Analysis

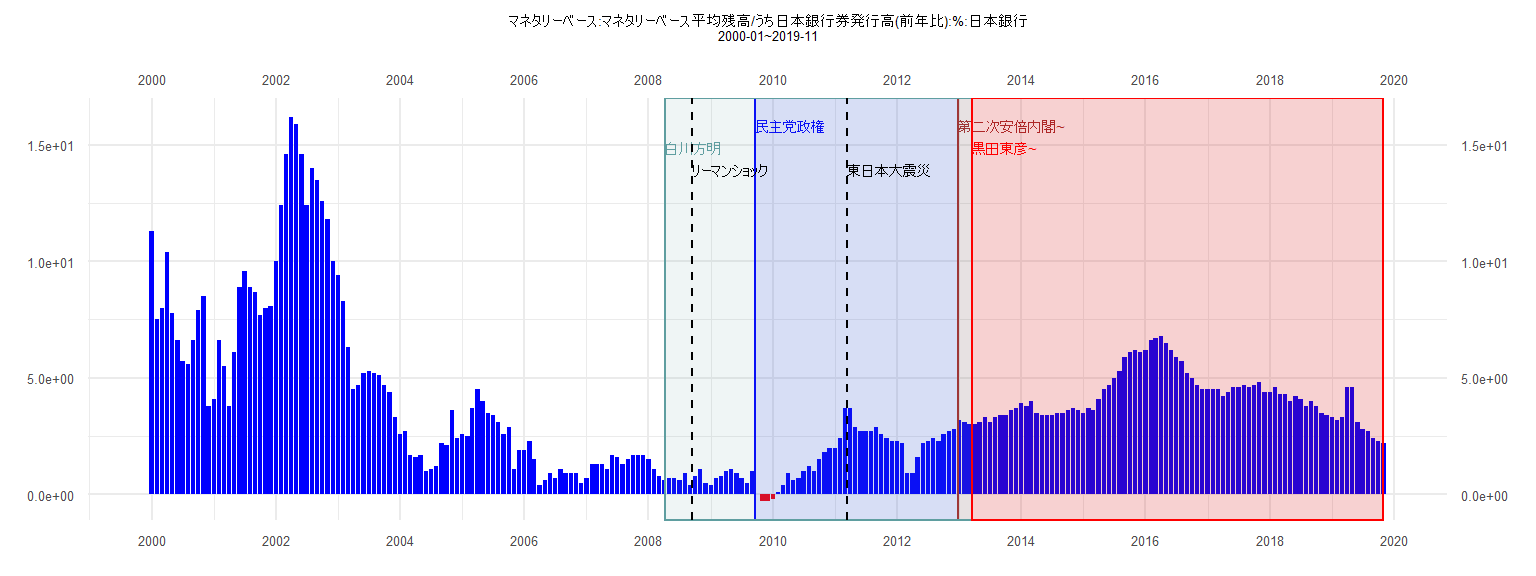

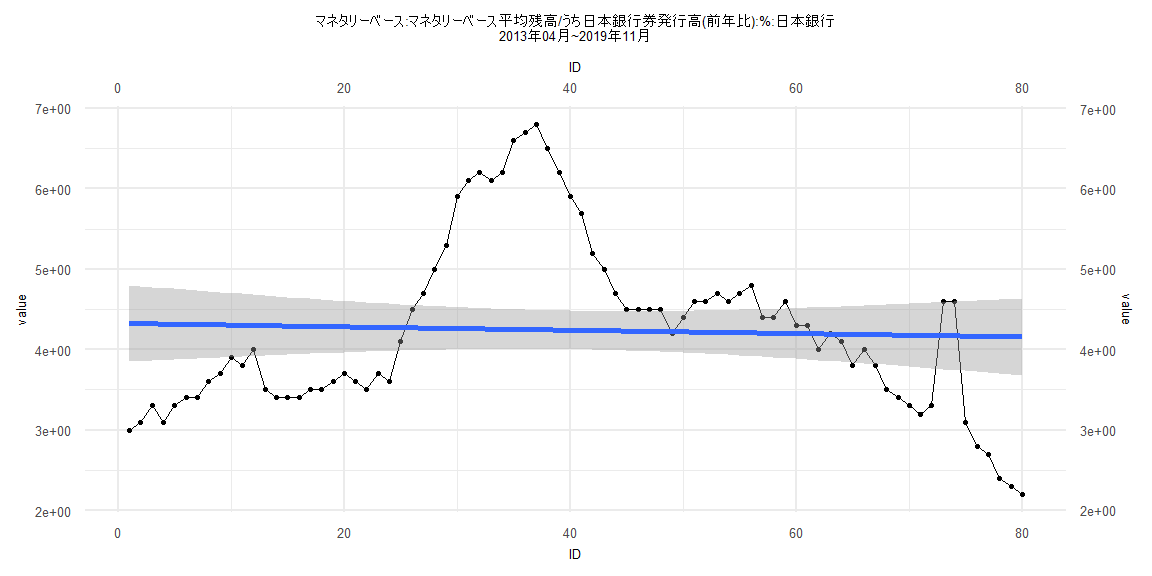

[1] "マネタリーベース:マネタリーベース平均残高/うち日本銀行券発行高(前年比):%:日本銀行"

Jan Feb Mar Apr May Jun Jul Aug Sep Oct Nov Dec

2000 11.3 7.5 8.0 10.4 7.8 6.6 5.7 5.6 6.6 7.9 8.5 3.8

2001 4.1 6.6 5.5 3.8 6.1 8.9 9.6 8.9 8.7 7.7 8.0 8.1

2002 10.0 12.4 14.6 16.2 15.9 14.6 12.4 14.0 13.5 12.6 11.8 10.0

2003 9.4 8.3 6.3 4.5 4.7 5.2 5.3 5.2 5.1 4.7 4.4 3.3

2004 2.6 2.7 1.7 1.6 1.7 1.0 1.1 1.2 2.2 2.1 3.6 2.4

2005 2.6 2.5 3.7 4.5 4.0 3.5 3.4 3.1 2.6 2.9 1.1 1.9

2006 1.9 2.3 1.5 0.4 0.6 0.9 0.7 1.1 0.9 0.9 0.9 0.5

2007 0.7 1.3 1.3 1.3 1.1 1.7 1.6 1.3 1.5 1.7 1.7 1.7

2008 1.5 1.1 0.8 0.6 0.7 0.7 0.6 0.9 0.4 0.8 1.1 0.5

2009 0.4 0.7 0.8 1.0 1.1 0.9 0.7 0.5 1.0 0.0 -0.3 -0.3

2010 -0.2 0.1 0.4 0.9 0.6 0.7 1.0 1.2 1.0 1.5 1.8 2.0

2011 2.0 2.4 3.7 3.7 2.9 2.7 2.7 2.7 2.9 2.6 2.4 2.3

2012 2.3 2.2 0.9 0.9 1.6 2.2 2.3 2.4 2.3 2.6 2.7 2.8

2013 3.2 3.1 3.0 3.0 3.1 3.3 3.1 3.3 3.4 3.4 3.6 3.7

2014 3.9 3.8 4.0 3.5 3.4 3.4 3.4 3.5 3.5 3.6 3.7 3.6

2015 3.5 3.7 3.6 4.1 4.5 4.7 5.0 5.3 5.9 6.1 6.2 6.1

2016 6.2 6.6 6.7 6.8 6.5 6.2 5.9 5.7 5.2 5.0 4.7 4.5

2017 4.5 4.5 4.5 4.2 4.4 4.6 4.6 4.7 4.6 4.7 4.8 4.4

2018 4.4 4.6 4.3 4.3 4.0 4.2 4.1 3.8 4.0 3.8 3.5 3.4

2019 3.3 3.2 3.3 4.6 4.6 3.1 2.8 2.7 2.4 2.3 2.2

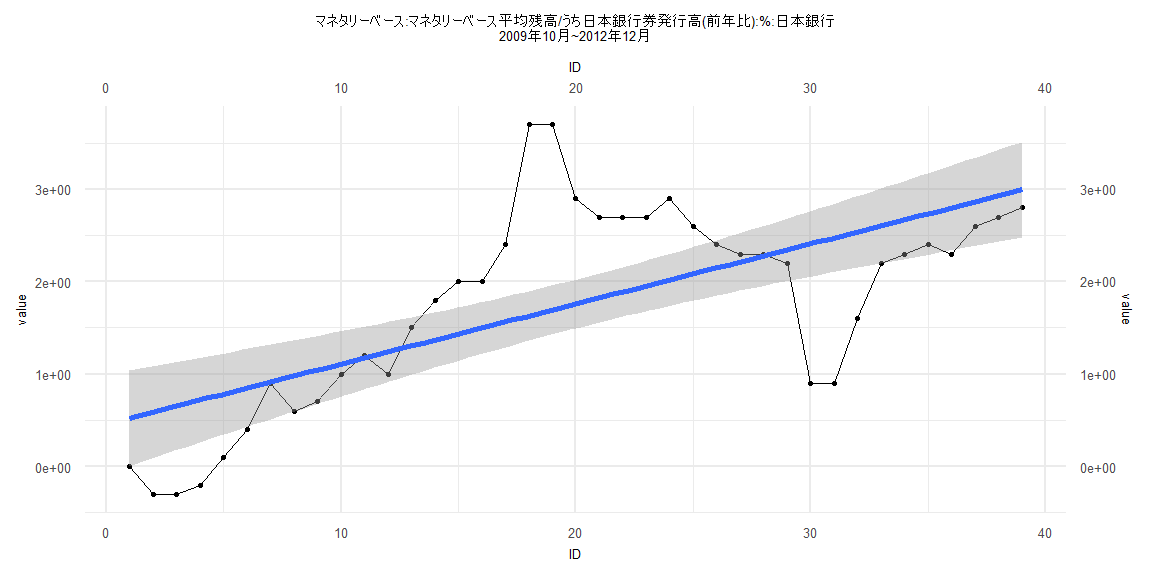

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-1.5733 -0.4265 -0.1434 0.5086 2.0709

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.46019 0.26571 1.732 0.0916 .

ID 0.06494 0.01158 5.609 0.00000213 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.8138 on 37 degrees of freedom

Multiple R-squared: 0.4595, Adjusted R-squared: 0.4449

F-statistic: 31.46 on 1 and 37 DF, p-value: 0.000002127

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.15385, p-value = 0.7523

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.26025, p-value = 0.000000000000004418

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 0.00024804, df = 1, p-value = 0.9874

Box-Ljung test

data: lm_residuals

X-squared = 31.375, df = 1, p-value = 0.00000002127

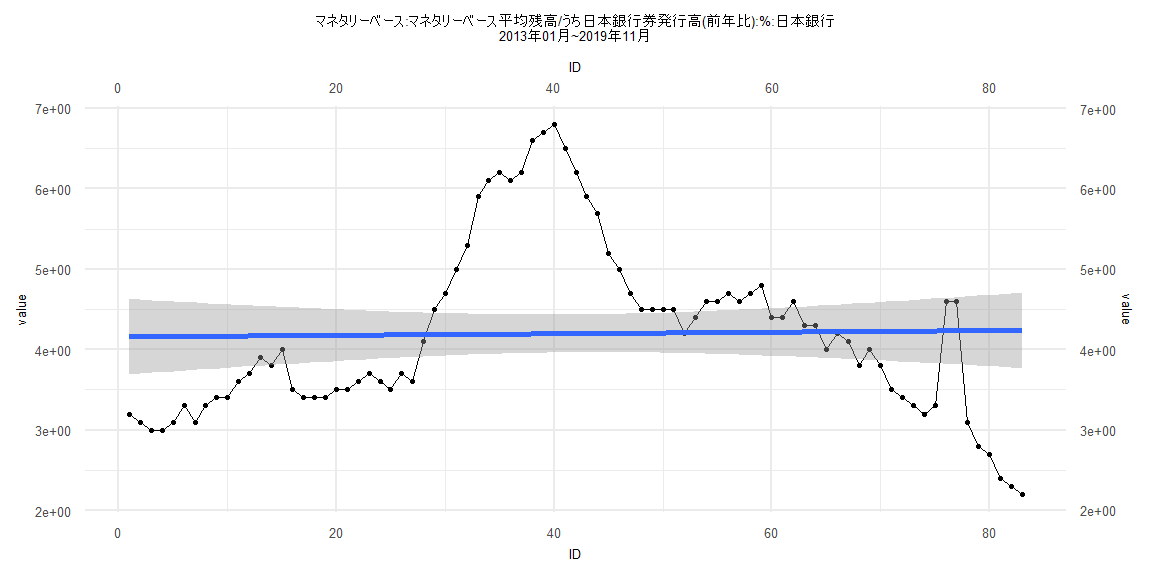

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-2.0407 -0.7717 -0.1732 0.4361 2.6020

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 4.1583015 0.2397486 17.34 <0.0000000000000002 ***

ID 0.0009928 0.0049583 0.20 0.842

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 1.082 on 81 degrees of freedom

Multiple R-squared: 0.0004947, Adjusted R-squared: -0.01184

F-statistic: 0.04009 on 1 and 81 DF, p-value: 0.8418

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.14458, p-value = 0.3526

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.081394, p-value < 0.00000000000000022

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 0.19229, df = 1, p-value = 0.661

Box-Ljung test

data: lm_residuals

X-squared = 74.815, df = 1, p-value < 0.00000000000000022

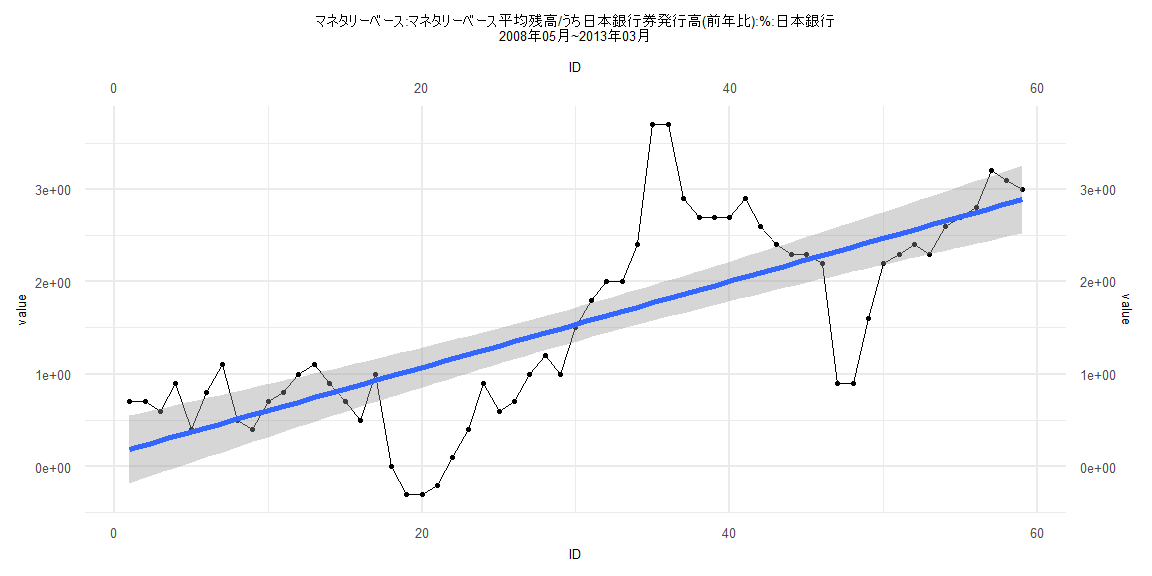

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-1.4757 -0.3332 0.0640 0.3751 1.9298

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.13986 0.18731 0.747 0.458

ID 0.04658 0.00543 8.579 0.00000000000758 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.7102 on 57 degrees of freedom

Multiple R-squared: 0.5635, Adjusted R-squared: 0.5559

F-statistic: 73.6 on 1 and 57 DF, p-value: 0.000000000007576

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.13559, p-value = 0.6544

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.31863, p-value < 0.00000000000000022

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 0.18887, df = 1, p-value = 0.6639

Box-Ljung test

data: lm_residuals

X-squared = 43.355, df = 1, p-value = 0.00000000004565

Call:

lm(formula = value ~ ID)

Residuals:

Min 1Q Median 3Q Max

-1.9584 -0.7926 -0.1329 0.4394 2.5514

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 4.326171 0.243733 17.750 <0.0000000000000002 ***

ID -0.002097 0.005228 -0.401 0.689

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 1.08 on 78 degrees of freedom

Multiple R-squared: 0.002058, Adjusted R-squared: -0.01074

F-statistic: 0.1609 on 1 and 78 DF, p-value: 0.6895

Two-sample Kolmogorov-Smirnov test

data: lm_residuals and rnorm(n = length(lm_residuals), mean = 0, sd = sd(lm_residuals))

D = 0.1125, p-value = 0.6953

alternative hypothesis: two-sided

Durbin-Watson test

data: value ~ ID

DW = 0.084632, p-value < 0.00000000000000022

alternative hypothesis: true autocorrelation is greater than 0

studentized Breusch-Pagan test

data: value ~ ID

BP = 0.014471, df = 1, p-value = 0.9042

Box-Ljung test

data: lm_residuals

X-squared = 71.351, df = 1, p-value < 0.00000000000000022