日次経済金融指標の計量分析

- 日経平均株価vs東京市場ドル円レート、ダウ平均株価vs日経平均株価、空売り比率vs日経平均株価、ドル円レートvs日経平均株価(月中平均、ベイズ推定)、トランプ大統領の就任前後における日経平均前営業日比ボラティリティの比較 -

アセット・マネジメント・コンサルティング株式会社 https://am-consulting.co.jp

更新日時:2019-12-25 14:06:00

Analysis

日経平均株価と東京市場ドル円レート(Source:日本銀行,日本経済新聞社) ダウ平均株価と日経平均株価(Source:Yahoo Finance,FRED,日本経済新聞社) 空売り比率と日経平均株価(Source:日本取引所グループ、日本経済新聞社) ドル円レートと日経平均株価:ベイズ推定:線形回帰モデル トランプ大統領の就任前後における日経平均前営業日比ボラティリティの比較

日経平均株価と東京市場ドル円レート(Source:日本銀行,日本経済新聞社)

[1] "USDJPY"

Date Open High Low Close Center Index CloseToOpen HighToLow MA25 DeviationRate Close:Diff(lag=1) Close:Ratio(lag=1)

56 2019-12-04 108.68 108.67 108.43 108.48 108.55 104.80 -0.184 0.221 108.8936 -0.38 -0.62 -0.568

57 2019-12-05 108.84 108.93 108.78 108.89 108.86 104.78 0.046 0.138 108.8948 0.00 0.41 0.378

58 2019-12-06 108.73 108.78 108.66 108.67 108.78 104.94 -0.055 0.110 108.8972 -0.21 -0.22 -0.202

59 2019-12-09 108.64 108.66 108.55 108.57 108.58 104.98 -0.064 0.101 108.9216 -0.32 -0.10 -0.092

60 2019-12-10 108.59 108.66 108.57 108.63 108.64 104.75 0.037 0.083 108.9152 -0.26 0.06 0.055

61 2019-12-11 108.78 108.86 108.67 108.73 108.74 104.82 -0.046 0.175 108.9052 -0.16 0.10 0.092

62 2019-12-12 108.56 108.65 108.46 108.65 108.58 103.63 0.083 0.175 108.8928 -0.22 -0.08 -0.074

63 2019-12-13 109.40 109.66 108.84 109.63 109.50 103.59 0.210 0.753 108.9064 0.66 0.98 0.902

64 2019-12-16 109.39 109.44 109.30 109.41 109.39 103.35 0.018 0.128 108.9244 0.45 -0.22 -0.201

65 2019-12-17 109.58 109.62 109.49 109.60 109.54 103.47 0.018 0.119 108.9388 0.61 0.19 0.174

66 2019-12-18 109.53 109.57 109.42 109.44 109.44 103.47 -0.082 0.137 108.9536 0.45 -0.16 -0.146

67 2019-12-19 109.55 109.72 109.55 109.58 109.58 103.62 0.027 0.155 108.9868 0.54 0.14 0.128

68 2019-12-20 109.39 109.40 109.26 109.37 109.39 103.61 -0.018 0.128 109.0192 0.32 -0.21 -0.192

69 2019-12-23 109.50 109.54 109.37 109.40 109.42 103.69 -0.091 0.155 109.0384 0.33 0.03 0.027

70 2019-12-24 109.40 109.45 109.37 109.40 109.40 NA 0.000 0.073 109.0676 0.30 0.00 0.000[1] "NIKKEI"

Date Open High Low Close CloseToOpen HighToLow MA25 DeviationRate Close:Diff(lag=1) Close:Ratio(lag=1)

56 2019-12-04 23186.74 23203.77 23044.78 23135.23 -0.222 0.690 23255.06 -0.52 -244.58 -1.046

57 2019-12-05 23292.70 23363.44 23259.82 23300.09 0.032 0.445 23273.34 0.11 164.86 0.713

58 2019-12-06 23347.67 23412.48 23338.40 23354.40 0.029 0.317 23290.43 0.27 54.31 0.233

59 2019-12-09 23544.31 23544.31 23360.01 23430.70 -0.483 0.789 23313.63 0.50 76.30 0.327

60 2019-12-10 23372.39 23449.47 23336.93 23410.19 0.162 0.482 23319.96 0.39 -20.51 -0.088

61 2019-12-11 23421.14 23438.43 23333.63 23391.86 -0.125 0.449 23323.48 0.29 -18.33 -0.078

62 2019-12-12 23449.28 23468.15 23360.43 23424.81 -0.104 0.461 23327.26 0.42 32.95 0.141

63 2019-12-13 23810.56 24050.04 23775.73 24023.10 0.893 1.154 23352.51 2.87 598.29 2.554

64 2019-12-16 23955.20 24036.30 23950.05 23952.35 -0.012 0.360 23377.33 2.46 -70.75 -0.295

65 2019-12-17 24091.12 24091.12 23996.51 24066.12 -0.104 0.394 23399.17 2.85 113.77 0.475

66 2019-12-18 24023.27 24046.09 23919.36 23934.43 -0.370 0.530 23423.75 2.18 -131.69 -0.547

67 2019-12-19 23911.46 23945.53 23835.29 23864.85 -0.195 0.463 23452.69 1.76 -69.58 -0.291

68 2019-12-20 23893.45 23908.77 23746.63 23816.63 -0.322 0.683 23473.22 1.46 -48.22 -0.202

69 2019-12-23 23921.29 23923.09 23810.82 23821.11 -0.419 0.472 23489.39 1.41 4.48 0.019

70 2019-12-24 23839.18 23853.56 23796.35 23830.58 -0.036 0.240 23510.91 1.36 9.47 0.040単位根検定・共和分検定

- CADFtest {CADFtest}

- ca.po {urca}

$USDJPY_CloseToOpen

ADF test

data: x

ADF(0) = -8.9544, p-value = 0.00000000251

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-1.144612

$NIKKEI_CloseToOpen

ADF test

data: x

ADF(1) = -7.2235, p-value = 0.0000004772

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-1.386642

########################################

# Phillips and Ouliaris Unit Root Test #

########################################

Test of type Pu

detrending of series none

Call:

lm(formula = z[, 1] ~ z[, -1] - 1)

Residuals:

Min 1Q Median 3Q Max

-0.18271 -0.04444 0.01570 0.08951 0.24238

Coefficients:

Estimate Std. Error t value Pr(>|t|)

z[, -1] 0.10416 0.03209 3.246 0.00193 **

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.09605 on 59 degrees of freedom

Multiple R-squared: 0.1515, Adjusted R-squared: 0.1372

F-statistic: 10.54 on 1 and 59 DF, p-value: 0.00193

Value of test-statistic is: 68.6696

Critical values of Pu are:

10pct 5pct 1pct

critical values 20.3933 25.9711 38.3413最小二乗法

- lm {stats}

- dwtest {lmtest}

- ks.test {stats}

- confint {stats}

- Box.test {stats}

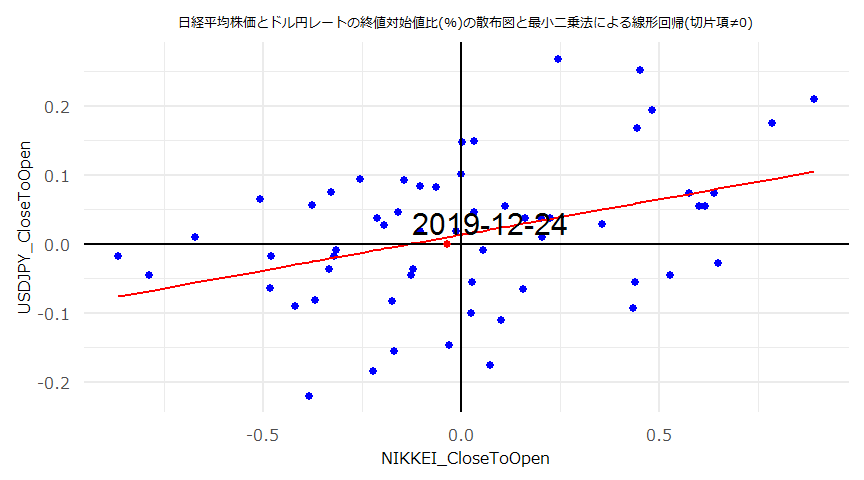

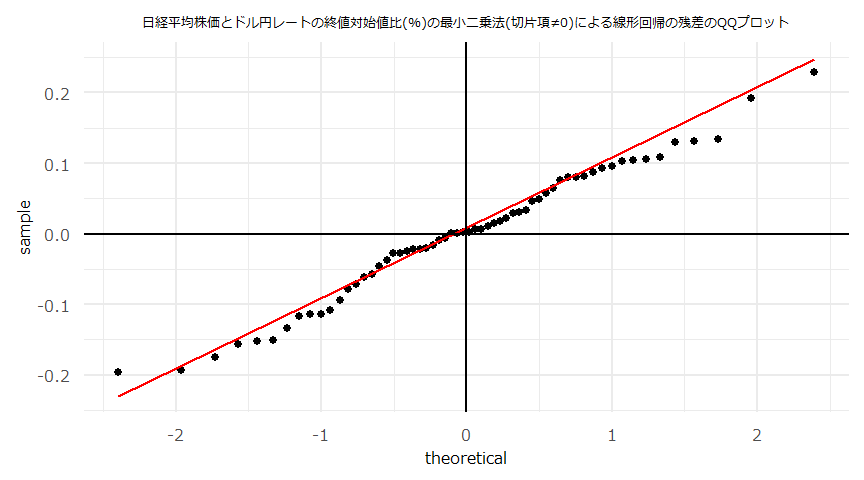

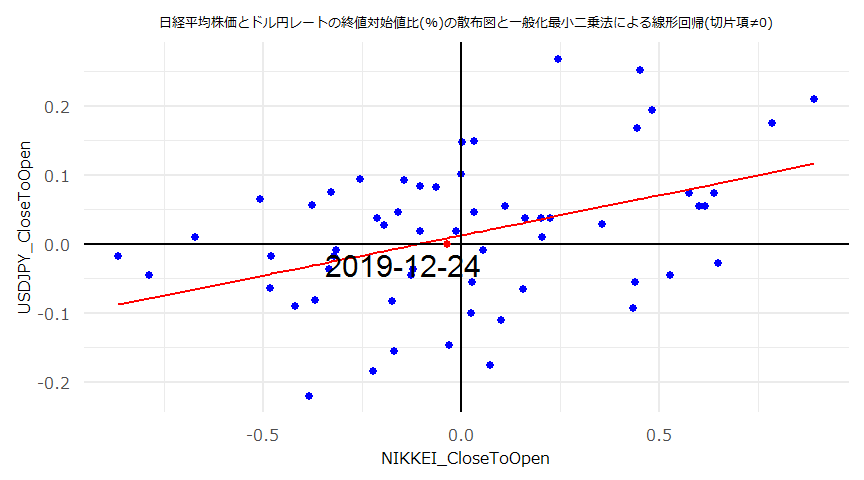

- 切片項\(\neq0\)

MODEL INFO:

Observations: 60

Dependent Variable: USDJPY_CloseToOpen

Type: OLS linear regression

MODEL FIT:

F(1,58) = 10.31, p = 0.00

R2 = 0.15

Adj. R2 = 0.14

Standard errors: OLS

---------------------------------------------------------------

Est. 2.5% 97.5% t val. p

------------------------ ------ ------- ------- -------- ------

(Intercept) 0.01 -0.01 0.04 1.06 0.29

NIKKEI_CloseToOpen 0.10 0.04 0.17 3.21 0.00

---------------------------------------------------------------

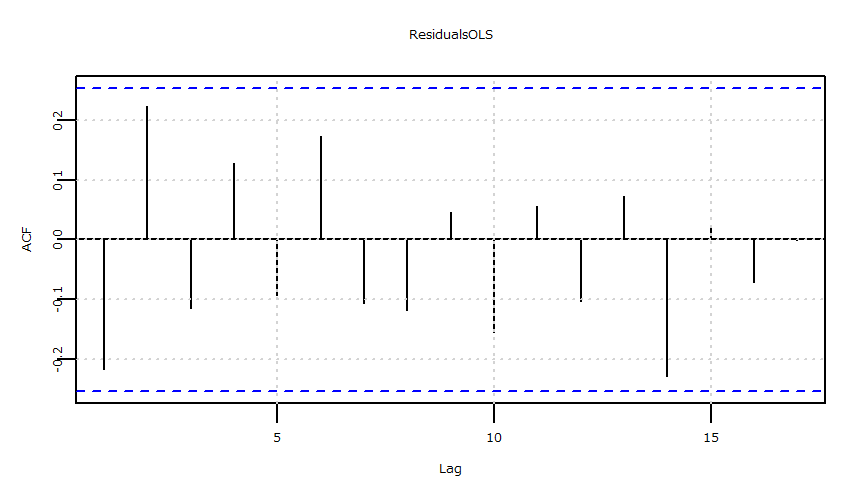

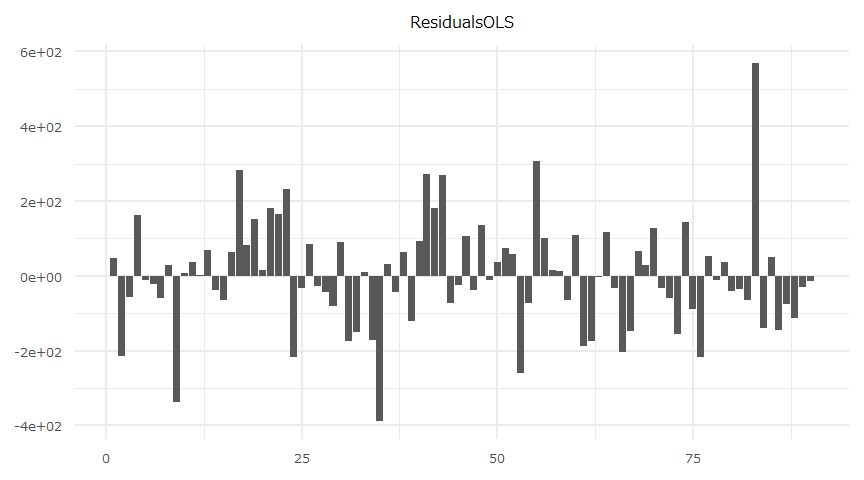

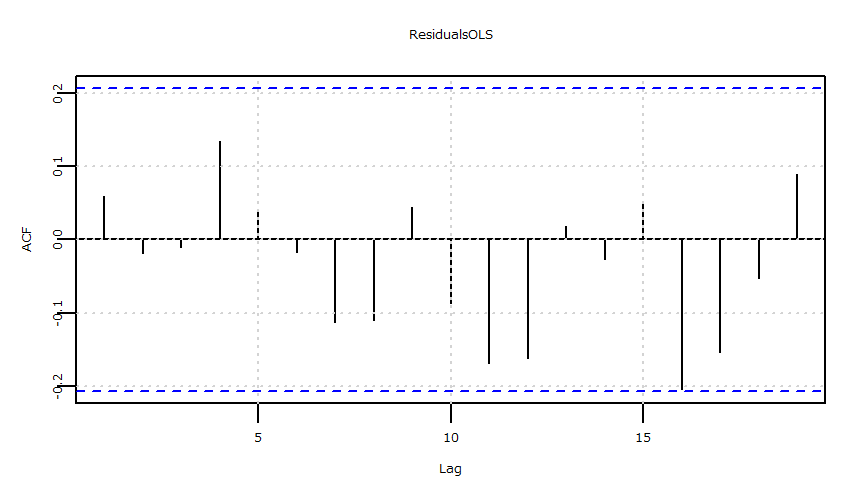

Durbin-Watson test

data: OLS_Model

DW = 2.4114, p-value = 0.9467

alternative hypothesis: true autocorrelation is greater than 0

One-sample Kolmogorov-Smirnov test

data: ResidualsOLS

D = 0.084468, p-value = 0.7534

alternative hypothesis: two-sided 2.5 % 97.5 %

(Intercept) -0.01163023 0.03798747

NIKKEI_CloseToOpen 0.03878814 0.16717655

Box-Ljung test

data: ResidualsOLS

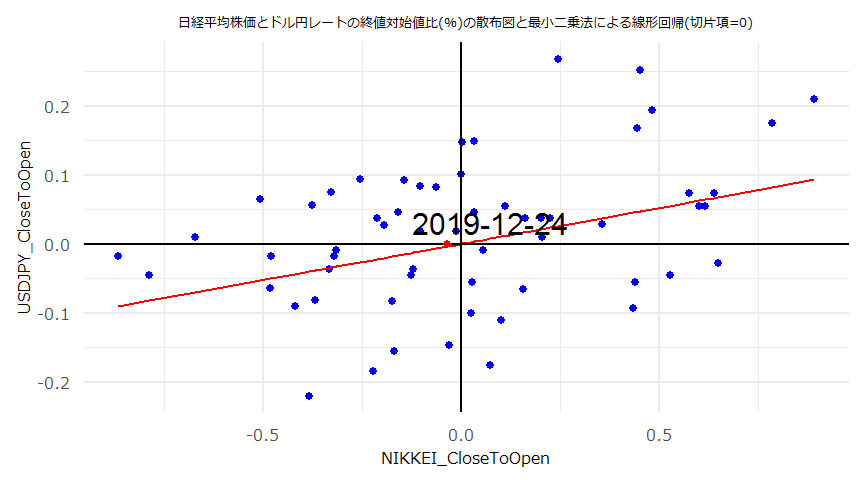

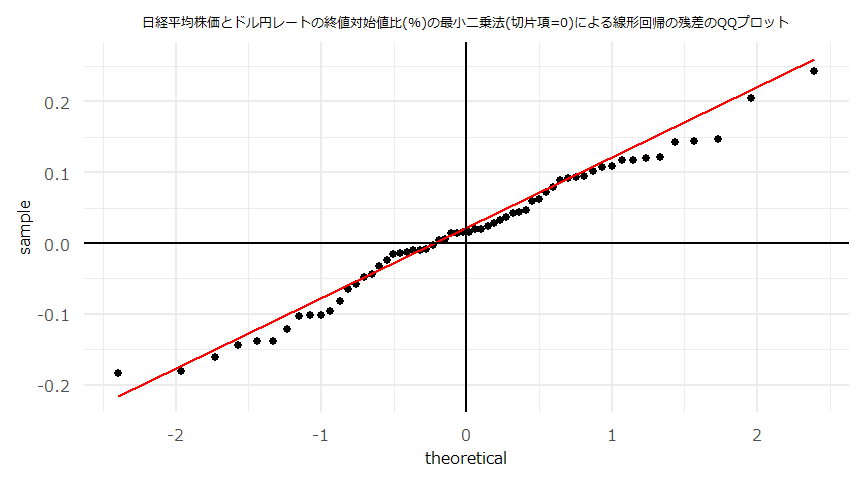

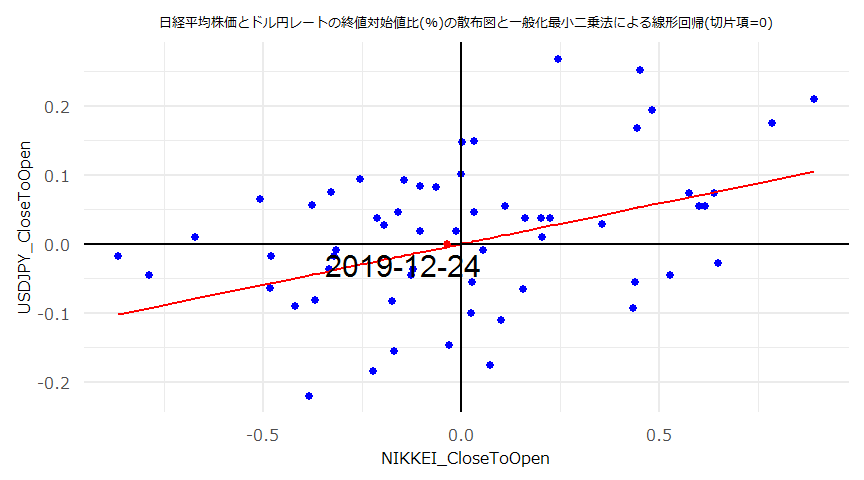

X-squared = 14.481, df = 10, p-value = 0.1522- 切片項\(=0\)

MODEL INFO:

Observations: 60

Dependent Variable: USDJPY_CloseToOpen

Type: OLS linear regression

MODEL FIT:

F(1,59) = 10.54, p = 0.00

R2 = 0.15

Adj. R2 = 0.14

Standard errors: OLS

--------------------------------------------------------------

Est. 2.5% 97.5% t val. p

------------------------ ------ ------ ------- -------- ------

NIKKEI_CloseToOpen 0.10 0.04 0.17 3.25 0.00

--------------------------------------------------------------

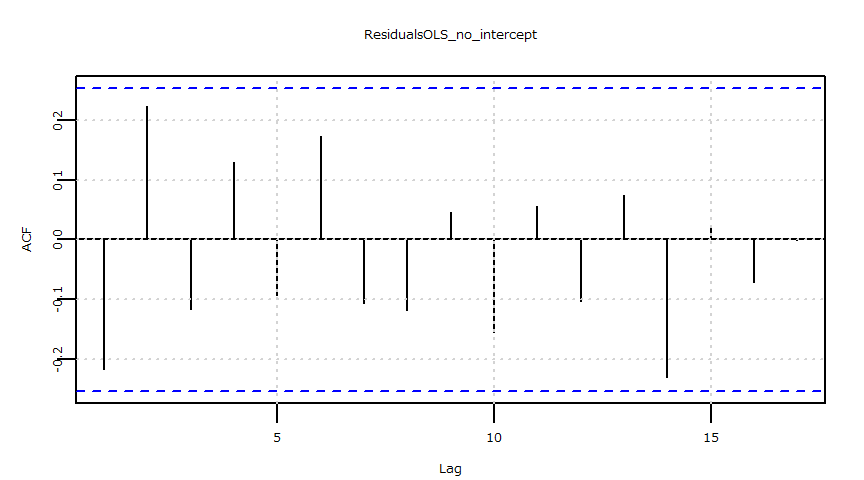

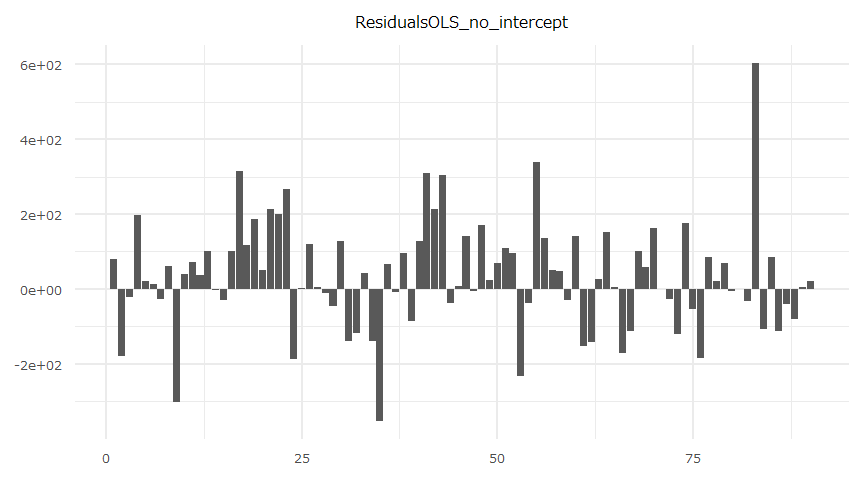

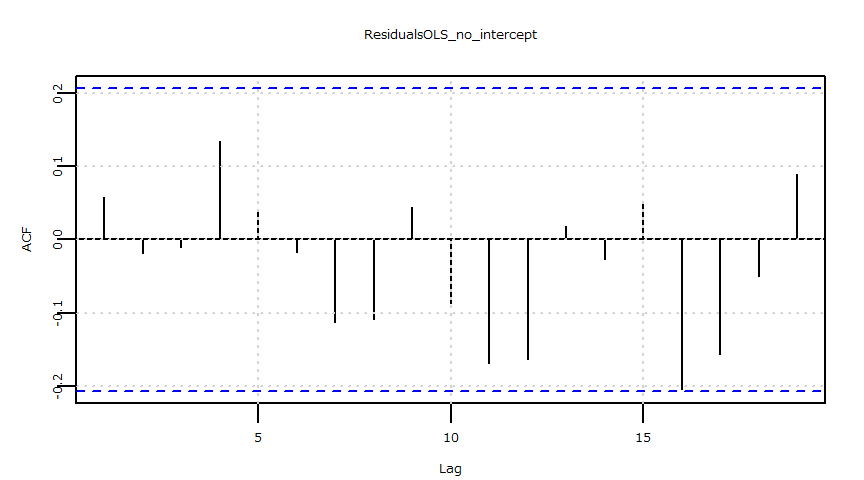

Durbin-Watson test

data: OLS_Model_no_intercept

DW = 2.3652, p-value = 0.9408

alternative hypothesis: true autocorrelation is greater than 0

One-sample Kolmogorov-Smirnov test

data: ResidualsOLS_no_intercept

D = 0.13805, p-value = 0.1849

alternative hypothesis: two-sided 2.5 % 97.5 %

NIKKEI_CloseToOpen 0.03995344 0.1683613

Box-Ljung test

data: ResidualsOLS_no_intercept

X-squared = 14.587, df = 10, p-value = 0.1479一般化最小二乗法

- gls {nlme}

- corARMA {nlme}

- ks.test {stats}

- confint {stats}

- Box.test {stats}

- 残差の系列相関の有無に拘わらず一般化最小二乗法による回帰係数を求めています。

- 最小二乗法の残差に系列相関が見られない場合、ここではAR(\(p=0,q=0\))の結果(AIC最小)が表示されます。

- http://user.keio.ac.jp/~nagakura/zemi/GLS.pdf

- http://tokyox.matrix.jp/wiki/index.php?%E4%B8%80%E8%88%AC%E5%8C%96%E6%9C%80%E5%B0%8F%E4%BA%8C%E4%B9%97%E6%B3%95

- 切片項\(\neq0\)

Generalized least squares fit by REML

Model: USDJPY_CloseToOpen ~ NIKKEI_CloseToOpen

Data: USDJPY_NIKKEI

AIC BIC logLik

-96.3286 -86.02638 53.1643

Correlation Structure: ARMA(1,1)

Formula: ~1

Parameter estimate(s):

Phi1 Theta1

-0.8426918 0.6615541

Coefficients:

Value Std.Error t-value p-value

(Intercept) 0.01243702 0.01064200 1.168674 0.2473

NIKKEI_CloseToOpen 0.11609381 0.02898921 4.004726 0.0002

Correlation:

(Intr)

NIKKEI_CloseToOpen -0.037

Standardized residuals:

Min Q1 Med Q3 Max

-2.03575806 -0.54324309 0.03505838 0.78076549 2.35744431

Residual standard error: 0.09629237

Degrees of freedom: 60 total; 58 residual

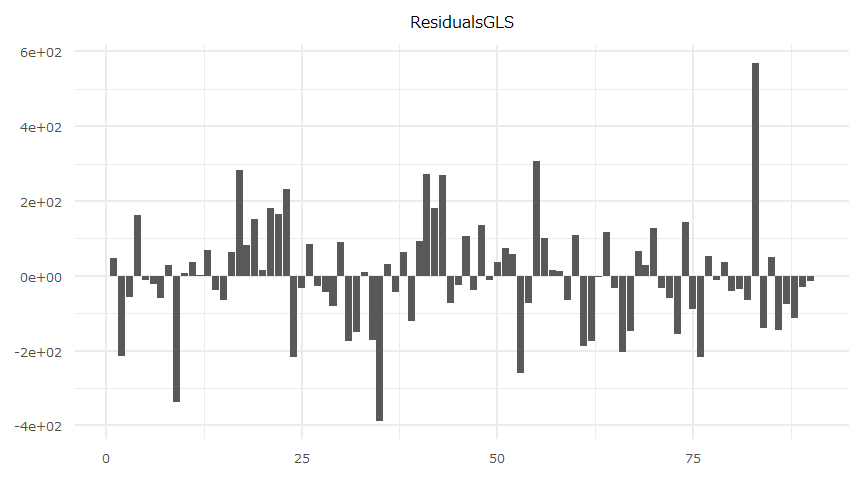

One-sample Kolmogorov-Smirnov test

data: ResidualsGLS

D = 0.080139, p-value = 0.8063

alternative hypothesis: two-sided 2.5 % 97.5 %

(Intercept) -0.008420907 0.03329496

NIKKEI_CloseToOpen 0.059276016 0.17291161

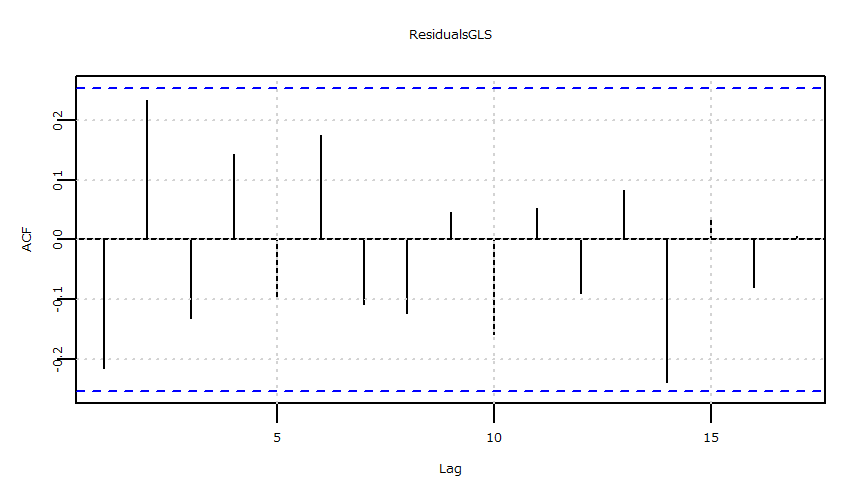

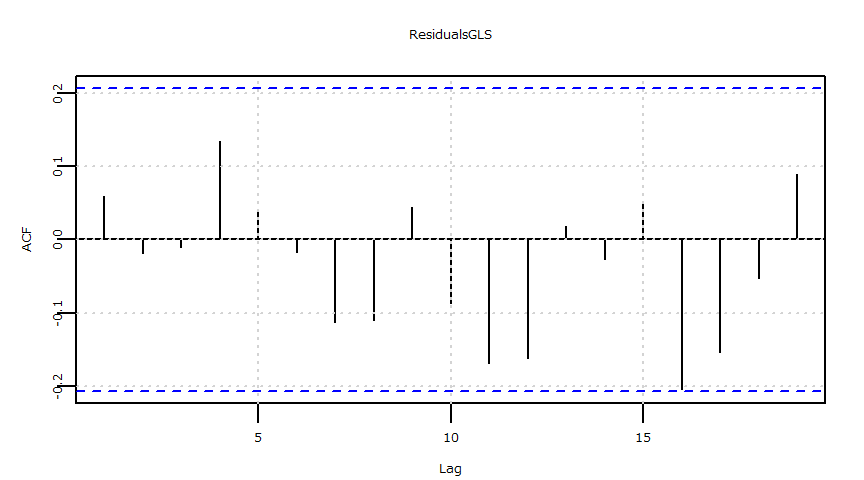

Box-Ljung test

data: ResidualsGLS

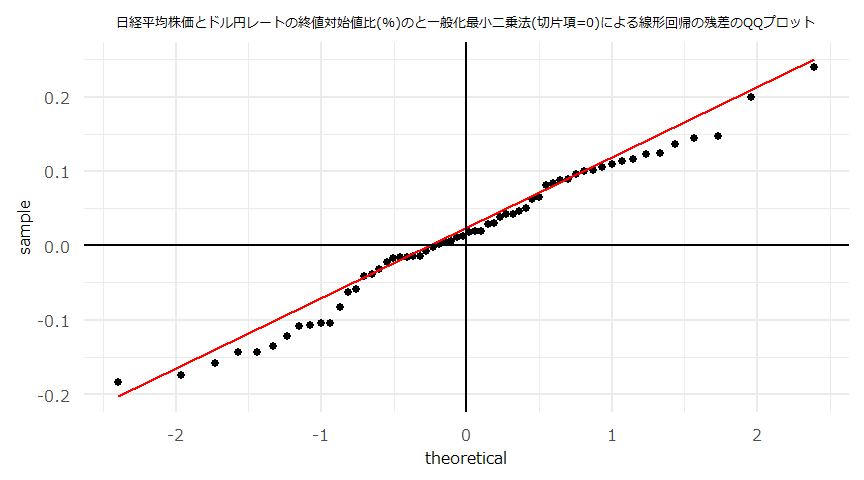

X-squared = 15.627, df = 10, p-value = 0.1108- 切片項\(=0\)

Generalized least squares fit by REML

Model: USDJPY_CloseToOpen ~ NIKKEI_CloseToOpen - 1

Data: USDJPY_NIKKEI

AIC BIC logLik

-104.2126 -95.90245 56.1063

Correlation Structure: ARMA(1,1)

Formula: ~1

Parameter estimate(s):

Phi1 Theta1

-0.8464688 0.6655166

Coefficients:

Value Std.Error t-value p-value

NIKKEI_CloseToOpen 0.1174511 0.0290519 4.042804 0.0002

Standardized residuals:

Min Q1 Med Q3 Max

-1.8998827 -0.4070335 0.1609874 0.9135233 2.4730353

Residual standard error: 0.09668565

Degrees of freedom: 60 total; 59 residual

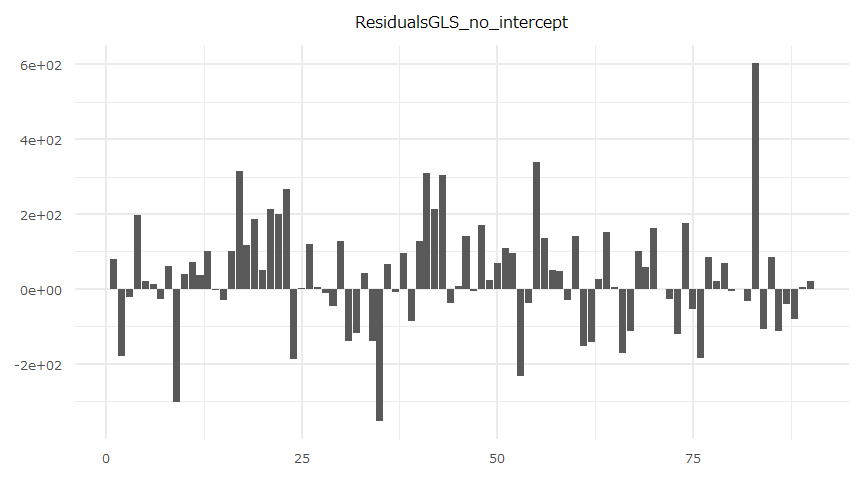

One-sample Kolmogorov-Smirnov test

data: ResidualsGLS_no_intercept

D = 0.12728, p-value = 0.2624

alternative hypothesis: two-sided 2.5 % 97.5 %

NIKKEI_CloseToOpen 0.06051046 0.1743918

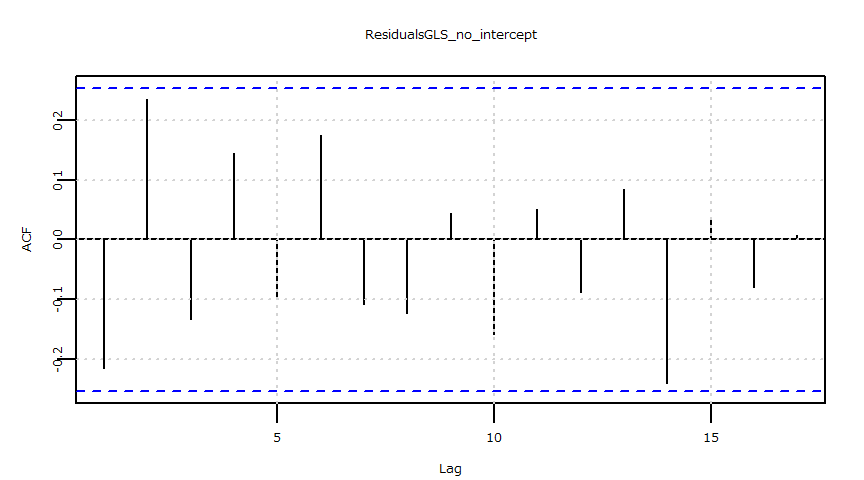

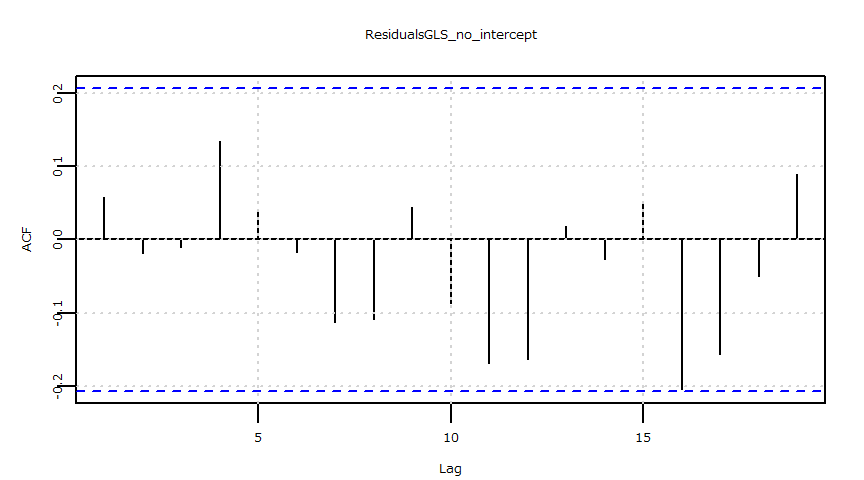

Box-Ljung test

data: ResidualsGLS_no_intercept

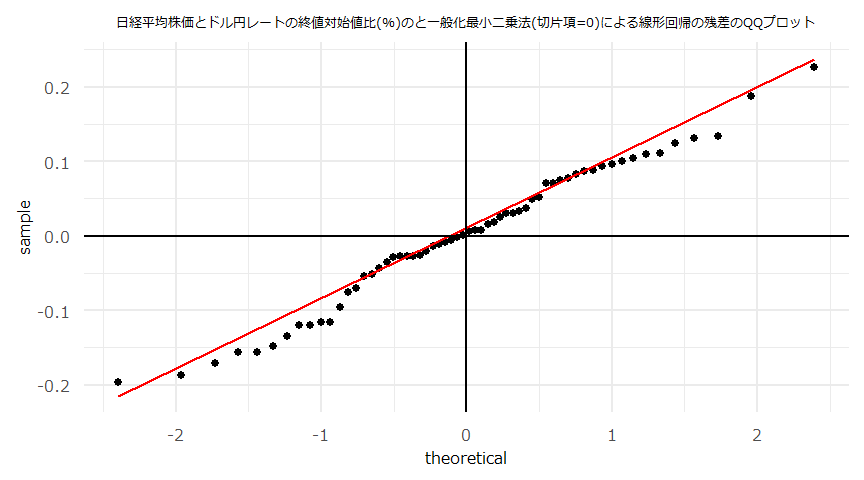

X-squared = 15.739, df = 10, p-value = 0.1073散布図・QQプロット・残差の時系列推移

- (注意)線形回帰の傾き(\(a\))、切片(\(b\))それぞれの検定統計量、p値に関わらず\(y=ax+b\)とした回帰直線やその残差を散布図、QQプロット等にプロットしています。

- 散布図とQQプロット

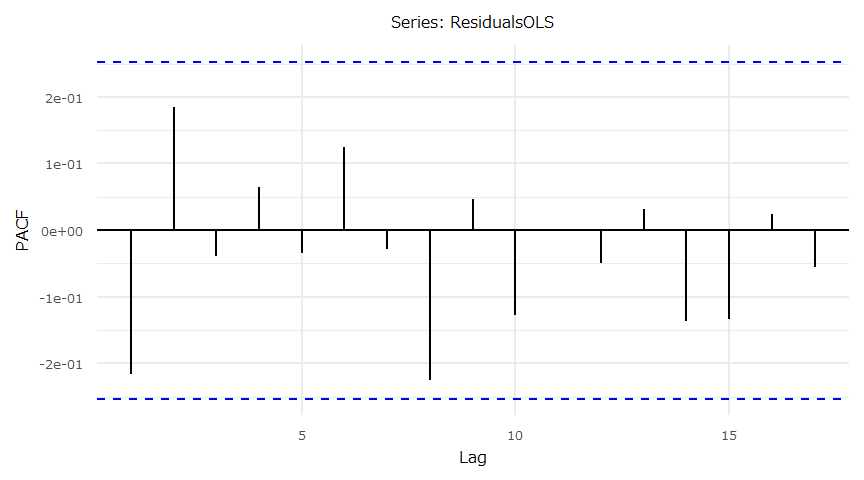

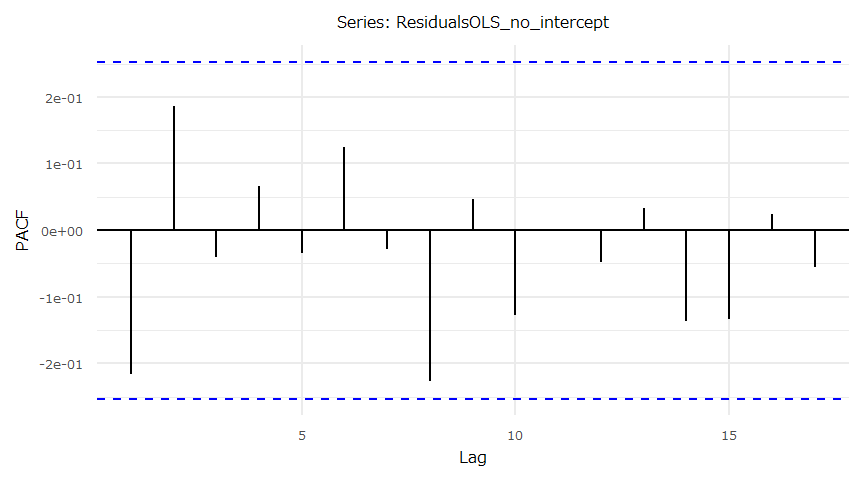

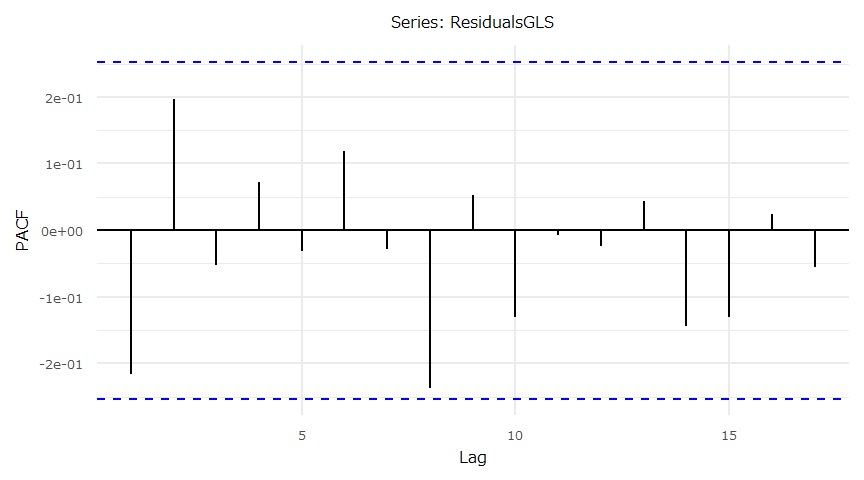

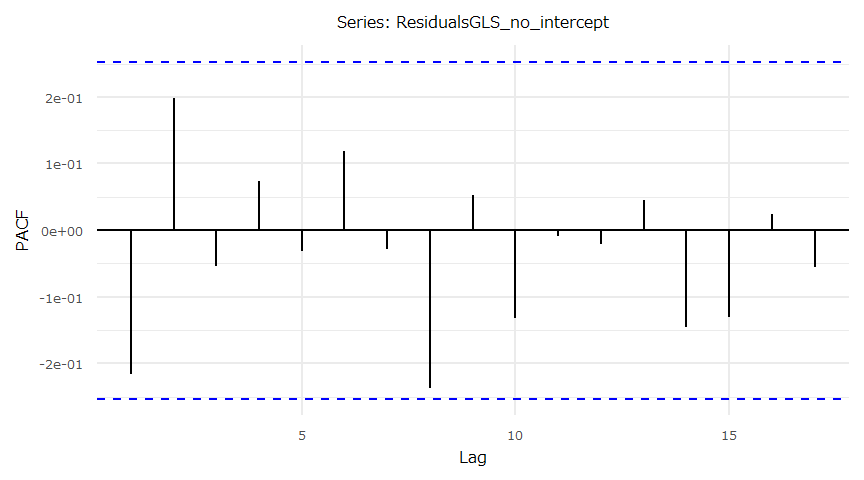

- 残差の自己相関(ACF)

- 残差の自己相関(PACF)

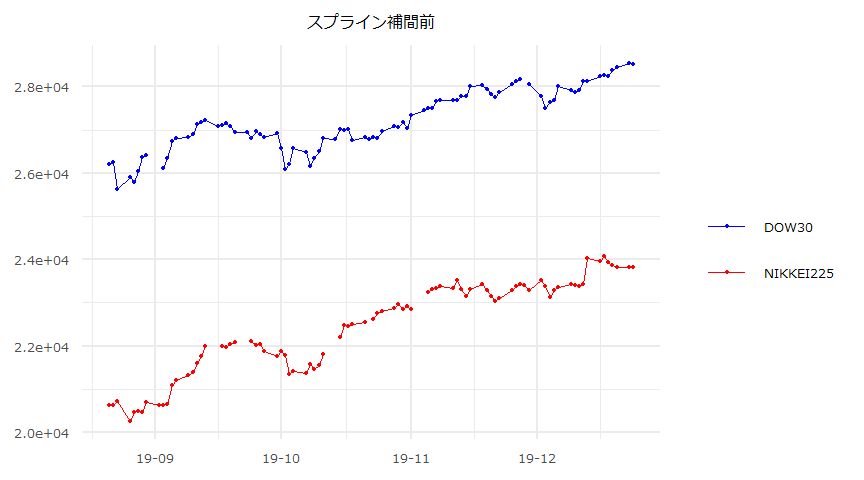

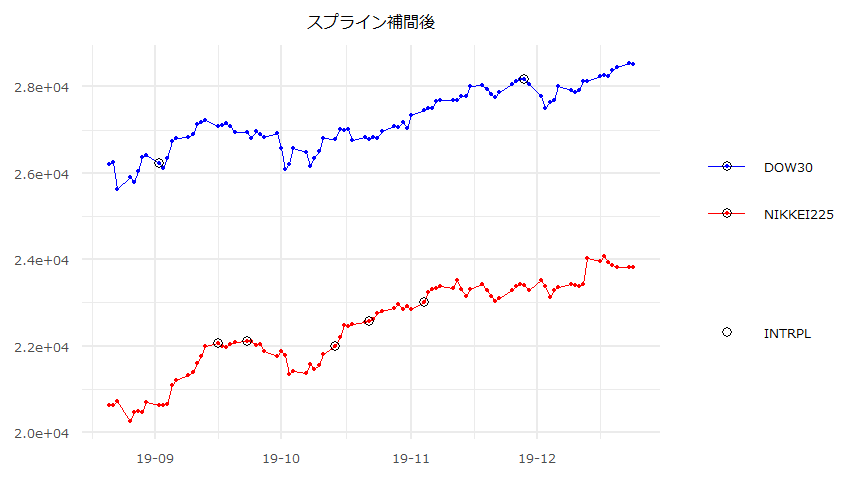

ダウ平均株価と日経平均株価(Source:Yahoo Finance,FRED,日本経済新聞社)

時系列チャート

- Source:

- (注意) 欠損値(休場日)は原系列にスプライン補間を掛けた上で前日比を算出している。

- 対象期間:2019-08-21~2019-12-24

- サンプルサイズ:n=90

単位根検定・共和分検定

- CADFtest {CADFtest}

- ca.po {urca}

単位根検定

$DOW30

ADF test

data: x

ADF(0) = -2.591, p-value = 0.2855

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-0.1330281

$NIKKEI225

ADF test

data: x

ADF(0) = -2.0945, p-value = 0.5413

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-0.1023453

$DOW30_Change

ADF test

data: x

ADF(2) = -7.2466, p-value = 0.00000009042

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-1.282188

$NIKKEI225_Change

ADF test

data: x

ADF(0) = -9.1982, p-value = 0.00000000005683

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-1.003339 共和分検定

[1] "DOW30 × NIKKEI225"

########################################

# Phillips and Ouliaris Unit Root Test #

########################################

Test of type Pu

detrending of series none

Call:

lm(formula = z[, 1] ~ z[, -1] - 1)

Residuals:

Min 1Q Median 3Q Max

-967.2 -484.4 -195.3 445.3 1575.1

Coefficients:

Estimate Std. Error t value Pr(>|t|)

z[, -1] 1.211440 0.003134 386.5 <0.0000000000000002 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 667.9 on 89 degrees of freedom

Multiple R-squared: 0.9994, Adjusted R-squared: 0.9994

F-statistic: 1.494e+05 on 1 and 89 DF, p-value: < 0.00000000000000022

Value of test-statistic is: 3.9619

Critical values of Pu are:

10pct 5pct 1pct

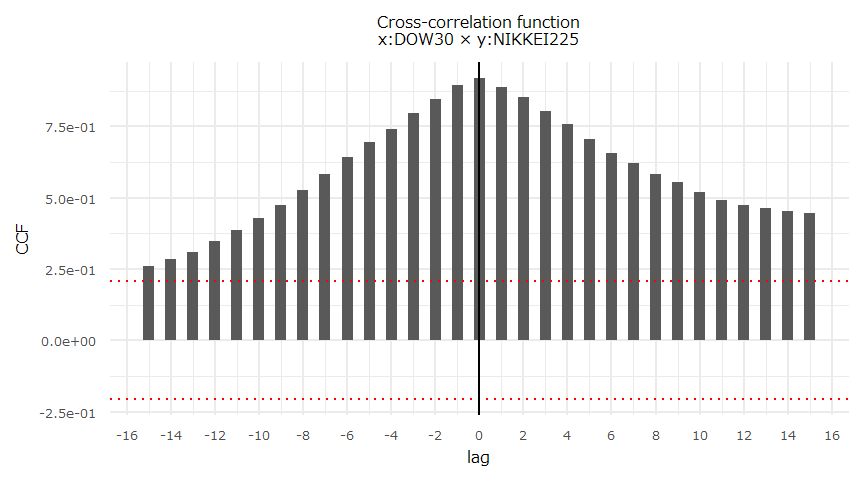

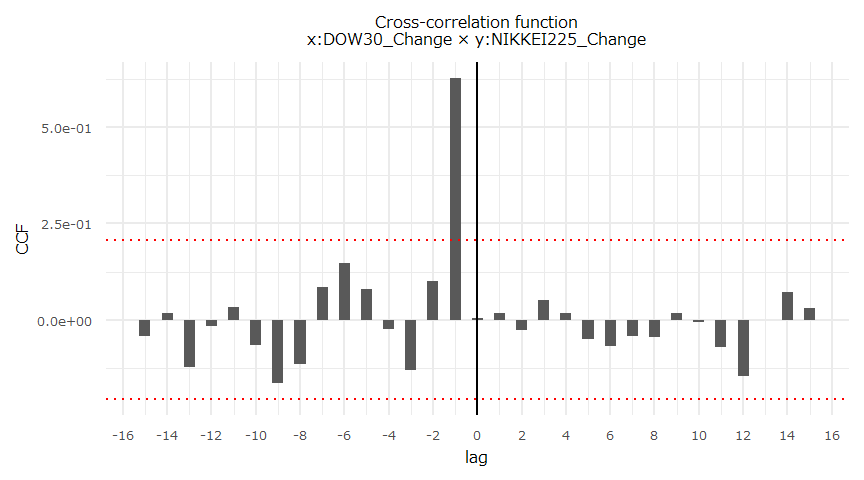

critical values 20.3933 25.9711 38.3413相互相関関数

- ggCcf {forecast}

ベクトル自己回帰モデル

- VARselect {vars}

- VAR {vars}

VAR Estimation Results:

=========================

Endogenous variables: DOW30, NIKKEI225

Deterministic variables: const

Sample size: 89

Log Likelihood: -1151.782

Roots of the characteristic polynomial:

0.9886 0.7546

Call:

VAR(y = obj, p = selected_lag, type = "const")

Estimation results for equation DOW30:

======================================

DOW30 = DOW30.l1 + NIKKEI225.l1 + const

Estimate Std. Error t value Pr(>|t|)

DOW30.l1 0.88230 0.06605 13.358 <0.0000000000000002 ***

NIKKEI225.l1 0.07046 0.04500 1.566 0.121

const 1647.32153 957.73430 1.720 0.089 .

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 173.7 on 86 degrees of freedom

Multiple R-Squared: 0.942, Adjusted R-squared: 0.9406

F-statistic: 698 on 2 and 86 DF, p-value: < 0.00000000000000022

Estimation results for equation NIKKEI225:

==========================================

NIKKEI225 = DOW30.l1 + NIKKEI225.l1 + const

Estimate Std. Error t value Pr(>|t|)

DOW30.l1 0.19275 0.05558 3.468 0.000821 ***

NIKKEI225.l1 0.86088 0.03786 22.737 < 0.0000000000000002 ***

const -2086.44362 805.89249 -2.589 0.011302 *

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 146.1 on 86 degrees of freedom

Multiple R-Squared: 0.9803, Adjusted R-squared: 0.9799

F-statistic: 2145 on 2 and 86 DF, p-value: < 0.00000000000000022

Covariance matrix of residuals:

DOW30 NIKKEI225

DOW30 30165 2271

NIKKEI225 2271 21358

Correlation matrix of residuals:

DOW30 NIKKEI225

DOW30 1.00000 0.08945

NIKKEI225 0.08945 1.00000

VAR Estimation Results:

=========================

Endogenous variables: DOW30_Change, NIKKEI225_Change

Deterministic variables: const

Sample size: 89

Log Likelihood: -159.944

Roots of the characteristic polynomial:

0.1094 0.09431

Call:

VAR(y = obj, p = selected_lag, type = "const")

Estimation results for equation DOW30_Change:

=============================================

DOW30_Change = DOW30_Change.l1 + NIKKEI225_Change.l1 + const

Estimate Std. Error t value Pr(>|t|)

DOW30_Change.l1 0.01659 0.10692 0.155 0.877

NIKKEI225_Change.l1 0.01535 0.10015 0.153 0.879

const 0.09291 0.07289 1.275 0.206

Residual standard error: 0.6615 on 86 degrees of freedom

Multiple R-Squared: 0.0005554, Adjusted R-squared: -0.02269

F-statistic: 0.0239 on 2 and 86 DF, p-value: 0.9764

Estimation results for equation NIKKEI225_Change:

=================================================

NIKKEI225_Change = DOW30_Change.l1 + NIKKEI225_Change.l1 + const

Estimate Std. Error t value Pr(>|t|)

DOW30_Change.l1 0.670169 0.089309 7.504 0.0000000000527 ***

NIKKEI225_Change.l1 -0.001546 0.083650 -0.018 0.985

const 0.092429 0.060883 1.518 0.133

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 0.5525 on 86 degrees of freedom

Multiple R-Squared: 0.3957, Adjusted R-squared: 0.3816

F-statistic: 28.15 on 2 and 86 DF, p-value: 0.000000000393

Covariance matrix of residuals:

DOW30_Change NIKKEI225_Change

DOW30_Change 0.437596 0.001839

NIKKEI225_Change 0.001839 0.305302

Correlation matrix of residuals:

DOW30_Change NIKKEI225_Change

DOW30_Change 1.00000 0.00503

NIKKEI225_Change 0.00503 1.00000グレンジャー因果

- causality {vars}

Dow → Nikkei

Granger causality H0: DOW30_Change do not Granger-cause NIKKEI225_Change

data: VAR object var_result

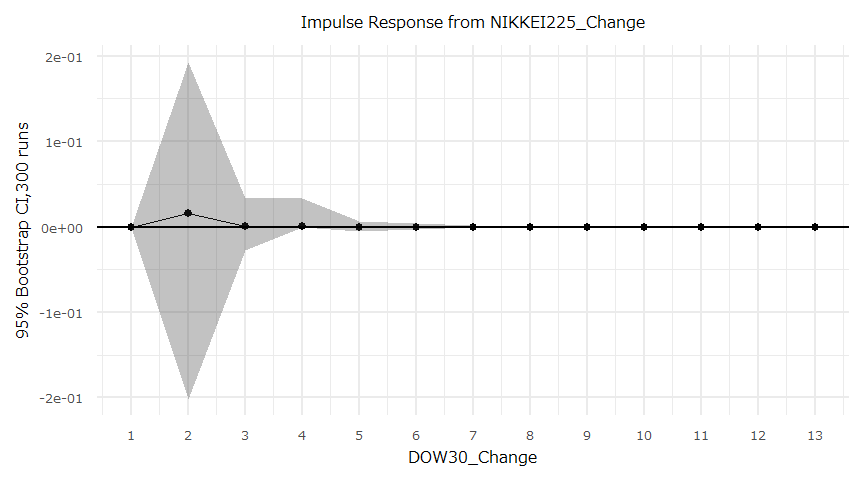

F-Test = 56.309, df1 = 1, df2 = 172, p-value = 0.000000000003182Nikkei → Dow

Granger causality H0: NIKKEI225_Change do not Granger-cause DOW30_Change

data: VAR object var_result

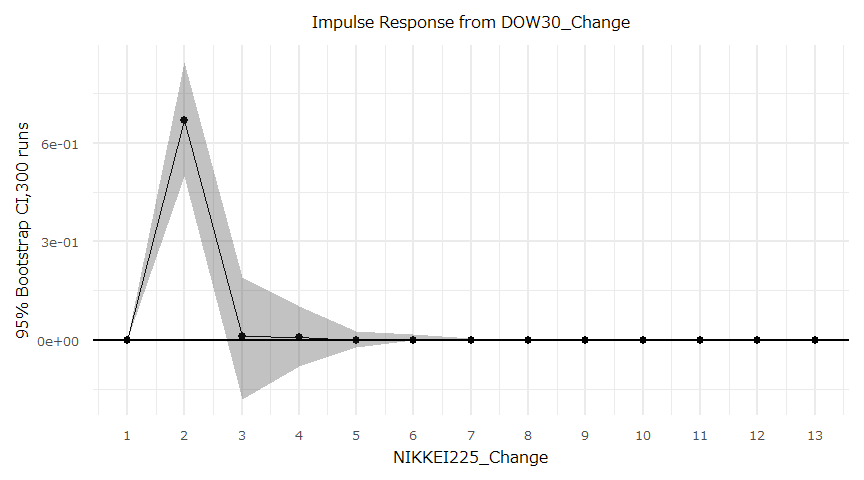

F-Test = 0.023496, df1 = 1, df2 = 172, p-value = 0.8784インパルス応答

- irf {vars}

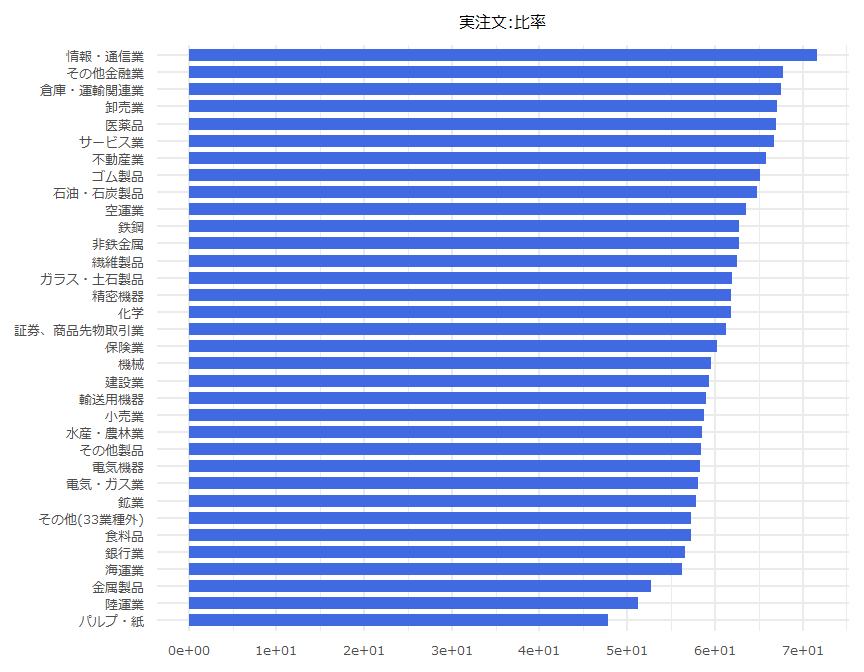

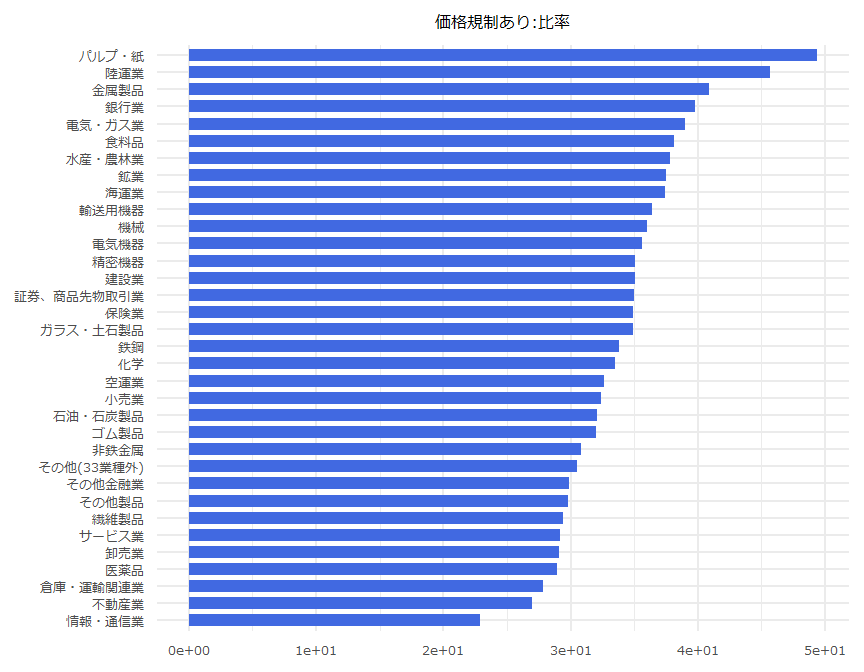

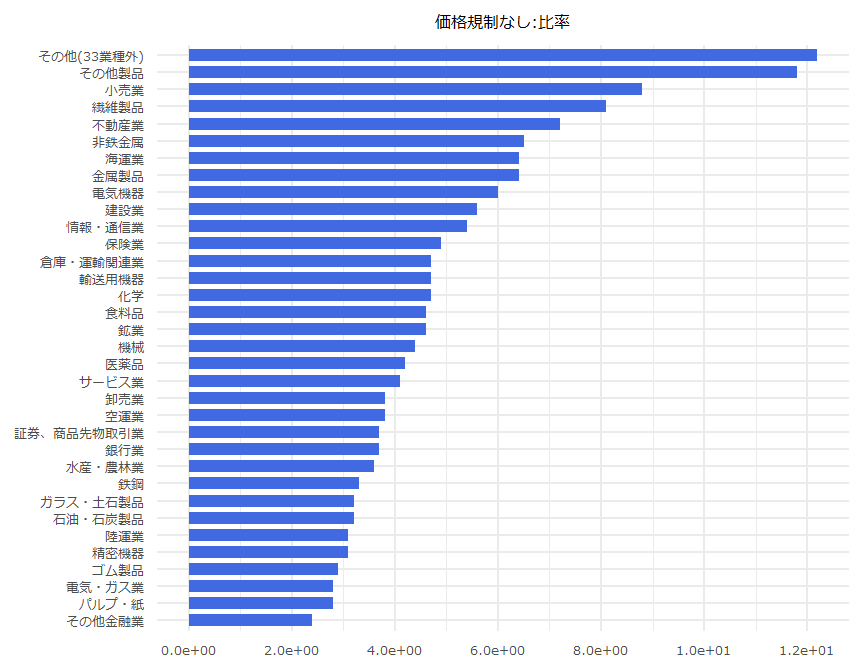

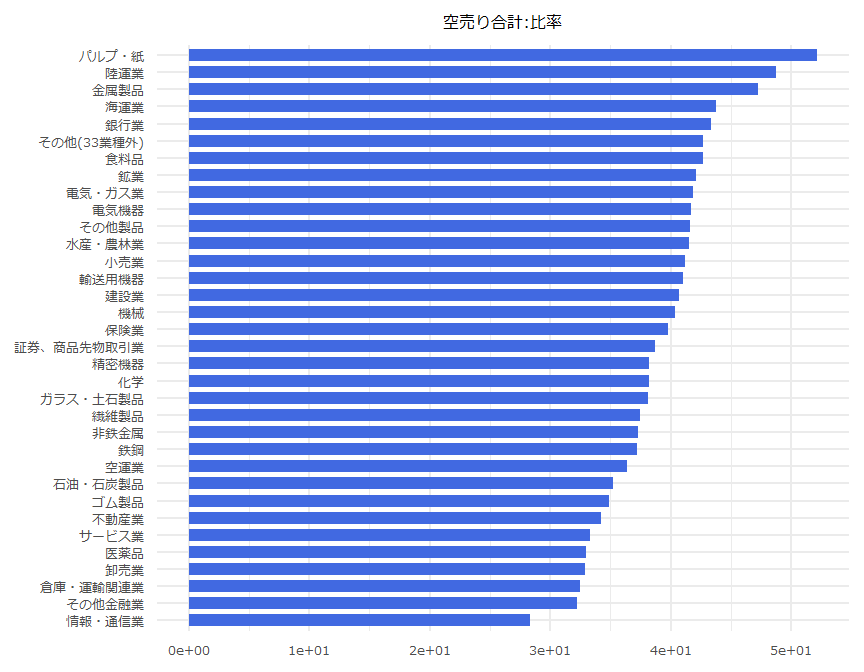

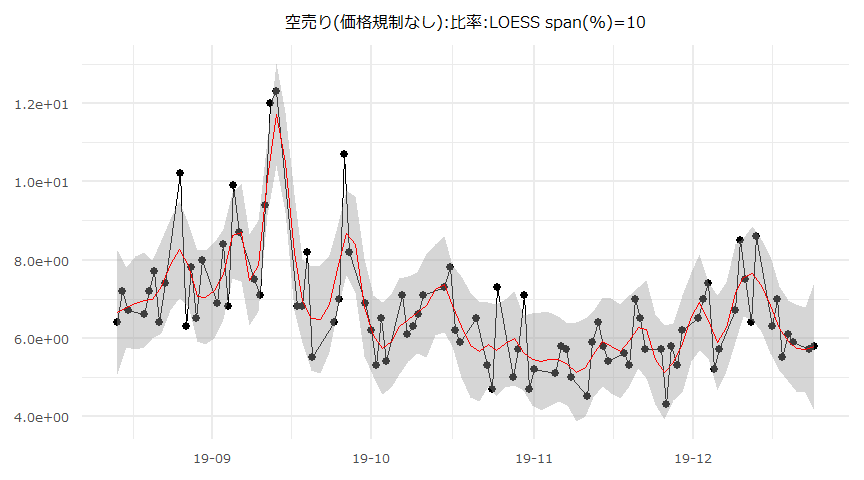

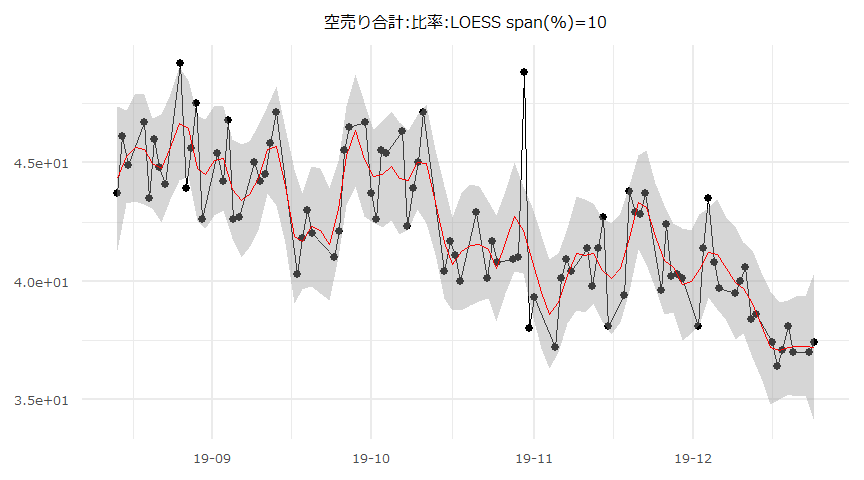

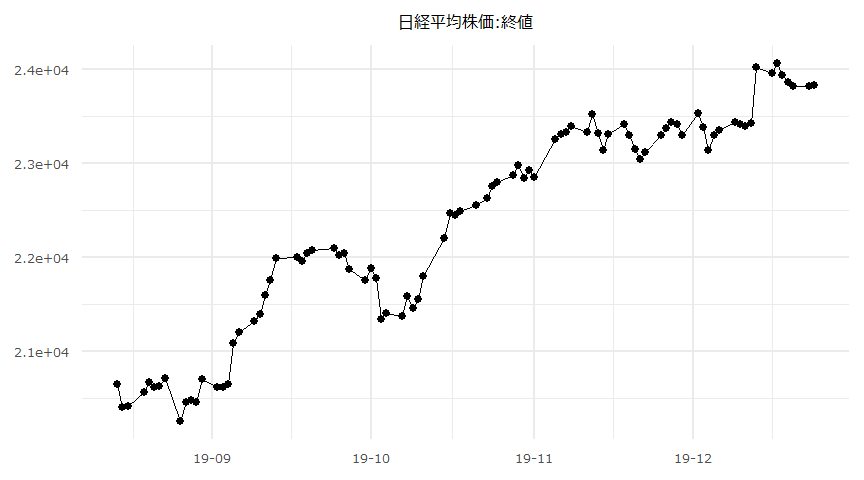

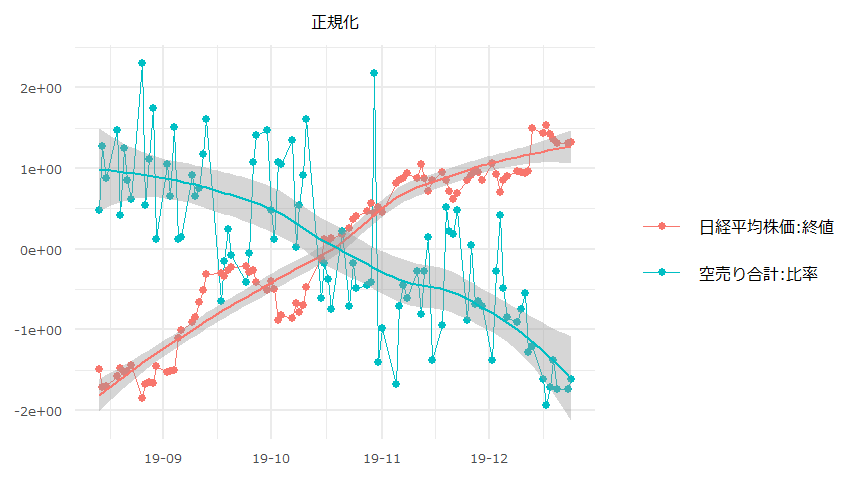

空売り比率と日経平均株価(Source:日本取引所グループ、日本経済新聞社)

業種別空売り集計

- 2019年12月24日

- 「空売り合計:比率」は100から「実注文:比率」を減じた数値としています。

| N | 業種名 | 空売り合計:比率 |

|---|---|---|

| 1 | 水産・農林業 | 41.5 |

| 2 | 鉱業 | 42.1 |

| 3 | 建設業 | 40.7 |

| 4 | 食料品 | 42.7 |

| 5 | 繊維製品 | 37.5 |

| 6 | パルプ・紙 | 52.2 |

| 7 | 化学 | 38.2 |

| 8 | 医薬品 | 33 |

| 9 | 石油・石炭製品 | 35.2 |

| 10 | ゴム製品 | 34.9 |

| 11 | ガラス・土石製品 | 38.1 |

| 12 | 鉄鋼 | 37.2 |

| 13 | 非鉄金属 | 37.3 |

| 14 | 金属製品 | 47.3 |

| 15 | 機械 | 40.4 |

| 16 | 電気機器 | 41.7 |

| 17 | 輸送用機器 | 41 |

| 18 | 精密機器 | 38.2 |

| 19 | その他製品 | 41.6 |

| 20 | 電気・ガス業 | 41.9 |

| 21 | 陸運業 | 48.8 |

| 22 | 海運業 | 43.8 |

| 23 | 空運業 | 36.4 |

| 24 | 倉庫・運輸関連業 | 32.5 |

| 25 | 情報・通信業 | 28.3 |

| 26 | 卸売業 | 32.9 |

| 27 | 小売業 | 41.2 |

| 28 | 銀行業 | 43.4 |

| 29 | 証券、商品先物取引業 | 38.7 |

| 30 | 保険業 | 39.8 |

| 31 | その他金融業 | 32.2 |

| 32 | 不動産業 | 34.2 |

| 33 | サービス業 | 33.3 |

| 34 | その他(33業種外) | 42.7 |

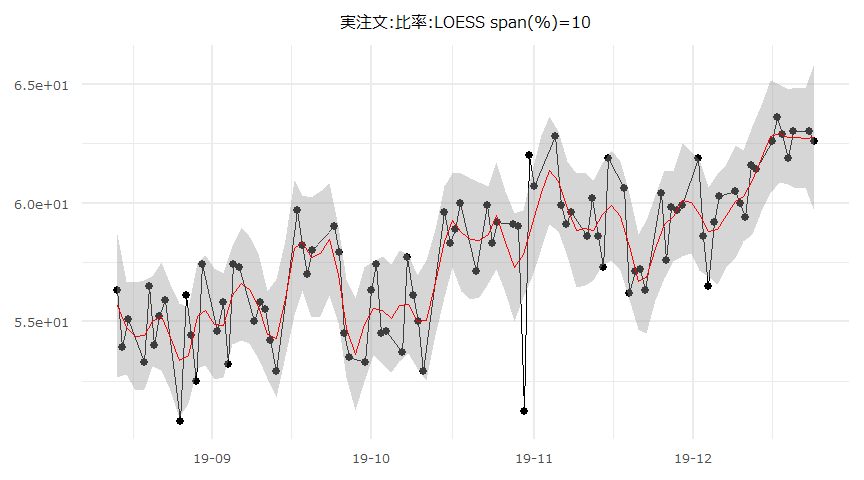

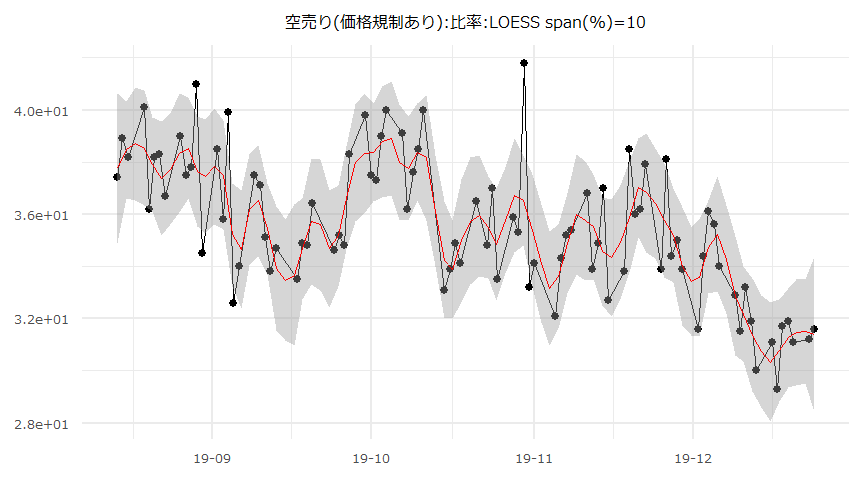

空売り比率の時系列推移

- 2019-08-14 ~ 2019-12-24

| Date | 12-24 | 12-23 | 12-20 | 12-19 | 12-18 | 12-17 | 12-16 | 12-13 |

|---|---|---|---|---|---|---|---|---|

| 実注文:比率 | 62.6 | 63 | 63 | 61.9 | 62.9 | 63.6 | 62.6 | 61.4 |

| 空売り(価格規制あり):比率 | 31.6 | 31.2 | 31.1 | 31.9 | 31.7 | 29.3 | 31.1 | 30 |

| 空売り(価格規制なし):比率 | 5.8 | 5.7 | 5.9 | 6.1 | 5.5 | 7 | 6.3 | 8.6 |

| 空売り合計:比率 | 37.4 | 37 | 37 | 38.1 | 37.1 | 36.4 | 37.4 | 38.6 |

日経平均株価と空売り比率

時系列推移

- 対象期間:2019-08-14 ~ 2019-12-24

単位根検定/共和分検定

- CADFtest {CADFtest}

- ca.po {urca}

- 各系列の“_change“は前営業日との差。

- 対象期間: 2019-08-14 ~ 2019-12-24,90days

### 単位根検定 ###

$NIKKEI225.close

ADF test

data: x

ADF(0) = -2.1666, p-value = 0.5017

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-0.1102726

$ShortSalerRatio

ADF test

data: x

ADF(0) = -7.9666, p-value = 0.000000005333

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-0.8607999

$NIKKEI225.close_change

ADF test

data: x

ADF(0) = -9.1907, p-value = 0.00000000005833

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-1.002416

$ShortSalerRatio_change

ADF test

data: x

ADF(2) = -8.8201, p-value = 0.0000000002165

alternative hypothesis: true delta is less than 0

sample estimates:

delta

-2.348904 ### 共和分検定 ###

########################################

# Phillips and Ouliaris Unit Root Test #

########################################

Test of type Pu

detrending of series none

Call:

lm(formula = z[, 1] ~ z[, -1] - 1)

Residuals:

Min 1Q Median 3Q Max

-5551.2 -2270.9 586.3 2250.0 4969.2

Coefficients:

Estimate Std. Error t value Pr(>|t|)

z[, -1] 524.640 6.377 82.28 <0.0000000000000002 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 2562 on 89 degrees of freedom

Multiple R-squared: 0.987, Adjusted R-squared: 0.9869

F-statistic: 6769 on 1 and 89 DF, p-value: < 0.00000000000000022

Value of test-statistic is: 0.2996

Critical values of Pu are:

10pct 5pct 1pct

critical values 20.3933 25.9711 38.3413最小二乗法

- lm {stats}

- dwtest {lmtest}

- ks.test {stats}

- confint {stats}

- Box.test {stats}

- Ljung-Box 検定のラグは15としている。

- 対象期間: 2019-08-14 ~ 2019-12-24,90days

- 切片項\(\neq0\)

Call:

lm(formula = NIKKEI225.close_change ~ ShortSalerRatio_change,

data = datadf)

Residuals:

Min 1Q Median 3Q Max

-387.74 -70.73 -11.15 73.78 569.85

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 34.182 15.347 2.227 0.0285 *

ShortSalerRatio_change -28.729 5.653 -5.082 0.00000208 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 145.5 on 88 degrees of freedom

Multiple R-squared: 0.2269, Adjusted R-squared: 0.2181

F-statistic: 25.82 on 1 and 88 DF, p-value: 0.000002082

Durbin-Watson test

data: OLS_Model

DW = 1.88, p-value = 0.3013

alternative hypothesis: true autocorrelation is greater than 0

One-sample Kolmogorov-Smirnov test

data: ResidualsOLS

D = 0.079749, p-value = 0.588

alternative hypothesis: two-sided 2.5 % 97.5 %

(Intercept) 3.682693 64.68076

ShortSalerRatio_change -39.964450 -17.49417

Box-Ljung test

data: ResidualsOLS

X-squared = 11.949, df = 15, p-value = 0.6829- 切片項\(=0\)

Call:

lm(formula = NIKKEI225.close_change ~ ShortSalerRatio_change -

1, data = datadf)

Residuals:

Min 1Q Median 3Q Max

-352.00 -36.53 22.49 107.50 604.14

Coefficients:

Estimate Std. Error t value Pr(>|t|)

ShortSalerRatio_change -29.265 5.773 -5.07 0.00000215 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 148.7 on 89 degrees of freedom

Multiple R-squared: 0.2241, Adjusted R-squared: 0.2154

F-statistic: 25.7 on 1 and 89 DF, p-value: 0.000002151

Durbin-Watson test

data: OLS_Model_no_intercept

DW = 1.7822, p-value = 0.1892

alternative hypothesis: true autocorrelation is greater than 0

One-sample Kolmogorov-Smirnov test

data: ResidualsOLS_no_intercept

D = 0.16801, p-value = 0.01088

alternative hypothesis: two-sided 2.5 % 97.5 %

ShortSalerRatio_change -40.73552 -17.79511

Box-Ljung test

data: ResidualsOLS_no_intercept

X-squared = 11.895, df = 15, p-value = 0.687一般化最小二乗法

- gls {nlme}

- corARMA {nlme}

- ks.test {stats}

- confint {stats}

- Box.test {stats}

- 残差の系列相関の有無に拘わらず一般化最小二乗法による回帰係数を求めています。

- 最小二乗法の残差に系列相関が見られない場合、ここではAR(p=0,q=0)の結果(AIC最小)が表示されます。

- http://user.keio.ac.jp/~nagakura/zemi/GLS.pdf

- http://tokyox.matrix.jp/wiki/index.php?%E4%B8%80%E8%88%AC%E5%8C%96%E6%9C%80%E5%B0%8F%E4%BA%8C%E4%B9%97%E6%B3%95

- Ljung-Box 検定のラグは15としている。

- 切片項\(\neq0\)

Generalized least squares fit by REML

Model: NIKKEI225.close_change ~ ShortSalerRatio_change

Data: datadf

AIC BIC logLik

1143.194 1150.626 -568.5972

Coefficients:

Value Std.Error t-value p-value

(Intercept) 34.18172 15.347047 2.227251 0.0285

ShortSalerRatio_change -28.72931 5.653498 -5.081687 0.0000

Correlation:

(Intr)

ShortSalerRatio_change 0.043

Standardized residuals:

Min Q1 Med Q3 Max

-2.66553684 -0.48624141 -0.07665896 0.50723977 3.91752212

Residual standard error: 145.4629

Degrees of freedom: 90 total; 88 residual

One-sample Kolmogorov-Smirnov test

data: ResidualsGLS

D = 0.079749, p-value = 0.588

alternative hypothesis: two-sided 2.5 % 97.5 %

(Intercept) 4.102064 64.26138

ShortSalerRatio_change -39.809963 -17.64866

Box-Ljung test

data: ResidualsGLS

X-squared = 11.949, df = 15, p-value = 0.6829- 切片項\(=0\)

Generalized least squares fit by REML

Model: NIKKEI225.close_change ~ ShortSalerRatio_change - 1

Data: datadf

AIC BIC logLik

1153.369 1158.346 -574.6846

Coefficients:

Value Std.Error t-value p-value

ShortSalerRatio_change -29.26532 5.772687 -5.069618 0

Standardized residuals:

Min Q1 Med Q3 Max

-2.3677540 -0.2457028 0.1513119 0.7231028 4.0638061

Residual standard error: 148.6643

Degrees of freedom: 90 total; 89 residual

One-sample Kolmogorov-Smirnov test

data: ResidualsGLS_no_intercept

D = 0.16801, p-value = 0.01088

alternative hypothesis: two-sided 2.5 % 97.5 %

ShortSalerRatio_change -40.57957 -17.95106

Box-Ljung test

data: ResidualsGLS_no_intercept

X-squared = 11.895, df = 15, p-value = 0.687残差

- 時系列推移

- 自己相関

- 時系列推移

- 自己相関

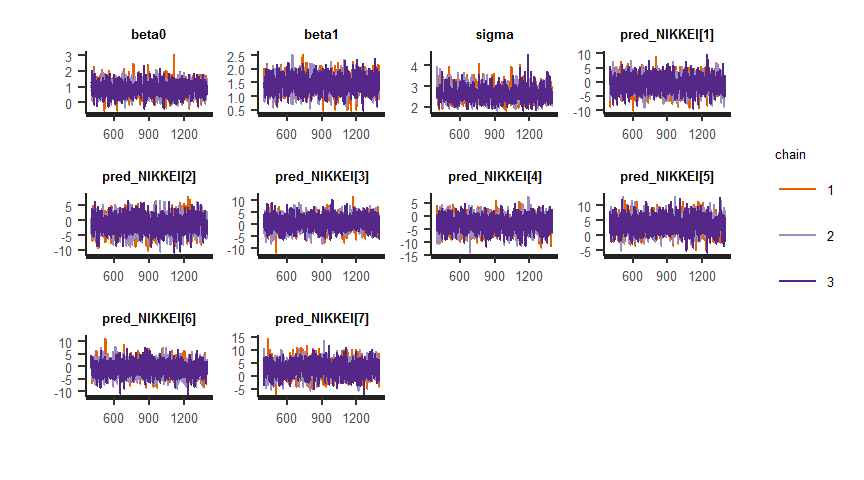

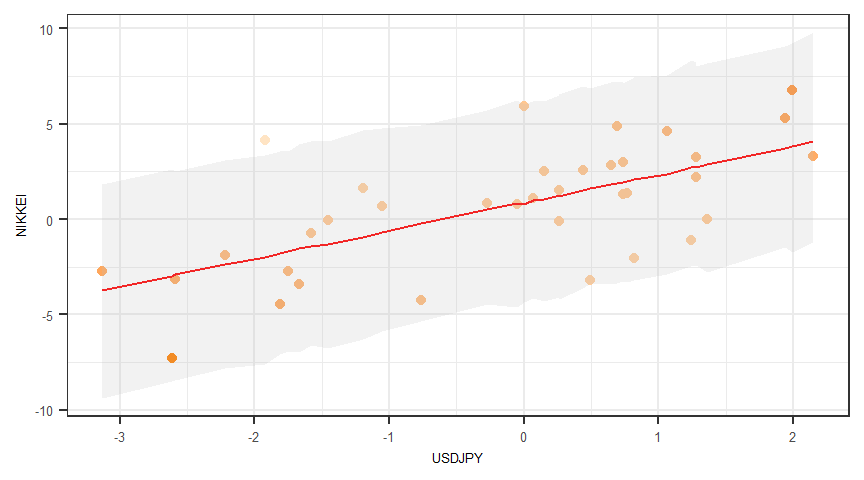

ドル円レートと日経平均株価:ベイズ推定:線形回帰モデル

\[\rm{NIKKEI}\sim\rm{Normal}(\beta_0 + \beta_1 \cdot \rm{USDJPY},\sigma)\]

# 数値はいずれも前月比(%)

head(df) Date NIKKEI USDJPY

13 2017-01-01 0.67 -1.05

14 2017-02-01 -0.03 -1.45

15 2017-03-01 0.79 -0.05

16 2017-04-01 -3.12 -2.59

17 2017-05-01 5.29 1.94

18 2017-06-01 1.62 -1.19tail(df) Date NIKKEI USDJPY

43 2019-07-01 2.53 0.15

44 2019-08-01 -4.46 -1.81

45 2019-09-01 4.63 1.06

46 2019-10-01 2.84 0.65

47 2019-11-01 4.87 0.69

48 2019-12-01 1.50 0.26apply(df[, -1], 2, adf.test)$NIKKEI

Augmented Dickey-Fuller Test

data: newX[, i]

Dickey-Fuller = -3.5875, Lag order = 3, p-value = 0.04791

alternative hypothesis: stationary

$USDJPY

Augmented Dickey-Fuller Test

data: newX[, i]

Dickey-Fuller = -4.1669, Lag order = 3, p-value = 0.01457

alternative hypothesis: stationary# 最尤推定

summary(lm(NIKKEI ~ USDJPY), confint = T, ci.width = 0.95)

Call:

lm(formula = NIKKEI ~ USDJPY)

Residuals:

Min 1Q Median 3Q Max

-4.7835 -1.1220 0.2934 1.2350 6.0612

Coefficients:

Estimate Std. Error t value Pr(>|t|)

(Intercept) 0.8789 0.4230 2.078 0.0454 *

USDJPY 1.4584 0.2974 4.903 0.0000229 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Residual standard error: 2.523 on 34 degrees of freedom

Multiple R-squared: 0.4142, Adjusted R-squared: 0.397

F-statistic: 24.04 on 1 and 34 DF, p-value: 0.00002293Gaussian <- "

data{

int N;

vector[N] NIKKEI;

vector[N] USDJPY;

}

parameters{

real beta0;

real beta1;

real <lower = 0> sigma;

}

model{

for(i in 1:N)

NIKKEI[i] ~ normal(beta0 + beta1*USDJPY[i], sigma);

}

generated quantities{

vector[N] pred_NIKKEI;

real log_lik[N];

for (i in 1:N){

pred_NIKKEI[i] = normal_rng(beta0 + beta1*USDJPY[i], sigma);

log_lik[i] = normal_lpdf(NIKKEI[i] | beta0 + beta1*USDJPY[i], sigma);

}

}

"datalist <- list(N = N, NIKKEI = NIKKEI, USDJPY = USDJPY)

iter <- 1400

warmup <- 400

chains <- 3

fit <- stan(model_code = Gaussian, data = datalist, iter = iter, warmup = warmup, thin = 1, chains = chains)

summary(fit)$summary[c("beta0", "beta1", "sigma"), ] mean se_mean sd 2.5% 25% 50% 75% 97.5% n_eff Rhat

beta0 0.8875346 0.009630047 0.4428774 0.03346326 0.5973444 0.8823194 1.186767 1.786213 2114.999 1.0008931

beta1 1.4635474 0.005635220 0.2999310 0.87680494 1.2622379 1.4641785 1.659193 2.056325 2832.833 0.9997827

sigma 2.6145262 0.006997019 0.3353027 2.03981008 2.3895432 2.5752479 2.804797 3.363150 2296.402 1.0004320traceplot(fit) + theme(axis.text.x = element_text(size = 5), axis.text.y = element_text(size = 5), strip.text.x = element_text(size = 5), legend.title = element_text(size = 5), legend.text = element_text(size = 5))

# EAP:事後期待値

df_result <- rstan::extract(fit)$pred_NIKKEI %>% data.frame() %>% gather() %>% dplyr::mutate(id = rep(c(1:N), each = (iter - warmup) * chains)) %>% group_by(id) %>% dplyr::summarize(pred_EAP = mean(value), pred_lower = quantile(value, 0.025), pred_upper = quantile(value, 0.975)) %>% dplyr::ungroup() %>% cbind(data.frame(NIKKEI, USDJPY))head(df_result) id pred_EAP pred_lower pred_upper NIKKEI USDJPY

1 1 -0.6670891 -5.887419 4.747134 0.67 -1.05

2 2 -1.3311440 -6.746644 4.062978 -0.03 -1.45

3 3 0.8456611 -4.601861 6.233359 0.79 -0.05

4 4 -2.8765245 -8.453013 2.506951 -3.12 -2.59

5 5 3.7032181 -1.472681 9.062403 5.29 1.94

6 6 -0.9205032 -6.276003 4.648296 1.62 -1.19tail(df_result) id pred_EAP pred_lower pred_upper NIKKEI USDJPY

31 31 1.049604 -4.285724 6.165953 2.53 0.15

32 32 -1.777217 -7.089221 3.549118 -4.46 -1.81

33 33 2.382464 -2.890374 7.561279 4.63 1.06

34 34 1.833427 -3.393662 7.165621 2.84 0.65

35 35 1.898318 -3.377486 7.176082 4.87 0.69

36 36 1.217293 -4.193934 6.568841 1.50 0.26

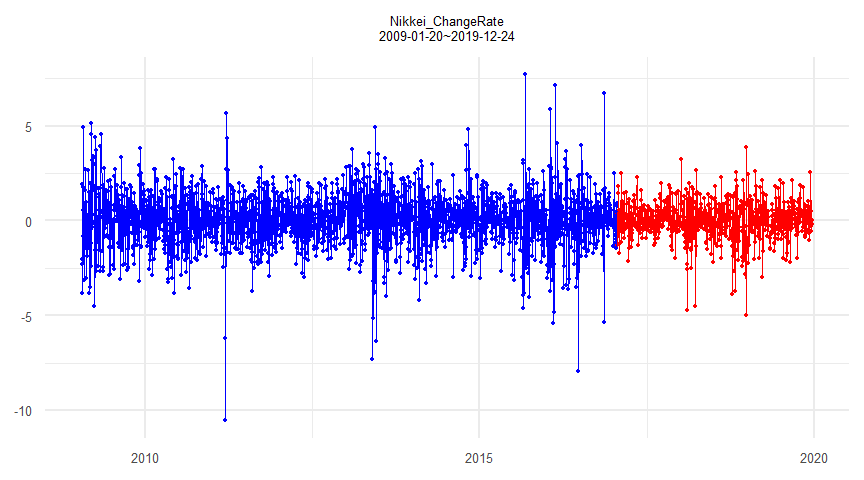

トランプ大統領の就任前後における日経平均前営業日比ボラティリティの比較

- 休日、祝日の補間はとっていない。

- helpより

- 『garchOrder The ARCH (q) and GARCH (p) orders.』

- 『external.regressors A matrix object containing the external regressors to include in the variance equation with as many rows as will be included in the data (which is passed in the fit function).』

- 参照引用Webページ

head(nikkei) Date Nikkei_ChangeRate trump

14882 2009-01-20 -2.313958 0

14883 2009-01-21 -2.035139 0

14884 2009-01-22 1.899606 0

14885 2009-01-23 -3.806506 0

14886 2009-01-26 -0.814822 0

14887 2009-01-27 4.932610 0tail(nikkei) Date Nikkei_ChangeRate trump

17554 2019-12-17 0.47498471 1

17555 2019-12-18 -0.54720080 1

17556 2019-12-19 -0.29071091 1

17557 2019-12-20 -0.20205449 1

17558 2019-12-23 0.01881039 1

17559 2019-12-24 0.03975465 1head(nikkei[as.Date("2017-1-17") <= nikkei$Date, ]) Date Nikkei_ChangeRate trump

16839 2017-01-17 -1.4752891 0

16840 2017-01-18 0.4296908 0

16841 2017-01-19 0.9414445 0

16842 2017-01-20 0.3442698 1

16843 2017-01-23 -1.2900050 1

16844 2017-01-24 -0.5454441 1

nikkei$trump <- as.numeric(nikkei$trump)datavalue <- nikkei[, 2]

trump <- as.matrix(nikkei$trump)Dummyなし

\[ r_t = \mu + \sqrt{h_t}\epsilon_t,\quad \epsilon_t\sim i.i.d. \textrm{N} (0,1),\quad h_t=\omega+\beta_{1}h_{t-1} + \alpha_{1} r^2_{t-1}\\r_tはt時点の日経平均前営業日比 \]

summary(tseries::garch(x = datavalue, order = c(1, 1)))

***** ESTIMATION WITH ANALYTICAL GRADIENT *****

I INITIAL X(I) D(I)

1 1.623355e+00 1.000e+00

2 5.000000e-02 1.000e+00

3 5.000000e-02 1.000e+00

IT NF F RELDF PRELDF RELDX STPPAR D*STEP NPRELDF

0 1 2.078e+03

1 3 2.059e+03 9.23e-03 2.35e-02 3.1e-02 4.9e+03 1.0e-01 5.73e+01

2 5 2.058e+03 5.60e-04 6.00e-04 2.4e-03 5.2e+02 1.0e-02 3.96e+00

3 7 2.056e+03 9.00e-04 9.04e-04 5.1e-03 2.0e+00 2.0e-02 1.24e+00

4 9 2.053e+03 1.25e-03 1.27e-03 1.2e-02 2.1e+00 4.0e-02 1.24e+00

5 12 2.036e+03 8.28e-03 1.40e-02 2.2e-01 2.4e+00 6.7e-01 1.33e+00

6 14 1.958e+03 3.85e-02 3.58e-02 5.0e-01 2.0e+00 6.7e-01 2.45e+00

7 16 1.952e+03 2.94e-03 9.82e-03 6.1e-02 2.2e+00 6.7e-02 2.10e-01

8 17 1.942e+03 5.21e-03 4.74e-03 6.1e-02 2.0e+00 6.7e-02 6.58e-01

9 18 1.928e+03 7.14e-03 5.82e-03 8.6e-02 2.0e+00 1.3e-01 6.73e-01

10 20 1.923e+03 2.94e-03 3.03e-03 1.7e-02 2.0e+00 2.7e-02 4.01e-01

11 21 1.918e+03 2.15e-03 2.12e-03 3.3e-02 2.0e+00 5.4e-02 2.16e-01

12 23 1.916e+03 1.49e-03 2.15e-03 2.1e-02 2.0e+00 3.2e-02 6.36e-02

13 24 1.913e+03 1.58e-03 1.97e-03 2.0e-02 2.0e+00 3.2e-02 5.18e-01

14 26 1.911e+03 6.85e-04 1.21e-03 1.1e-02 2.6e+00 1.7e-02 5.93e-02

15 27 1.909e+03 1.15e-03 1.19e-03 1.2e-02 2.0e+00 1.7e-02 3.45e-01

16 28 1.907e+03 1.24e-03 1.51e-03 2.0e-02 2.0e+00 3.5e-02 3.58e-01

17 30 1.905e+03 7.81e-04 1.57e-03 1.7e-02 2.0e+00 2.8e-02 6.00e-02

18 31 1.902e+03 1.51e-03 1.90e-03 1.5e-02 2.0e+00 2.8e-02 1.17e-01

19 33 1.901e+03 5.04e-04 8.07e-04 8.1e-03 3.9e+00 1.3e-02 3.76e-02

20 34 1.900e+03 8.22e-04 8.75e-04 7.5e-03 2.0e+00 1.3e-02 1.35e-01

21 35 1.898e+03 1.02e-03 1.21e-03 1.4e-02 2.0e+00 2.7e-02 1.16e-01

22 37 1.897e+03 5.00e-04 1.22e-03 1.2e-02 1.9e+00 2.4e-02 3.09e-02

23 38 1.894e+03 1.52e-03 1.92e-03 1.2e-02 1.8e+00 2.4e-02 1.65e-02

24 39 1.894e+03 2.03e-04 5.81e-04 1.3e-02 2.4e+00 2.4e-02 9.68e-03

25 40 1.892e+03 8.46e-04 1.33e-03 1.1e-02 1.7e+00 2.4e-02 4.22e-03

26 42 1.892e+03 1.76e-04 2.51e-04 3.8e-03 1.8e+00 8.0e-03 1.98e-03

27 43 1.892e+03 3.92e-05 7.67e-05 3.7e-03 1.3e+00 8.0e-03 2.09e-04

28 44 1.891e+03 3.35e-05 8.04e-05 3.3e-03 1.5e+00 8.0e-03 2.45e-04

29 45 1.891e+03 5.34e-06 6.67e-06 8.3e-04 0.0e+00 1.5e-03 6.67e-06

30 46 1.891e+03 7.71e-08 4.41e-08 3.9e-05 0.0e+00 7.0e-05 4.41e-08

31 47 1.891e+03 2.30e-08 1.70e-09 2.8e-05 0.0e+00 6.6e-05 1.70e-09

32 50 1.891e+03 1.06e-10 8.64e-11 3.4e-07 3.9e+00 8.0e-07 7.06e-10

33 63 1.891e+03 2.40e-16 2.90e-15 1.4e-11 6.6e+04 3.3e-11 6.21e-10

34 67 1.891e+03 -2.04e-15 2.64e-18 1.3e-14 7.3e+07 3.0e-14 6.21e-10

***** FALSE CONVERGENCE *****

FUNCTION 1.891483e+03 RELDX 1.280e-14

FUNC. EVALS 67 GRAD. EVALS 34

PRELDF 2.640e-18 NPRELDF 6.208e-10

I FINAL X(I) D(I) G(I)

1 6.669583e-02 1.000e+00 -3.293e-02

2 1.260811e-01 1.000e+00 1.181e-01

3 8.401724e-01 1.000e+00 1.113e-01

Call:

tseries::garch(x = datavalue, order = c(1, 1))

Model:

GARCH(1,1)

Residuals:

Min 1Q Median 3Q Max

-5.24492 -0.52032 0.05918 0.63678 4.16860

Coefficient(s):

Estimate Std. Error t value Pr(>|t|)

a0 0.066696 0.010176 6.554 0.0000000000559 ***

a1 0.126081 0.009789 12.880 < 0.0000000000000002 ***

b1 0.840172 0.012699 66.161 < 0.0000000000000002 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Diagnostic Tests:

Jarque Bera Test

data: Residuals

X-squared = 363.46, df = 2, p-value < 0.00000000000000022

Box-Ljung test

data: Squared.Residuals

X-squared = 2.9477, df = 1, p-value = 0.086garchresult <- fGarch::garchFit(formula = ~garch(1, 1), data = datavalue, trace = F)

summary(garchresult)

Title:

GARCH Modelling

Call:

fGarch::garchFit(formula = ~garch(1, 1), data = datavalue, trace = F)

Mean and Variance Equation:

data ~ garch(1, 1)

<environment: 0x0000000090dc12b0>

[data = datavalue]

Conditional Distribution:

norm

Coefficient(s):

mu omega alpha1 beta1

0.078505 0.067370 0.130548 0.835957

Std. Errors:

based on Hessian

Error Analysis:

Estimate Std. Error t value Pr(>|t|)

mu 0.07851 0.02130 3.685 0.000229 ***

omega 0.06737 0.01458 4.621 0.00000382 ***

alpha1 0.13055 0.01566 8.336 < 0.0000000000000002 ***

beta1 0.83596 0.01943 43.022 < 0.0000000000000002 ***

---

Signif. codes: 0 '***' 0.001 '**' 0.01 '*' 0.05 '.' 0.1 ' ' 1

Log Likelihood:

-4347.433 normalized: -1.623388

Description:

Wed Dec 25 14:11:52 2019 by user: 20141203

Standardised Residuals Tests:

Statistic p-Value

Jarque-Bera Test R Chi^2 349.3298 0

Shapiro-Wilk Test R W 0.9839647 0

Ljung-Box Test R Q(10) 3.561866 0.9649559

Ljung-Box Test R Q(15) 8.267654 0.9126042

Ljung-Box Test R Q(20) 14.63216 0.7970545

Ljung-Box Test R^2 Q(10) 8.770687 0.5539958

Ljung-Box Test R^2 Q(15) 13.22446 0.5849653

Ljung-Box Test R^2 Q(20) 17.99165 0.5879581

LM Arch Test R TR^2 12.6677 0.3936489

Information Criterion Statistics:

AIC BIC SIC HQIC

3.249763 3.258565 3.249759 3.252947 garchresult@fit$par mu omega alpha1 beta1

0.07850523 0.06736971 0.13054763 0.83595724 Dummyあり

\[ r_t = \mu + \sqrt{h_t}\epsilon_t,\quad \epsilon_t\sim i.i.d. \textrm{N} (0,1),\quad h_t=\omega+\beta_{1}h_{t-1} + \alpha_{1} r^2_{t-1} + \delta_{\textrm{dummy}}\\r_tはt時点の日経平均前営業日比 \]

garch_sim <- function(data, v_model, garchorder, armaorder, external_regressors) {

garch_model <- ugarchspec(variance.model = list(model = v_model, garchOrder = garchorder, external.regressors = external_regressors), mean.model = list(armaOrder = armaorder, include.mean = T))

garch_result <- ugarchfit(spec = garch_model, data = data)

return(garch_result)

}garch_sim(data = datavalue, v_model = "sGARCH", garchorder = c(1, 1), armaorder = c(0, 0), external_regressors = trump)

*---------------------------------*

* GARCH Model Fit *

*---------------------------------*

Conditional Variance Dynamics

-----------------------------------

GARCH Model : sGARCH(1,1)

Mean Model : ARFIMA(0,0,0)

Distribution : norm

Optimal Parameters

------------------------------------

Estimate Std. Error t value Pr(>|t|)

mu 0.078496 0.021307 3.6840 0.000230

omega 0.067388 0.014914 4.5186 0.000006

alpha1 0.130437 0.017501 7.4533 0.000000

beta1 0.835981 0.020542 40.6960 0.000000

vxreg1 0.000000 0.012304 0.0000 1.000000

Robust Standard Errors:

Estimate Std. Error t value Pr(>|t|)

mu 0.078496 0.022608 3.4721 0.000516

omega 0.067388 0.024060 2.8008 0.005098

alpha1 0.130437 0.034129 3.8219 0.000132

beta1 0.835981 0.042182 19.8183 0.000000

vxreg1 0.000000 0.018174 0.0000 1.000000

LogLikelihood : -4347.443

Information Criteria

------------------------------------

Akaike 3.2505

Bayes 3.2615

Shibata 3.2505

Hannan-Quinn 3.2545

Weighted Ljung-Box Test on Standardized Residuals

------------------------------------

statistic p-value

Lag[1] 0.1275 0.7211

Lag[2*(p+q)+(p+q)-1][2] 0.4871 0.6997

Lag[4*(p+q)+(p+q)-1][5] 0.9972 0.8603

d.o.f=0

H0 : No serial correlation

Weighted Ljung-Box Test on Standardized Squared Residuals

------------------------------------

statistic p-value

Lag[1] 1.785 0.1816

Lag[2*(p+q)+(p+q)-1][5] 3.761 0.2855

Lag[4*(p+q)+(p+q)-1][9] 5.435 0.3684

d.o.f=2

Weighted ARCH LM Tests

------------------------------------

Statistic Shape Scale P-Value

ARCH Lag[3] 0.2444 0.500 2.000 0.6210

ARCH Lag[5] 2.2187 1.440 1.667 0.4249

ARCH Lag[7] 3.0699 2.315 1.543 0.5005

Nyblom stability test

------------------------------------

Joint Statistic: 2.2715

Individual Statistics:

mu 0.02258

omega 0.40987

alpha1 0.31496

beta1 0.38790

vxreg1 0.51160

Asymptotic Critical Values (10% 5% 1%)

Joint Statistic: 1.28 1.47 1.88

Individual Statistic: 0.35 0.47 0.75

Sign Bias Test

------------------------------------

t-value prob sig

Sign Bias 0.7623 0.445961

Negative Sign Bias 1.9032 0.057126 *

Positive Sign Bias 2.6777 0.007458 ***

Joint Effect 15.9191 0.001178 ***

Adjusted Pearson Goodness-of-Fit Test:

------------------------------------

group statistic p-value(g-1)

1 20 78.42 0.000000003483

2 30 97.35 0.000000002588

3 40 106.38 0.000000036719

4 50 129.39 0.000000003535

Elapsed time : 0.4200239 garch_sim(data = datavalue, v_model = "eGARCH", garchorder = c(1, 1), armaorder = c(0, 0), external_regressors = trump)

*---------------------------------*

* GARCH Model Fit *

*---------------------------------*

Conditional Variance Dynamics

-----------------------------------

GARCH Model : eGARCH(1,1)

Mean Model : ARFIMA(0,0,0)

Distribution : norm

Optimal Parameters

------------------------------------

Estimate Std. Error t value Pr(>|t|)

mu 0.039469 0.018666 2.1145 0.034472

omega 0.048555 0.008707 5.5768 0.000000

alpha1 -0.130764 0.014568 -8.9758 0.000000

beta1 0.926704 0.011290 82.0837 0.000000

gamma1 0.204104 0.021111 9.6679 0.000000

vxreg1 -0.052201 0.012956 -4.0290 0.000056

Robust Standard Errors:

Estimate Std. Error t value Pr(>|t|)

mu 0.039469 0.018293 2.1576 0.030958

omega 0.048555 0.013575 3.5768 0.000348

alpha1 -0.130764 0.031889 -4.1005 0.000041

beta1 0.926704 0.018905 49.0200 0.000000

gamma1 0.204104 0.028291 7.2145 0.000000

vxreg1 -0.052201 0.018491 -2.8230 0.004758

LogLikelihood : -4291.448

Information Criteria

------------------------------------

Akaike 3.2094

Bayes 3.2226

Shibata 3.2094

Hannan-Quinn 3.2142

Weighted Ljung-Box Test on Standardized Residuals

------------------------------------

statistic p-value

Lag[1] 0.1647 0.6849

Lag[2*(p+q)+(p+q)-1][2] 0.5559 0.6680

Lag[4*(p+q)+(p+q)-1][5] 0.8880 0.8845

d.o.f=0

H0 : No serial correlation

Weighted Ljung-Box Test on Standardized Squared Residuals

------------------------------------

statistic p-value

Lag[1] 0.0009056 0.9760

Lag[2*(p+q)+(p+q)-1][5] 0.6053180 0.9403

Lag[4*(p+q)+(p+q)-1][9] 1.6258991 0.9446

d.o.f=2

Weighted ARCH LM Tests

------------------------------------

Statistic Shape Scale P-Value

ARCH Lag[3] 0.003485 0.500 2.000 0.9529

ARCH Lag[5] 1.221804 1.440 1.667 0.6684

ARCH Lag[7] 1.421639 2.315 1.543 0.8369

Nyblom stability test

------------------------------------

Joint Statistic: 0.9803

Individual Statistics:

mu 0.08740

omega 0.07265

alpha1 0.23937

beta1 0.11870

gamma1 0.38681

vxreg1 0.01974

Asymptotic Critical Values (10% 5% 1%)

Joint Statistic: 1.49 1.68 2.12

Individual Statistic: 0.35 0.47 0.75

Sign Bias Test

------------------------------------

t-value prob sig

Sign Bias 0.7846 0.4328

Negative Sign Bias 0.3202 0.7488

Positive Sign Bias 1.6208 0.1052

Joint Effect 2.8228 0.4198

Adjusted Pearson Goodness-of-Fit Test:

------------------------------------

group statistic p-value(g-1)

1 20 56.71 0.00001266

2 30 71.38 0.00001958

3 40 77.55 0.00023487

4 50 98.18 0.00003875

Elapsed time : 0.619035

分析設計