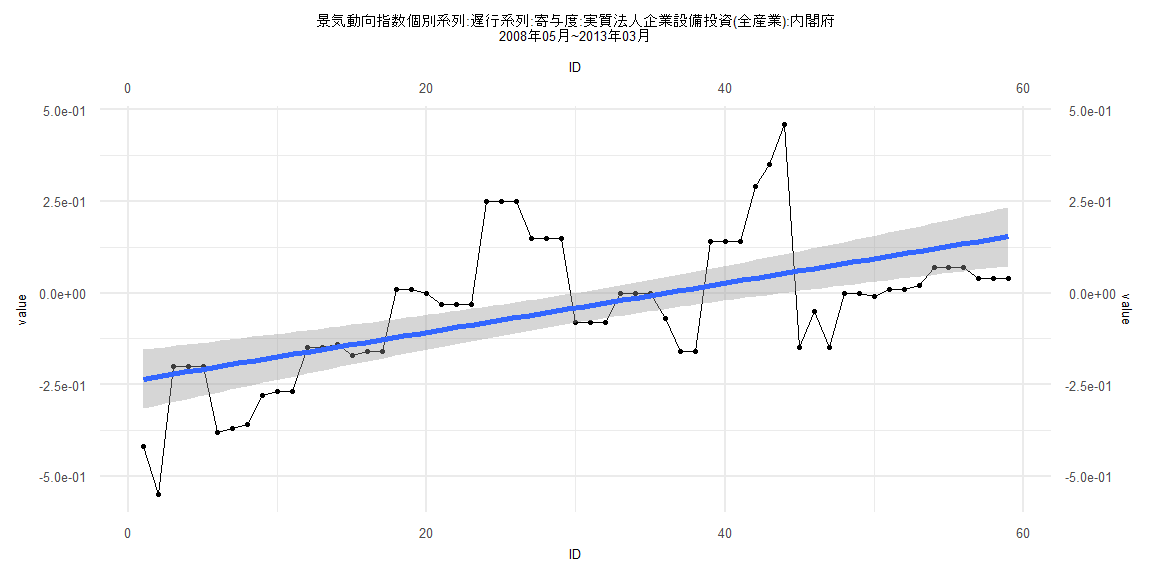

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.32170 -0.09942 -0.03221 0.08898 0.40687

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) -0.241701 0.041194 -5.867 0.000000237 ***

ID 0.006701 0.001194 5.611 0.000000617 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.1562 on 57 degrees of freedom

Multiple R-squared: 0.3558, Adjusted R-squared: 0.3445

F-statistic: 31.49 on 1 and 57 DF, p-value: 0.0000006172

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.16949, p-value = 0.3674

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.66716, p-value = 0.0000000006401

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 0.00002203, df = 1, p-value = 0.9963

Box-Ljung test

data: lm_residuals

X-squared = 26.174, df = 1, p-value = 0.0000003119

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-0.185767 -0.044733 0.001526 0.038758 0.190314

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.0793766 0.0216601 3.665 0.000467 ***

ID -0.0013064 0.0004953 -2.638 0.010193 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.09285 on 73 degrees of freedom

Multiple R-squared: 0.08702, Adjusted R-squared: 0.07451

F-statistic: 6.958 on 1 and 73 DF, p-value: 0.01019

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.16, p-value = 0.2937

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 1.0364, p-value = 0.000002176

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 1.8358, df = 1, p-value = 0.1754

Box-Ljung test

data: lm_residuals

X-squared = 17.697, df = 1, p-value = 0.00002591